As capital markets continue to wait for Fed interest rate cuts, no action is likely to occur before September. “The inverted yield curve is most likely with us until those Fed rate cuts begin,” says Haworth.

The inversion between the two-year and 10-year Treasury, often considered a signal of a pending recession, has been in place since early July 2022, the longest period of an inverted curve in history.3 Yet no recession has occurred in that time. “You would typically see a recession by now,” says Haworth, “but keep in mind that we’re in a unique environment that’s included a lot of fiscal stimulus and that started from a point of zero interest rates.” Haworth believes these unusual circumstances may account for the inverted curve’s false recession reading to this point.

How the yield curve could change

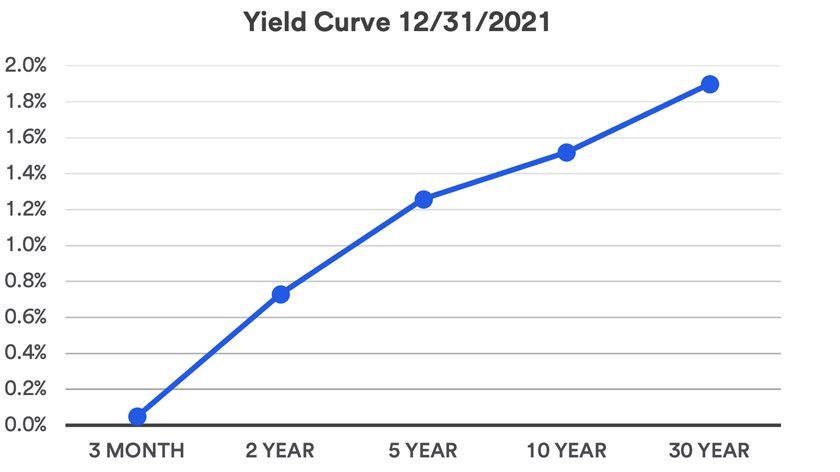

With the yield curve flattening in recent months, the next question is when to expect a return to a normal, upward sloping yield curve, when long-term bond yields exceed those of shorter-term bonds. Haworth sees two different scenarios, one preferred over the other.

“If long-term bond yields begin to fall, it’s likely because inflation is declining. Once that occurs, the Fed will feel more comfortable cutting short-term rates.” Haworth believes that the preferred way to see the yield curve return to normal is with short-term rates declining more precipitously than long-term rates. Declining short-term Treasury yields would likely follow fed funds rate cuts.

Haworth says the “Goldilocks” version of this scenario is one where declining inflation is paired with a growing economy. “In this circumstance, the Fed will feel more confident about its ability to lower rates without risking a significant inflation uptick,” says Haworth.

A less desirable scenario, according to Haworth, is one where the economy appears at risk. “The Fed will cut short-term rates to offset a recession threat,” says Haworth. “That could happen, for example, if unemployment suddenly moves sharply higher, which could temper consumer spending power and trigger a recession.”

Haworth doesn’t rule out the possibility that a recession could still occur, as many believes the inverted yield curve signals. But he notes that to this point, the U.S. economy has managed to stay on track.

Haworth also cautions about the economic challenges stemming from the current interest rate environment, as it creates headwinds for business investment. “It represents a steeper cost for corporations. With short-term rates so high, companies could become increasingly reluctant to borrow, as it is more challenging to realize a payoff when investing the borrowed capital in new equipment and facilities or added employees. Yet Haworth notes today’s unusual environment may also work to the benefit of many large companies. “Companies that have cash on the balance sheet, even if they also issue debt, are earnings higher yields on cash reserves, offsetting some of their higher borrowing costs.”

Investment considerations in today’s unusual environment

With yields higher on short-term securities, it’s no surprise investors have put significant sums to work on the short-end of the yield continuum. However, Haworth recommends investors also consider longer-term bonds, with yields that are far more attractive today than they were at the start of 2022. “It’s important to get today’s higher, long-term rates locked in before yields begin turning lower,” says Haworth. “Once the Fed starts to cut rates, investors need to have fixed income assets anchored on the longer end of the yield curve to protect their income streams over time.”

One consideration for bond investors is the risk of rising interest rates. When interest rates rise, values of bonds held in an existing portfolio lose market value. “A 30-year bond is much more sensitive to interest rate movements than a 6-month bond,” says Eric Freedman, chief investment officer at U.S. Bank Wealth Management. Yet Freedman believes attractive interest rates create opportunities for investors. “It may be a time for fixed income investors to spread out exposures across the maturity spectrum.”

Haworth notes there’s increasingly positive investor sentiment for non-Treasury segments of the market. With certain non-taxable portfolios, this includes non-government agency issued residential mortgage-backed securities, while managing total portfolio duration using longer-maturity U.S. Treasuries. Certain tax-aware portfolios can benefit from municipal bonds, including some longer-duration and high-yield municipal securities. Trust portfolios may benefit from reinsurance as a way of capturing differentiated cash flow with low correlation to other portfolio factors.

Check-in with your wealth planning professional to make sure you’re comfortable with your current mix of investments and that your portfolio’s asset allocations remain consistent with your goals, risk appetite and time horizon.