Your gateway to organizational growth

Explore related insights or solutions.

The federal government’s push toward payment modernization has resulted in an array of faster and even instant payment channels.

Adopting these new channels can unlock a host of benefits for companies, including speed, efficiency, 24/7 visibility of real-time information, cost savings and payee satisfaction.

Digital transformation is requiring treasury professionals to revise their payment strategies by selecting, for each disbursement type, the payment channel that makes the most sense.

Faster payment channels are driving major changes in how businesses and consumers are moving money. In doing so, these channels are creating opportunities for corporate treasury managers to build a payments strategy that better serves their businesses as well as their payees.

The payments ecosystem has boomed in recent years thanks to a government push toward payment modernization that started with the Federal Reserve’s Faster Payments Task Force in 2015. This push resulted in payment offerings like Same Day ACH, the RTP® network, Zelle®, and the FedNow® Service. Adopting these new channels can deliver smarter money movement, including speed, efficiency, 24/7 visibility of real-time information, cost savings and payee satisfaction.

“While neither the smartphone or APIs are new, the sheer pervasiveness and the power of these technologies, combined with some of the development in the payments ecosystem, are leading the new payment revolution.”

Treasury managers are finding the key to taking advantage of these developments is understanding which payment tools to bring on board and when to use each one. Not every payment type is available to every payee, so building a holistic strategy involves making sure your company is using the right payment method at the right time.

Like a set of golf clubs or cooking knives, different payment solutions can provide the best fit for specific situations, so mixing and matching them effectively to build a toolkit is essential. Doing so can unlock a host of benefits, such as speed, certainty and real-time information 24 hours a day, 365 days a year – driving visibility, cost savings and payee satisfaction.

Companies are seeing the wisdom of moving toward an advantageous mix of traditional and new payment channels. Indeed, the smart strategy is to adopt faster payments for targeted use cases, ones where a new channel can add major benefits to a specific category of disbursements without overly taxing company resources.

“Adopting the right mix of digital payment solutions has the capacity to help businesses solve some of the key issues they’re facing,” says Anuradha Somani, head of Global Payables & Embedded Payments at U.S. Bank.

Track the rise of instant payments.

Adoption of instant payments is on the rise, according to our survey of more than 2,030 senior finance leaders. The research showed 51% of businesses are currently using instant payments and 80% plan to use them by 2026. Dive into what’s driving the rise of instant payments.

Evolving customer expectations around faster payments and improvements in the enabling technologies have expedited these trends. According to Somani, both consumers and corporate treasury professionals are asking themselves: “When everything from food, coffee and a taxi ride is available instantly with a click, why does it take three days for me to transfer funds from one of my bank accounts to the other?

“The supercomputer that you carry in your pocket — your phone — and the underlying APIs on apps enable you to access literally the entire world through your touchscreen,” Somani adds. “While neither the smartphone or APIs are new, the sheer pervasiveness and the power of these technologies, combined with some of the development in the payments ecosystem, are leading the new payment revolution.”

In fact, faster payments are powering a digital shift in business-to-business (B2B) and business-to-consumer (B2C) payments.

“Companies want to make payments more efficiently, and they want more control over those payments,” Somani says. “They also want to receive payments quicker and apply them accurately and as close to real-time as possible.”

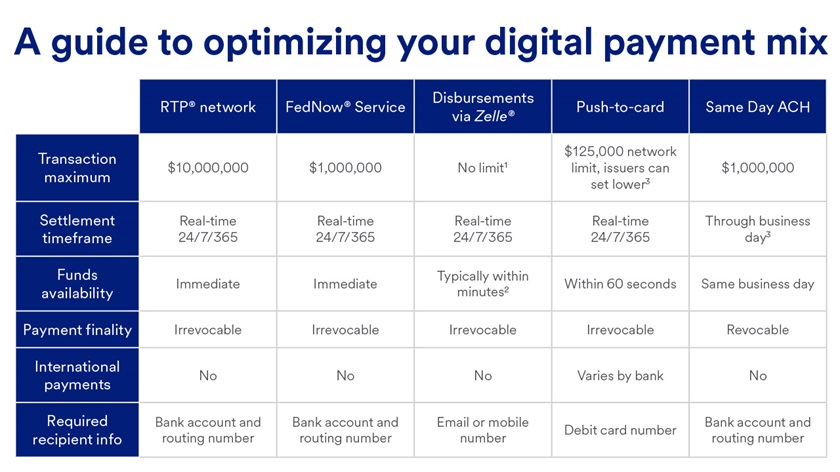

While traditional payments are still widely used, faster payment platforms offer the additional benefits that Somani describes. Thus, treasury managers are wise to identify the channel options their clients and business partners can access that will enable them to deliver payments in a timelier manner. Here’s a look at some popular faster payments options and how they might strengthen your company’s payments strategy.

Instant payments allow companies to send or receive money immediately between businesses, suppliers and consumers. Businesses can manage payments, cash flow and rich data through two instant payment services that work together, the RTP network and the FedNow Service.

The RTP network, operated by The Clearing House, was introduced first, in 2017. It enables consumers and businesses to send or receive money between any participating financial institutions in real time. Unlike wire transfers and ACH payments, funds can move at any time and settle instantly.

In 2023, the Federal Reserve launched the FedNow Service, which enables financial institutions of every size across the U.S. to provide safe and efficient instant payment services. The FedNow Service is greatly expanding the network for instant payments, particularly with smaller regional banks and credit unions.

These instant payments channels facilitate a level of accompanying data, such as bill details and potentially invoices, that enables AP/AR teams within these organizations to mitigate longstanding reconciliation problems. The largest pain point with many electronic transactions is often the exchange of information associated with the payment. Facilitating this communication digitally provides significant process efficiencies.

