Investment strategies by age

6 things to know about long-term care insurance cost and benefits

Military homeownership: Your guide to resources, financing and more

Do I need a financial advisor?

How to plan and save for adoption and in vitro fertility treatment costs

Preparing for retirement: 8 steps to take

Car shopping: Buying versus leasing your next vehicle

For today's homebuyers, time and money are everything

How I did it: Bought a home without a 20 percent down payment

How I did it: Built living spaces to support my family

Money Moments: Tips for selling your home

Overcoming high interest rates: Getting your homeownership goals back on track

Should you buy a house that’s still under construction?

What financial advice would you give your younger self?

10 ways to increase your home’s curb appeal

Avoiding the pitfalls of warehouse lending

What you should know about buying a car

Is it the right time to refinance your mortgage?

Is it cheaper to build or buy a house

6 questions to ask before buying a new home

5 things to avoid that can devalue your home

What is a home equity line of credit (HELOC) and what can it be used for?

9 simple ways to save

3 awkward situations Zelle can help avoid

Is raising backyard chickens a good idea financially?

Here’s how to create a budget for yourself

Money Moments: How to manage your finances after a divorce

Money Moments: 8 dos and don’ts for saving money in your 30s

Travel for less: Smart (not cheap) ways to spend less on your next trip

Understanding guardianship and power of attorney in banking

What’s in your emergency fund?

What you need to know about renting

From LLC to S-corp: Choosing a small business entity

6 tips for trust fund distribution to beneficiaries

How to build wealth at any age

How to manage your money: 7 tips to improve your finances

LGBTQ+ financial planning tips

Should I itemize my taxes?

Your 5-step guide to financial planning

What is Medicare? Understanding your coverage options

8 steps to take before you buy a home

What is refinancing a mortgage?

Are professional movers worth the cost?

What to know when buying a home with your significant other

Building a dream home that fits your life

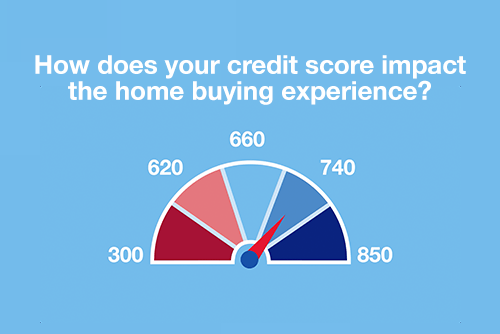

Mortgage basics: How does your credit score impact the homebuying experience?

Mortgage basics: 3 key steps in the homebuying process

Mortgage basics: How much house can you afford?

Mortgage basics: Buying or renting – What’s right for you?

Mortgage basics: Prequalification or pre-approval – What do I need?

How you can take advantage of low mortgage rates

Mortgage basics: Finding the right home loan for you

Mortgage basics: What is refinancing, and is it right for you?

5 financial goals for the new year

Retirement savings by age

Annual insurance policy review checklist

A checklist for starting a mobility program review

Tips for realtors to help clients get their homeownership goals back on track

How I did it: Turned my side hustle into a full-time job

Retirement plan options for the self-employed

5 reasons why couples may have separate bank accounts

It's possible: 7 tips for breaking the spending cycle

Closing on a house checklist for buyers

Multiple accounts can make it easier to follow a monthly budget

Is it time to get a shared bank account with your partner?

Don’t underestimate the importance of balancing your checking account

7 steps to keep your personal and business finances separate

Which is better: Combining bank accounts before marriage — or after?

30-day adulting challenge: Financial wellness tasks to complete in a month

Estate planning checklist: 8 steps to secure your legacy

8 steps to choosing a health insurance plan

Key milestone ages as you near and start retirement

5 ways to maximize your garage sale profits

Estate planning documents: Living trusts vs. will vs. living will

Why estate planning is important

How a Health Savings Account (HSA) can benefit your retirement plan

Year-end financial checklist

Housing market trends and relocation impact

Finance or operating lease? Deciphering the legalese of equipment finance

Buying or leasing? Questions to ask before signing a contract

Insource or outsource? 10 considerations

The secret to successful service provider integration

Safeguarding the payment experience through contactless

COVID-19 safety recommendations: Are you ready to reopen?

