Eighteen years ago, Cheryl Roberts was part of a group that put their heads together to come up with ways to help close the racial homeownership gap in Portland, Ore. That conversation became the seed that eventually grew into the African American Alliance for Homeownership (AAAH), a nonprofit that helps to connect its local Black community and other underserved individuals with economic opportunities and homeownership.

Today, as Executive Director of AAAH, Cheryl continues to lead the organization’s efforts to find creative ways to bring economic opportunity to underserved communities. Since its inception, AAAH has been on a mission to empower African Americans and underserved individuals to become homeowners by providing education, financial resources and community support.

The organization and its advocates have always been unified in their desire to help African Americans get connected to tools that can help close the racial gap in accessibility to homeownership. “We came together to form the committee, addressing the low numbers of African American homeownership in Portland – at that time, it was actually the lowest in the nation,” says Cheryl. “We decided, ‘what can we do to improve homeownership or create accessibility?’ and we started homeownership fairs – that started the organization.”

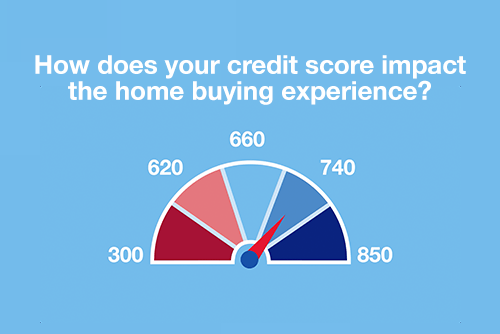

With challenges like low credit scores, lack of savings and minimal access to financial assistance creating roadblocks for many African Americans, the development of AAAH became a key instrument in forming solutions.

AAAH's approach to building economic opportunity

Since its founding, AAAH’s events like homeownership fairs have offered an opportunity for prospective homebuyers to consult with housing professionals and attend free workshops. Now, with help from this additional funding from U.S. Bank, the organization remains focused on continuing its important work. “This will support our operations and help us continue to do exactly what we do but in some new ways. We are actually being introduced to loan officers that have some of the same mission or passion we have, and serve the same communities .”AAAH is also one of the one of the organizations that received funding from U.S. Bank’s $15 million Rebuild and Transform Fund to support organizations working to address systemic economic and racial inequities.

AAAH also works one-on-one with people to find personalized solutions for their needs. Cheryl recalls a story of a woman who needed to fund an unexpected and urgent home repair while also struggling to pay her mortgage and came in to AAAH seeking support. The organization connected her with a local loan assistance program and provided internal help as well. “We paid over $10,000 of her mortgage,” says Cheryl. “These are the types of stories or situations that brings us to tears and keep us going.”

In previous years, the organization’s well-loved “Homes for Sale” bus tour has been a huge success, with 42 passengers coming aboard and viewing affordable homes. An AAAH staff member is the tour guide, with a realtor and mortgage lender in attendance as well. The realtor selected the homes and explained the details of each one to the group. The lender would also discuss the type of financing available to purchase a home, and Cheryl, the AAAH representative, shared resources the organization had available to help with the purchase. “In the past, we’ve actually had people travel with us because they are so excited about being part of that tour,” says Cheryl. “It builds community and brings people together.”

Pivoting during unprecedented times

But despite there being a global pandemic, AAAH didn’t let that get in the way. With COVID-19 limiting the ability to gather in-person, the structure of the event has gone virtual. Rather than viewing this as a challenge, Cheryl and the AAAH team are excited to execute new ideas and explore different possibilities. “I think it’s going to go very well,” Cheryl commented, prior to the event. “This one is just going to be very creative. We actually have a picture of a bus driver so it’s like you’re actually on the bus with the driver there.”

This year’s online event also included a realtor and virtual tours of the homes. They were able to showcase a wider variety of homes in different regions, since they weren’t limited by the time it takes to drive to each home. The virtual tour featured a U.S. Bank mortgage lender who talked about different programs the bank offers for first-time homebuyers, and information about employment opportunities at the company. To add an extra element of fun, the virtual tour included Black history trivia in honor of Black History Month, with raffle prizes as well.

Although this year’s bus tour looked a little different, one thing has stayed the same – the sense of unity and comradery that the event brings out in its participants. “People learn well together and can become motivated, especially when you are all moving toward the same goal,” says Cheryl.

Read more stories about how doing real good is making a big difference.