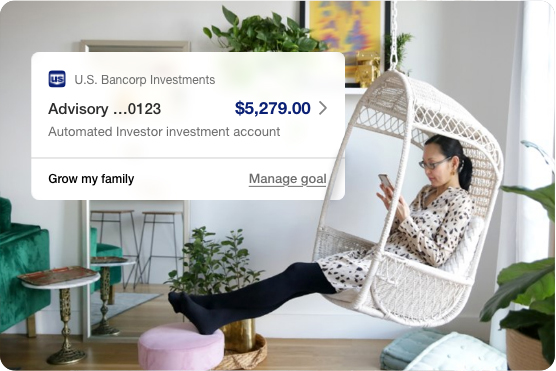

How we invest. Automated Investor is a robo-advisor from U.S. Bancorp Investments. Like many other robo-advisors, it uses a set of investing rules run by advanced computer software to manage your investments automatically in an investment advisory account. You provide the robo-advisor information about your investment goals, your comfort with financial risk and when you would like to reach your goal. The robo-advisor will monitor your mix of investments regularly and make trades for you to help keep you on track with your goal.

What you will own. We invest your money in exchange-traded funds (ETFs) and a cash allocation. U.S. Bancorp Investments will have discretionary management authority on your account, which means that we’ll select the ETFs you’ll own and decide how much cash will be held in your account, at any time.

Fees and expenses. Annual fees are 0.24% of invested assets, billed quarterly. You pay no commission or fees on individual trades. The annual advisory fee doesn’t include ETF fees and expenses, which are reflected in the daily pricing of the fund, or other account fees as described in our Automated Investor Wrap Fee Program Brochure.