Unexpected cost savings may be hiding in your payment strategy

Changes in credit reporting and what it means for homebuyers

What’s the difference between Fannie Mae and Freddie Mac?

Why other lenders may be reaching out to your employees

High-cost housing and down payment options in relocation

Crypto + Relo: Mobility industry impacts

For today's relocating home buyers, time and money are everything

How to sell your business without emotions getting in the way

5 steps to take before transitioning your business

10 tips on how to run a successful family business

Talent acquisition 101: Building a small business dream team

Costs to consider when starting a business

How to test new business ideas

The costs of hiring a new employee

How to expand your business: Does a new location make sense?

How to build a content team

Multigenerational household financial planning strategies

How to track expenses

How to manage your finances when you're self-employed

Good debt vs. bad debt: Know the difference

Reviewing your beneficiaries: A 5-step guide

How to talk about money with your family

Financial steps to take after the death of a spouse

Retirement advice: How to retire happy

Retirement income planning: 4 steps to take

Preparing for retirement: 8 steps to take

Working after retirement: Factors to consider

4 steps to finding a charity to support

Year end tax planning tips

Tips for navigating a medical hardship when you’re unable to work

11 essential things to do before baby comes

Checklist: 10 questions to ask your home inspector

Resources for managing financial matters after an unexpected death

What you need to know as the executor of an estate

What documents do you need after a loved one dies?

Checklist: financial recovery after a natural disaster

How I did it: Paid off student loans

Bank Notes: College cost comparison

Is online banking safe?

Pros and cons of a personal line credit

3 tips for saving money when moving to a new home

Uncover the cost: Wedding

Uncover the cost: International trip

Tips to overcome three common savings hurdles

Adulting 101: How to make a budget plan

Personal loans first-timer's guide: 7 questions to ask

How can I help my student manage money?

You can take these 18 budgeting tips straight to the bank

Save time and money with automatic bill pay

Do you and your fiancé have compatible financial goals?

U.S. Bank asks: Transitioning out of college life? What’s next?

U.S. Bank asks: Do you know your finances?

Personal finance for teens can empower your child

How to save for a wedding

Dear Money Mentor: How do I set and track financial goals?

Lost job finance tips: What to do when you lose your job

Money Moments: 3 smart financial strategies when caring for aging parents

Money management guide to financial independence

7 financial questions to consider when changing jobs

How to stop living paycheck to paycheck post-pay increase

How grandparents can contribute to college funds instead of buying gifts

How to open and invest in a 529 plan

Using 529 plans for K-12 tuition

Parent checklist: Preparing for college

What to consider before taking out a student loan

How to use debt to build wealth

What’s a subordination agreement, and why does it matter?

Understanding the true cost of borrowing: What is amortization, and why does it matter?

Know your debt-to-income ratio

Your quick guide to loans and obtaining credit

Checklist: 10 things to look for when touring a home

Crypto + Homebuying: Impacts on the real estate market

How I did it: Bought my dream home using equity

House Hacks: How buying an investment property worked as my first home

Managing the impacts of appraisal gaps in a hot housing market

Spring cleaning checklist for your home: 5 budget-boosting tasks

Saving for a down payment: Where should I keep my money?

Your guide to breaking the rental cycle

Checklist: 6 to-dos for after a move

What are conforming loan limits and why are they increasing

Uncover the cost: Building a home

The lowdown on 6 myths about buying a home

4 ways to free up your budget (and your life) with a smaller home

Get more home for your money with these tips

Money Moments: How to finance a home addition

First-time homebuyer’s guide to getting a mortgage

Dear Money Mentor: When should I refinance a mortgage?

Beyond the mortgage: Other costs for homeowners

10 questions to ask when hiring a contractor

What is an escrow account? Do I have one?

These small home improvement projects offer big returns on investment

Should you get a home equity loan or a home equity line of credit?

Mortgage basics: What’s the difference between interest rate and annual percentage rate?

Is a home equity line of credit (HELOC) right for you?

How to use your home equity to finance home improvements

How do I prequalify for a mortgage?

Home equity: Small ways to improve the value of your home

Can you take advantage of the dead equity in your home?

4 questions to ask before you buy an investment property

10 uses for a home equity loan

6 essential credit report terms to know

Test your loan savvy

What types of credit scores qualify for a mortgage?

Take the stress out of buying your teen a car