How to manage cash flow for small business owners

How to prepare for unexpected expenses in business

Small business growth: 6 ways to scale your business

Whether you’re managing day-to-day operations or planning for long-term growth, our secure, user-friendly online banking brings real-time visibility into your entire financial picture, helping you streamline your financial operations and make better-informed decisions.

Stay on top of your finances with our free cash flow tool that provides insights to analyze and predict cash flow.

Profile Switch allows you to effortlessly toggle between your business and personal accounts using the same login information.

Zelle® for your business lets you send, receive and request money from your customers and eligible vendors.1

Move funds quickly between accounts to manage cash flow or transfer to external accounts for payments.

U.S. Bank Spend Management is available with all U.S. Bank business credit cards and allows business owners to save time with a comprehensive suite of card controls.

Send secure, same-day or scheduled payments to vendors, suppliers and employees with ACH.

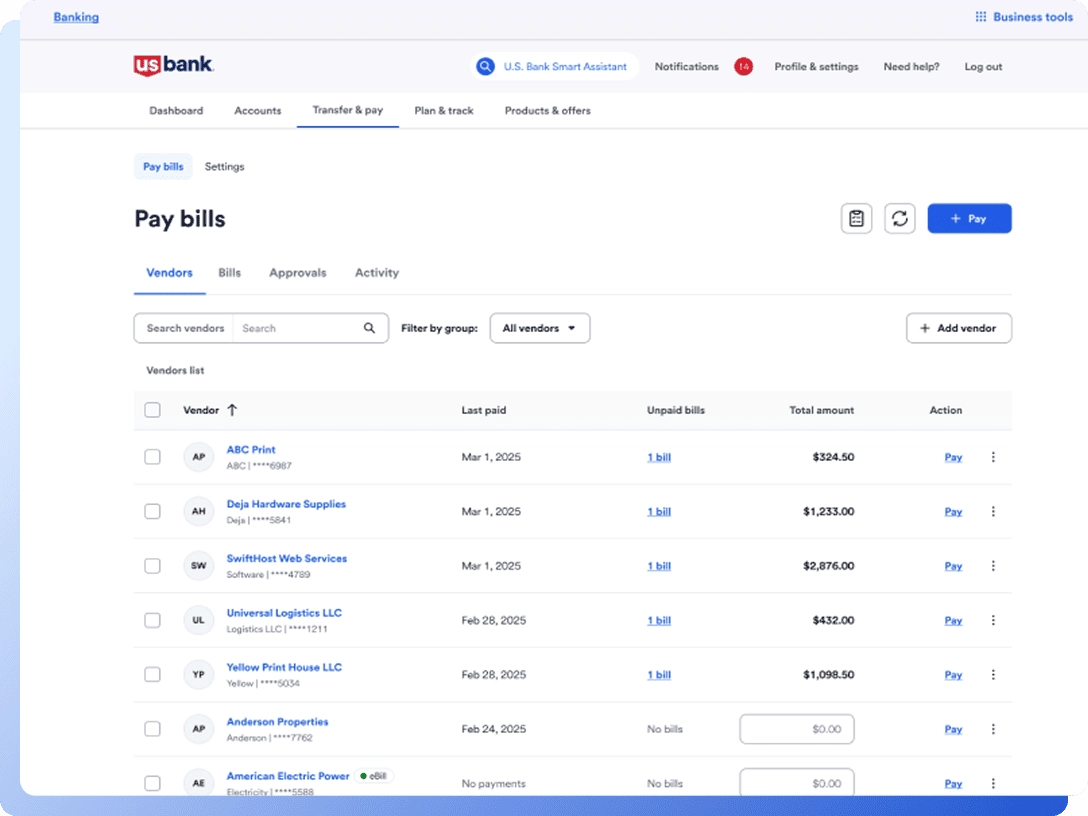

Take control of your finances directly from business online banking or mobile app. Easily schedule and make payments using your credit card or checking account, all with the confidence that your bank details remain secure and private.

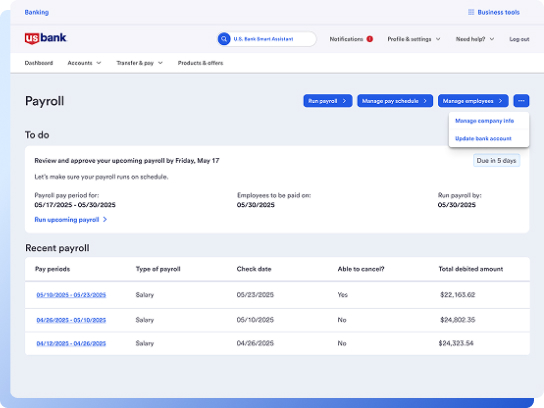

U.S. Bank Payroll powered by Gusto centralizes the tools you need to run payroll, automate tax filings and simplify daily business activities.2

Run your business anytime, anywhere with a full view of your finances in one place. Our easy-to-use online management software is designed to make your financial management seamless, intuitive and efficient. With business online banking, you can easily view account summaries, transfer money, track your cash flow, receive reminders about upcoming payments and more.

Get a feel for the experience and features with our digital simulator.

Online banking provides digital access to your accounts where you can view statements, manage business credit cards, receive alerts and more. When you log in to online banking using your business profile, you’ll see your dashboard, which provides a command-center view of your accounts, balances, income and expenses, and enables you to seamlessly transfer money, link external accounts and connect to our partner apps.

Yes, our online banking is secured by our digital security guarantee. Read more about our digital security measures.

Yes, log in to online banking and select “Link external accounts” from the dashboard to view and manage all your accounts in one place.

To pay your Central Billing account, which includes all of your employees’ transactions, you are required to use a business online banking profile.

The business owner needs to create a business online profile by registering his/her business credit card, which will allow access to the Central Billing account and all the employee cards.

If you already have a personal online banking profile, the business owner will only see his/her individual business card account used for making purchases and will not see a minimum due because the minimum due only appears on the Central Billing account.

Find the U.S. Bank branch nearest you.

Schedule a virtual or in-person meeting with a business banker.

Fill in details about your banking needs and a representative will call you.

Call 800-673-3555 to talk with a representative right away.