The U.S. Bank ExtendPay® Loan allows you to request cash from your credit card account, up to 25% of your credit line ($15,000 maximum). Then pay it back with no interest during your chosen repayment period — just a fixed monthly fee.

No credit check

Use a portion of your card’s unused credit line. It’s as easy as that.

Flexibility

Choose the plan that works for you with 3, 6, 12, 18, and 24 payment term repayment options.4

No application required

Simply visit your credit card dashboard and select 'Set up ExtendPay' to set up your ExtendPay Loan.

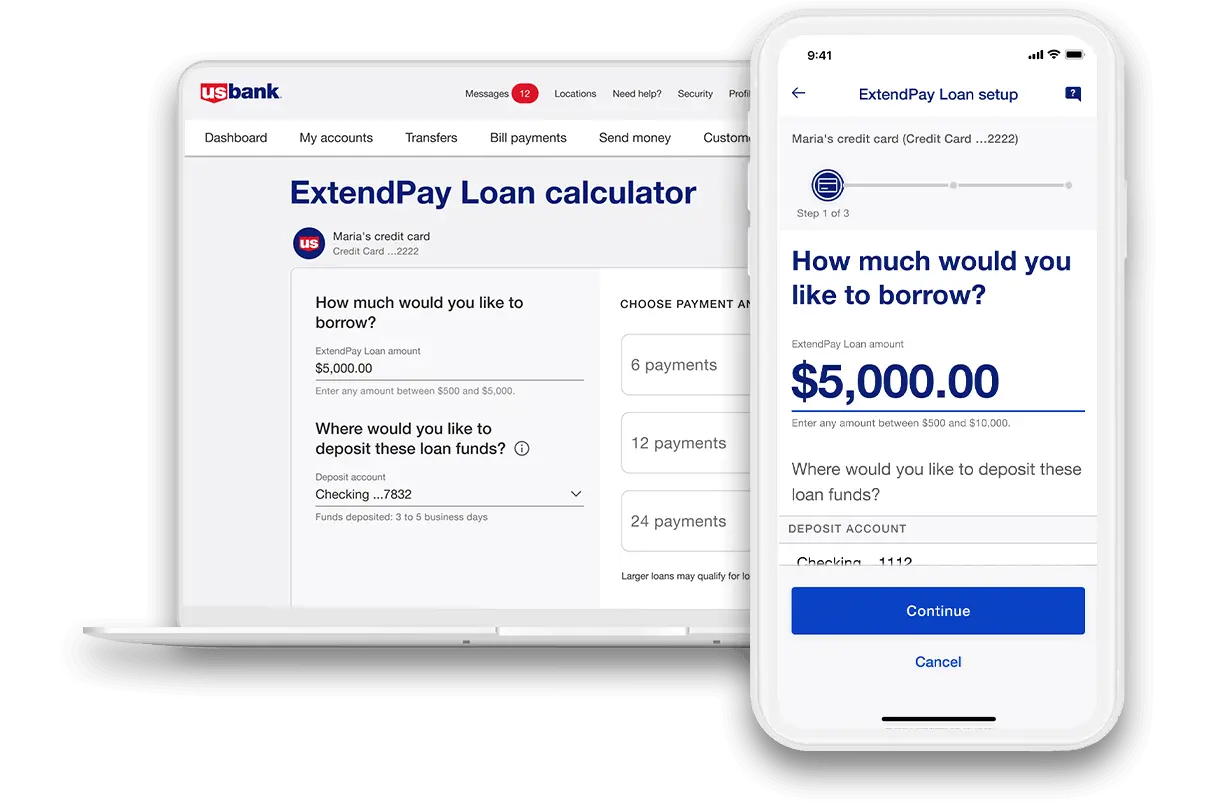

Step by step enrollment experience

Step 1: Log in or sign up for online banking. Visit your credit card dashboard, choose Set up ExtendPay and then Set up a new ExtendPay Loan.

Step 2: Choose your loan amount, tell us where to deposit your funds and choose the length of your ExtendPay Loan.

Step 3: Confirm your details, agree to the terms and you’re done!

Expected or unexpected expenses, your existing credit line can work for you.

Whether it is planned like buying a used car, or unplanned, like discovering you need a plumber, a U.S. Bank ExtendPay® Loan makes it easy to get the funds you need. It uses your existing credit line and there's no application, credit check or origination fee – just fixed monthly payments with no interest6 during your chosen repayment period and a fixed monthly fee.

Frequently asked questions

What are the benefits of an ExtendPay Loan, and how do I set one up?

No. An ExtendPay Loan doesn’t increase your credit card account’s available credit. It gives you a payment option to cover expenses you can’t charge to your card.

If your credit card account is eligible for an ExtendPay Loan, you’ll receive a notification via email, or you’ll see ExtendPay Loan as an option when you choose Set up ExtendPay in mobile or online banking.

ExtendPay Loan eligibility may change based on your credit card account activity.

