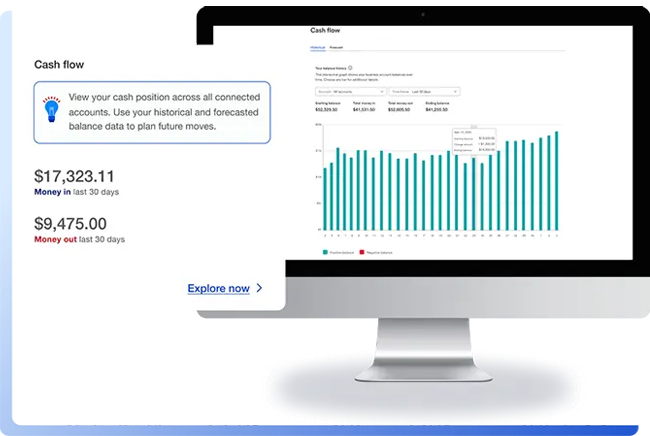

How to manage cash flow for small business owners

Learn how to manage cash flow with our financial management tips. Start managing your cash flow today!

How to choose the right business savings account

Learn how to choose the right business savings account to protect your finances and support your business growth.

How to build a business credit score

Build your business credit score now for a smoother loan application process and learn how to manage your business debt effectively.

How to apply for an SBA loan: requirements explained

How to apply for an SBA loan. Understand the key requirements such as preparing legal documents, providing collateral and more to secure the loan.