Compare your auto financing options.

Buying a new vehicle? Refinancing your current auto loan? U.S. Bank has an option that fits your car financing journey.

Used car financing

Finance your used car or truck with a personal loan.

Can’t find your preferred dealer or seller among our participating dealerships? You could be able to use a personal loan for your financing needs.

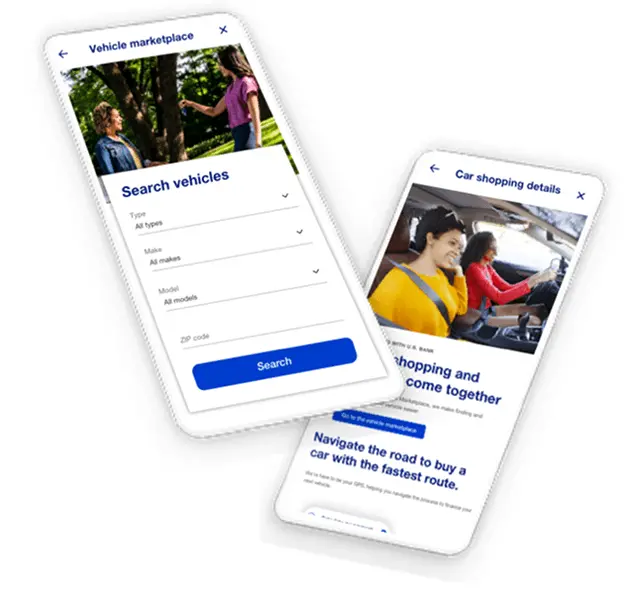

Explore tools to calculate your payment or locate a dealership.

Estimate your car payment.

See an estimated rate and monthly payment for a new or used car using our auto financing calculator.

Search participating dealerships.

When you’re ready to buy, your U.S. Bank auto financing pre-approval is good at any of our participating dealerships.

Get the basics on auto loans and financing.

How does car financing work?

Understand your car financing options: purchase loan, personal loan, auto lease, auto refinance and lease buyout.

Should you buy a new or used car?

Find tools and tips to help you compare the pros and cons of a new vs. used car purchase.

The good news about EV costs

Discover the surprising ways driving an electric vehicle can save you money over the long haul.

Looking for more car-buying info?

Check out our resources for additional guidance on finding, financing and caring for your next vehicle.