Eligible cardmembers can start their ExtendPay Loan enrollment in a couple different ways:

- Using the link in their ExtendPay Loan invitation email

- By going to their card account details online, choosing Set up ExtendPay and then Set up a new ExtendPay Loan

From here, you’ll choose your ExtendPay Loan amount, tell us where to deposit your funds and choose the length of your ExtendPay Loan. Confirm your details, agree to the terms and you’re set!

Additional information about ExtendPay Loans, including your maximum loan amount and monthly fee, will be provided during enrollment.

You can only have one active ExtendPay Loan – up to 25% of your credit line – at a time.

But you can have an ExtendPay Loan and one or more ExtendPay Plan(s) active at the same time. Your total ExtendPay balances (ExtendPay Loan plus ExtendPay Plans) can total up to 50% of your credit line, as long as your account meets the necessary requirements.

Your ExtendPay Loan gets transferred directly into the deposit account you choose during your loan setup. To deposit funds to an account outside U.S. Bank, you’ll need to link your external account first.

ExtendPay Loan funds can only be deposited to an eligible, pre-validated account at a financial institution in the United States.

If you deposit your loan to a U.S. Bank account, the funds will be available within 48 hours. For loans deposited to an eligible account outside of U.S. Bank, funds will be available in 3 to 5 business days.

ExtendPay Fees are fixed fees you will pay each month when you have an ExtendPay Loan balance. ExtendPay Fees are calculated based upon the loan’s original principal amount, your credit card’s Purchase APR and other factors. They’re calculated and shown to you at the time of enrollment. You won’t have to pay any remaining monthly ExtendPay Fees for an ExtendPay Loan you have paid off in full.

You can choose from a range of repayment options – from 3 to 24 months – designed to work with your budget.

No. Since an ExtendPay Loan isn’t a purchase, it’s not eligible for any rewards your credit card would otherwise offer.5

What are my options for repaying or managing an ExtendPay Loan?

After creating an ExtendPay Loan, it can take 24 to 48 hours for it to appear in your credit card account activity.

No. Once your ExtendPay Loan has been confirmed, it will remain active until the balance is paid in full. Loan lengths are final and can’t be changed. However, there are no penalties for early payoff.

You may pay off your ExtendPay Loan balance early by paying your credit card balance in full. That includes any account activity since the previous statement – even pending transactions. To successfully pay your full balance, wait for any pending transactions to post to your account before making your payment.

Once you’ve paid your ExtendPay Loan balance in full, your ExtendPay Loan is completed, and no further ExtendPay Fees will be charged.

Your ExtendPay Loan will cause your monthly Minimum Payment to increase. Until the ExtendPay Loan is paid in full, your monthly Minimum Payment calculation will include your regular monthly payment amount (based on non-ExtendPay balances) plus the monthly ExtendPay Loan principal and monthly ExtendPay Fee.

If you also have an active ExtendPay Plan, your monthly Minimum Payment will include the monthly ExtendPay Plan principal and monthly ExtendPay Plan fee. See the “Minimum Payment” section of your Cardmember Agreement for more information.

Your ExtendPay Loan payments are included in your credit card’s minimum monthly payment. If you set up an ExtendPay Loan and ExtendPay Plan(s), they will all be included in your total minimum monthly payment. Another option would be to pay your Plan Adjusted Balance, which is the amount you need to pay on your account each month to avoid any interest charges on new purchases during that statement period. It includes your monthly ExtendPay payment due plus the non-ExtendPay portion of your remaining statement balance. You can manage your payments from your account dashboard.

If your autopay preferences are set up to pay more than the minimum payment due, you may want to adjust your payment amount. If your existing autopay preferences would pay off your entire statement balance, you’ll be prompted to update your preferences to pay the Plan Adjusted Balance before you confirm your ExtendPay Loan.

You can adjust your autopay preferences at any time after setting up an ExtendPay Loan. If your automatic payment is scheduled within two business days from the date you requested the modification, we are unable to cancel or adjust the amount of that payment. Future autopay payments will reflect your requested adjustment.

If you have an ExtendPay balance, the “Plan Adjusted Balance” is the amount you must pay on your Account each month to avoid paying interest on new purchases. It includes your monthly ExtendPay payment due plus the non-ExtendPay portion of your remaining statement balance. Check your Cardmember Agreement for full details.

Yes. If you pay your previous statement balance, or Plan Adjusted Balance, in full by your payment due date each month, you have a 24- to 30-day interest-free period for new purchase transactions. See your Cardmember Agreement for more information.

Any late or missed payments are subject to late fees and may result in account closure. Any unpaid balance remaining on your ExtendPay Loan after the chosen pay-back period becomes subject to the APR and minimum payment calculation for purchases outlined in your Cardmember Agreement.

Under certain circumstances the law allows you to work with the bank if you’re dissatisfied with something you’ve purchased with your credit card. Because an ExtendPay Loan is not a credit card purchase, these rights do not apply. These rules are different from other error-resolution rights that may still apply.

Need more help?

Don’t see your question? Give Cardmember Service a call by using the number on the back of your card and a representative will be happy to help.