Digital tools

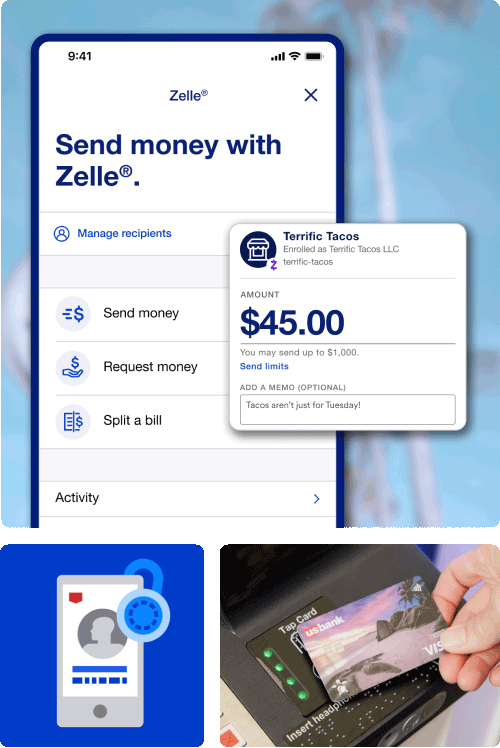

Bank on the go with the U.S. Bank Mobile App and online banking. Transfer funds between accounts with ease. Use bill pay, track spending, send money with Zelle®, set savings goals and more.

Easily access and manage funds, track everyday expenses, set up direct deposit and more.

Reach your short- and long-term goals by earning steady interest in a savings account.

Set aside money you don't need access to and see your savings grow faster.

![]()

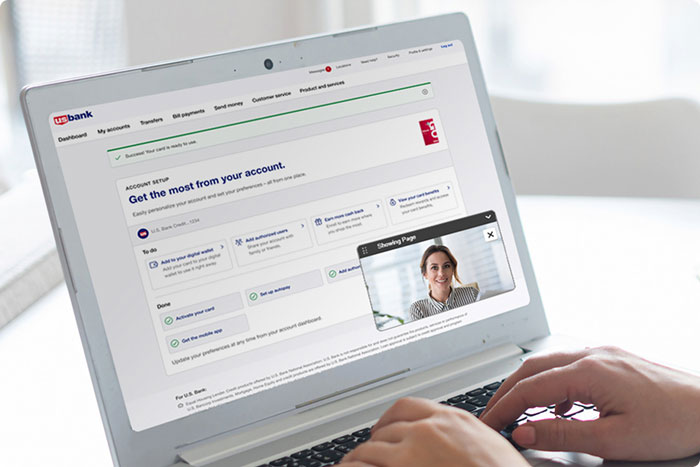

Schedule time with one of our experienced bankers online, on the phone or in person to get help with a bank account.

Online appointments include cobrowse, allowing our banker to securely view your screen and assist you with setting up your account, managing your finances and more. You can start a cobrowse session from anywhere with just one click for immediate support.

With resources and exclusive benefits, we’re committed to helping military veterans achieve their financial goals.

Open a bank account as a young adult under 24 and enjoy benefits designed for you, plus tools and services to help you manage your finances with confidence.

Looking for account support? Not sure which bank account works for you? Our goals coaches can help. You’ll meet with your coach online or in person and discuss your goals – financial or not. Best of all, it’s on us.

You can open a bank account online or in a branch if you’re 18 years or older and a legal U.S. resident. You’ll need:

If you prefer to visit a U.S. Bank branch, you’ll also need personal details such as a valid government ID and Social Security number. Feel free to call a U.S. Bank representative at 855-605-1871 to ensure you have what you need.

With a bank account, you can:

Accessing your account online is safe and secure. Our industry-leading encryption and security features are always on to protect you and your information.

A minor can only open a bank account with an adult.

If you want to open a Bank Smartly Checking® account with a minor (aged 13 through 17), you can open the account online or in a branch, as long as you’re both present. If opening the account online, you’ll need the teen’s Social Security number, income (if any) and a few other details.

If the minor is under the age of 13, or if you’d like to open any other type of bank account with a minor aside from the above, you’ll need to make an appointment and go to a branch together. Get more tips for teaching kids about money.

You can apply for an individual account if you’re 18 years or older and a legal U.S. resident. You’ll need to provide your Social Security number and a valid, government-issued photo ID. Find out how to open your first bank account.

You can usually access your bank account immediately after it's opened and funded. Depending on the account, you may be able to view balances, transfer money, pay bills, and set up direct deposits.

Understanding the difference between checking and savings accounts is key to finding the right one for you. A checking account is typically used for day-to-day spending and paying your bills. You can easily access your money with a debit card, ATM or check. A savings account is meant to help you grow your money or set aside funds for a big purchase. It’s often beneficial to have both as part of your financial plan.

Our do-it-yourself automated direct deposit setup makes it easy and takes just a few minutes in the Mobile App or online. Your direct deposit update is seamless, secure and verified in real time. You can do this for paychecks, Social Security benefits and more. (For other federal benefits, visit godirect.gov.)

Whether you’re opening a new account or want to add a beneficiary to an existing one, we’ll need to know the type of account (checking, savings, CD) and some personal information about your beneficiary. You’ll also need to provide written confirmation of your request via signature.

Head to a U.S. Bank branch or call 800-USBANKS (872-2657) to get started. We accept relay calls.

You can find your account number and routing number through any of the following: