Your gateway to organizational growth

Explore related insights or solutions.

For organizations saddled with tens or even hundreds of demand deposit accounts (DDAs), virtual account management can provide a more efficient way to operate.

A virtual bank account is a sub-ledger account linked to a DDA. Virtual account management (VAM) offers a way to manage accounts digitally within a single physical account.

VAM can produce more effective liquidity management, reduce administrative effort and banking fees, and support flexible reporting and efficient receipts reconciliation.

Money movement is notoriously complex. Corporate treasury departments spend an incredible amount of time organizing demand deposit accounts (DDAs) and their associated transactions to manage cash flow, reporting and reconciliation — as well as for any number of operational and strategic reasons.

Not only can it be cumbersome to manage numerous physical DDAs, but paying related transaction fees can also be expensive.

For many organizations today saddled with tens or even hundreds of DDAs, there is now a more efficient way to operate.

It’s called virtual account management (VAM).

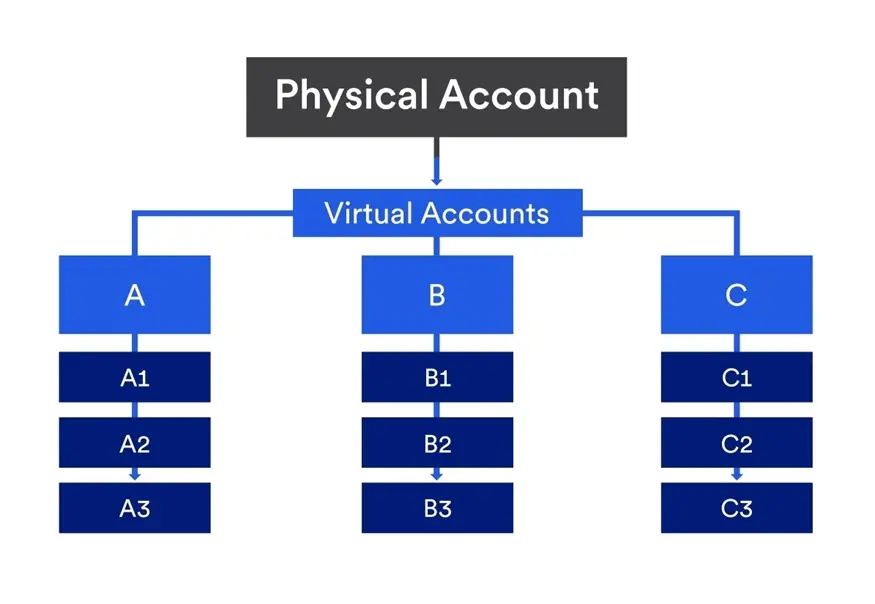

A virtual bank account is a sub-ledger account linked to a traditional physical demand deposit account. VAM offers a way to manage accounts digitally within a single physical account, which provides a variety of benefits.

If an organization maintains multiple physical bank accounts, opening and closing those accounts, as well as adding and deleting services from each account, is complex and time-consuming. Plus, you pay a fee for each account. With VAM banking, you can maintain one traditional DDA and build multi-level account hierarchies with virtual accounts.

“VAM gives you the flexibility to segregate balances and/or transactions to align with your organization’s business needs,” explains David Bearl, group product manager for emerging liquidity solutions at U.S. Bank.

Virtual account management uses unique identifiers to allocate transactions to virtual accounts within a physical account. An incoming or outgoing payment simultaneously posts to the master physical account and to the relevant virtual account.

All your monetary transactions settle within the traditional DDA. However, you can designate certain transactions to be copied or replicated in appropriate virtual accounts.

Each individual virtual bank account provides the same segregation of data, balance analysis and transaction identification that a physical account would.

You can associate any number of virtual accounts with your physical bank account, assigning a purpose for each virtual account. This allows you to create and operate virtual account structures that mirror your organizational set-up.

“If a business needs to move a few million payments or more each day, it’s likely their solution is going to be powered by APIs.”

Using virtual accounts in banking produces an array of benefits:

VAM also simplifies adoption of faster digital payment alternatives like Zelle® and instant payments. Once you establish these payment services on your traditional DDA, they are inherited by your virtual accounts.

What types of businesses can employ VAM to achieve these benefits?

“There is not one single industry or business, size, scale, vertical or segment that can’t immediately benefit from virtual accounts,” says Adam Carter, Head of Faster and Embedded Payments at U.S. Bank.

VAM can typically benefit any organization that holds 10 or more DDAs.

For some, using VAM is an easy decision. Retail businesses with multiple locations are a prime example. “Each location has cash flow, mostly inflows for sales, and the retailer wants to track those flows by location,” explains Bearl.

VAM can also be attractive to many commercial real estate businesses, particularly ones that manage many properties and need to open and close accounts for those properties on a regular basis. VAM allows them to maintain a single physical account and designate virtual accounts for each property, which eases account administration. Also helpful to property managers: With some VAM banking offerings, each virtual account can be designated as having a different owner.

Similarly, it’s easy to understand how VAM might benefit a charitable non-profit that wishes to segregate donor funds by specific use, or a law firm that regularly opens trust and escrow accounts for its clients.

Treasurers can build virtual account structures with as many levels as they want.

Establishing a hierarchical bank account structure using virtual accounts is a natural for higher education. A statewide university system, for instance, could maintain a single physical DDA with virtual accounts that segregate cash flows for each of its 20 campuses. A third level in the hierarchy could include accounts for each college within each campus, such as the business, journalism and engineering colleges.

Moreover, the university’s treasurer might want the athletic department at each campus to have virtual accounts for each of its student sports, such as football, basketball and lacrosse.

The pace of business continues to accelerate. In this environment, you need to be able to open and manage bank accounts in minutes rather than weeks, and you need precise cash reporting.

VAM allows you to conveniently open and close accounts in a self-service mode while giving you the ability to review your consolidated cash position in real time. It’s a flexible tool that can benefit organizations across industries, enabling them to create account structures as layered as their businesses are.

“The possibilities presented by virtual account management are only limited by a treasurer’s imagination,” Bearl says.

For more information about innovations in treasury management and the benefits of digital-first payment solutions, and how faster payments and virtual accounts can accelerate your strategy, enhance liquidity and reduce risk, connect with a U.S. Bank Relationship Manager.

Building payments into the normal business flow makes paying easier for customers — enhancing the seller’s brand — while simplifying collection and reconciliation.

Send, receive and request immediate payments with an end-to-end payment solution that streamlines the experience for customers, vendors and employees.

Unlock timely, actionable strategies and perspectives from U.S. Bank experts — delivered straight to your inbox.