Instant payments can be used for B2B payments such as merchant funding and settlement, loan/lease funding and payment on delivery; B2C transactions such as payroll, title and escrow payments, and insurance claim payments

One emerging B2C use for instant payments is making payroll corrections. If there is an issue with an employee’s pay, an instant payment allows a business to make a real-time correction. Today, with such an acute focus on employee satisfaction, that’s a huge win.

Zelle® is a digital payment network, comprised of more than 2,200-member financial institutions, that allows clients to seamlessly transfer funds to clients who have an eligible checking or savings account, just by knowing their email or U.S. mobile phone number. More than 150 million Americans can access Zelle® through their mobile banking application. With Zelle®, your business can streamline processing, exception management and reduce check costs with an easier digital option for customers.

People aren’t always comfortable sharing their bank information, and businesses don’t necessarily want to collect it for infrequent payments. Zelle® addresses this issue.

Consumers enroll through their mobile banking app or in the Zelle® app (if their financial institution does not offer Zelle®). They then identify and register either their email address or U.S. mobile phone number. Following the enrollment, transactions are conducted by using these identifiers and without sharing bank information.

Making payments with Zelle® allows companies to eliminate the costs of printing and mailing checks, as well as avoid the risks associated with collecting and storing payee bank account information when making ACH payments. Zelle® is often used for refunds, such as utility refunds to homeowners; rebates; insurance claim payments; incentive payouts; employee payouts; and gig worker payments.

Zelle® payments have become popular in higher education. “Zelle® is a great option for issuing students convenient refunds when they drop classes, for instance,” Somani says. “In addition, Zelle can support payments to students after they graduate, when checks often can’t be delivered and cashed due to outdated addresses.”

Push-to-card is another option for making faster payments to consumers without requiring them to provide bank account information. The push-to-card channel takes advantage of the fact that while fewer consumers carry a checkbook, most do carry a debit card. Companies can use the debit card payment rails to deliver money to a consumer’s checking account or fund a prepaid card.

Visa Direct and Mastercard Send® platforms leverage the Visa and Mastercard debit networks, respectively, to allow B2C deposits into consumer bank accounts or prepaid cards, in real-time, 24 hours a day, seven days a week.

Push-to-card supports a variety of use cases. For instance, it is ideal for insurers paying consumer claims following a natural disaster. It can provide the immediate funds insureds need to recover and overcomes the obstacle of delivering those funds to people who may have left their homes. “Where it may be impossible to deliver a check or prepaid card by mail to an insured, push to card affords digital, near real-time delivery,” Somani says.

While the speed and ease of payment are strong advantages of these solutions, Somani has some advice: “In order to reap the benefits of increased efficiency through debit card payments to individuals, consumers should safeguard their debit card credentials,” she notes.

Additionally, as with other faster payment options, you need to be aware of transaction limits, which sometimes the issuing bank may impose, leading to transaction rejection.

The ACH network is an electronic channel through which money moves directly from one bank account to another. ACH is popular for many uses, but traditional ACH deposits are subject to a one- to three-business-day turnaround, which may be too long for critical situations.

Enter Same Day ACH payments. Introduced in September 2016, Same Day ACH uses the existing ACH infrastructure but processes payments within the same business day. All banks are required to receive Same Day ACH transactions, which allows originators to send a payment to any bank or credit union in the United States.

“It makes sense to utilize Same Day ACH when the standard one- to three-day settlement time will not suffice, but an irrevocable payment is not required,” Somani advises.

Same Day ACH has become a mainstream payment alternative, an extension of the ACH system that affords same-day settlement. In 2024, Same Day ACH volume reached 1.2 billion payments representing $3.2 trillion.

Same Day ACH is limited to domestic transactions of no more than $1 million, and there are fixed windows during which the payment must be received to be posted on the same day. Regarding the last point, there is an important development to follow: A Nacha proposal that would take effect in September 2026 would provide 3¼ more hours each processing day for initiating Same Day ACH payments, aligning the closing of the same-day payment window with close of business in the Pacific time zone.

Note: The above details are a general guide and can vary based on individual sender/receiver bank requirements. 1.There are no limits for B2C payments through the Zelle Network®, however recipient banks may establish a lower limit. 2.Once recipient is enrolled and payment is sent, funds can arrive as quickly as minutes or may take up to three business days. U.S. checking or savings account required to use. 3.Payments to out-of-network recipients are sent over debit card networks, which have a network limit of $125,000, and banks may set their own lower limits. Daily network limit of 150 transactions or $250,000.

As faster payments systems continue to emerge and evolve, treasury professionals are faced with determining which payment channel will make the most sense for each type of disbursement within their organization. One way that treasury management banks can ease that challenge is by offering intelligent payment routing. With this capability, a company can send a bank a payment file and have the bank use business rules the company establishes to decide in each case the most appropriate and cost-effective channel for sending that payment out.

“Digital transformation is requiring corporate treasurers to revise their payment strategies,” Somani says. “Companies should look for a bank that can support them in using both traditional and newer payment rails to their best advantage.”

At U.S. Bank, we can help you get started navigating the new payments landscape. We’ll begin with a comprehensive assessment of your payments strategy and then explore how faster payment options can fit within your plan. If you’re on the fence about faster payments, we’re happy to provide additional information.

To learn how real-time payments are changing the way companies do business, visit our instant payments resource page, explore our survey of 2,030 American businesses, or schedule a call with a treasury management expert.

Building payments into the normal business flow makes paying easier for customers — enhancing the seller’s brand — while simplifying collection and reconciliation.

Send, receive and request immediate payments with an end-to-end payment solution that streamlines the experience for customers, vendors and employees.

Unlock timely, actionable strategies and perspectives from U.S. Bank experts — delivered straight to your inbox.