Want retirement help or a second opinion on your plan?

Connect with a wealth specialist for a free no-obligation consultation.

Sequence of returns is the risk of negative market returns occurring as you enter retirement, which can deplete your retirement nest egg and significantly impact long-term retirement security.

A retirement income strategy, such as a bucket strategy, may help protect against the impact of negative markets and other financial challenges.

A financial professional can help you create a diversified, tax-efficient strategy to make the most of your retirement money.

One of the most important financial decisions you make in life is choosing when to retire. You want to enter this stage of life feeling confident that you’re financially prepared for the future.

However, retirees face two unique investment challenges that were not a concern when wealth accumulation was the primary focus. The first is making sure your wealth is protected against the impact of uncertain markets. The second is to ensure that income generated from your investments keeps pace with rising living costs during retirement.

In short, a balancing act that accounts for retirees’ unique risks and opportunities is required.

“Increased life expectancy is a welcome development, but it creates significant challenges in terms of the increasing costs of retirement over time. Add to that the potential for unpredictable markets, and retirees need to be willing to make adjustments over time to maintain their long-term financial security.”

-Shannon Baustian, Private Wealth Advisor, U.S. Bank Private Wealth Management

Sequence of returns risk applies specifically to retirement income planning and is the risk of negative market returns occurring late in your working years and/or early in retirement. At this stage of your investment life, market downturns can have a much more significant impact on your portfolio and your lifetime income strategy, because you don’t have the luxury of time for your investments to recover.

“You always want to be careful about liquidating assets in down markets to meet income needs,” says Shannon Baustian, Private Wealth Advisor with U.S. Bank Private Wealth Management. “This is where sequence of returns risk comes into play.”

Sequence of returns risk is just one of the financial complications you’ll need to untangle before and during retirement. Financial challenges for retirees include:

Periodic market downturns are an investment fact of life. “Market volatility is a real risk for retired investors,” says Baustian. “You should be careful about putting money to work in a passive fashion and simply hoping that you’re on the right side of the markets.”

“You need to have a big enough nest egg to meet income needs over an extended period. If you anticipate a long retirement, you may need to work longer to accumulate that nest egg,” says Baustian.

Most or all distributions from employer retirement plans and traditional IRAs are subject to tax at ordinary income tax rates. “Limiting the tax hit on distributions is important to preserve principal to last through the course of retirement,” says Baustian.

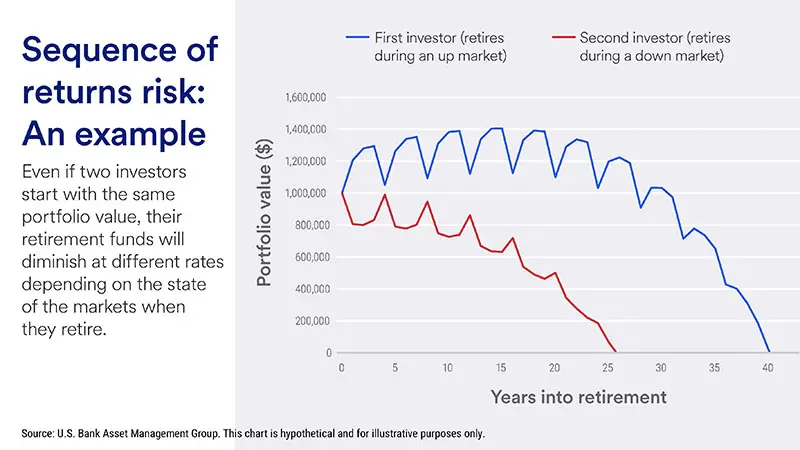

Consider this hypothetical example of two investors who retired in different years. They both invested $1,000,000 on retirement and plan to withdraw $45,000 each year, adjusted upward by 3% every year to account for inflation.

Over the course of retirement, their portfolios generate comparable annual returns but follow a different year-to-year return pattern.

For both investors, the same pattern of returns and income distributions continues throughout retirement.

The first investor benefits by earning positive returns in the initial years of retirement. Their portfolio grows as a result, even as they generate income by liquidating assets. This strong start to retirement allows the investor’s nest egg to generate the desired amount of income for 40 years.

Unfortunately, the second investor retired in a year when the markets were down. Just a single year of negative returns at the outset of retirement meant their portfolio lost significant value. Because they were selling their assets into a down market, their portfolio couldn’t recover like it would have during the pre-retirement accumulation period. This caused significant damage to the investor’s long-term income strategy, with their money running out after just 25 years.

“Retirement is a long runway, and you still need growth in your assets,” