What is a good credit score?

What type of loan is right for your business?

How liquid asset secured financing helps with cash flow

Hybridization driving demand

Avoiding the pitfalls of warehouse lending

8 steps to take before you buy a home

Money Moments: How to finance a home addition

How to request a credit limit increase

Why other lenders may be reaching out to your employees

What’s the difference between Fannie Mae and Freddie Mac?

High-cost housing and down payment options in relocation

A checklist for starting a mobility program review

How I did it: Bought a home without a 20 percent down payment

Crypto + Relo: Mobility industry impacts

Changes in credit reporting and what it means for homebuyers

For today's relocating home buyers, time and money are everything

Common small business banking questions, answered

These small home improvement projects offer big returns on investment

Webinar: Mortgage basics: Finding the right home loan for you

Dear Money Mentor: What is cash-out refinancing and is it right for you?

The lowdown on 6 myths about buying a home

3 signs it’s time for your business to switch banks

4 small business trends that could change the way you work

3 tips for saving money when moving to a new home

Pros and cons of a personal line credit

For today's homebuyers, time and money are everything

5 tips to use your credit card wisely and steer clear of debt

How to build and maintain a solid credit history and score

How to improve your credit score

6 essential credit report terms to know

Leverage credit wisely to plug business cash flow gaps

How to establish your business credit score

Streamline operations with all-in-one small business financial support

How to establish your business credit score

Do I need a credit card for my small business?

What kind of credit card does my small business need?

Credit: Do you understand it?

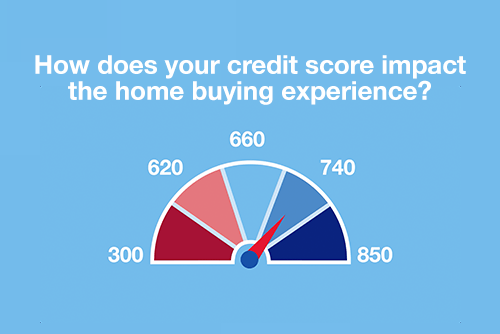

What types of credit scores qualify for a mortgage?

Test your loan savvy

Webinar: Mortgage basics: What’s the difference between interest rate and annual percentage rate?

Credit score help: Repairing a bad credit score

How do I prequalify for a mortgage?

Can you take advantage of the dead equity in your home?

Webinar: Mortgage basics: How much house can you afford?

Is a home equity line of credit (HELOC) right for you?

Webinar: Mortgage basics: 3 Key steps in the homebuying process

Webinar: Mortgage basics: Buying or renting – What’s right for you?

How to use your home equity to finance home improvements

Webinar: Mortgage basics: What is refinancing, and is it right for you?

Should you get a home equity loan or a home equity line of credit?

6 questions to ask before buying a new home

What is refinancing a mortgage?

What is an escrow account? Do I have one?

Quiz: How prepared are you to buy a home?

What to know when buying a home with your significant other

Webinar: Mortgage basics: How does your credit score impact the homebuying experience?

Dear Money Mentor: When should I refinance a mortgage?

Are professional movers worth the cost?

First-time homebuyer’s guide to getting a mortgage

How I did it: Bought my dream home using equity

Saving for a down payment: Where should I keep my money?

Is it the right time to refinance your mortgage?

Overcoming high interest rates: Getting your homeownership goals back on track

Home buying myths: Realities of owning a home

How to use credit cards wisely for a vacation budget

5 steps to selecting your first credit card

Should you buy a house that’s still under construction?

Dear Money Mentor: How do I begin paying off credit card debt?

10 uses for a home equity loan

Know your debt-to-income ratio

Common unexpected expenses and three ways to pay for them

Should you give your child a college credit card?

Webinar: Mortgage basics: Prequalification or pre-approval – What do I need?

How you can take advantage of low mortgage rates

Buying a home Q&A: What made three homeowners fall in love with their new home

Myth vs. truth: What affects your credit score?

Improving your credit score: Truth and myths revealed

How to spot a credit repair scam

Decoding credit: Understanding the 5 C’s

Practical money skills and financial tips for college students

5 unique ways to take your credit card benefits further

5 tips to use your credit card wisely and steer clear of debt

What’s a subordination agreement, and why does it matter?

Understanding the true cost of borrowing: What is amortization, and why does it matter?

What’s your financial IQ? Game-night edition

How to build credit as a student

Money Moments: Tips for selling your home

Crypto + Homebuying: Impacts on the real estate market

Your quick guide to loans and obtaining credit

4 questions to ask before you buy an investment property

Good debt vs. bad debt: Know the difference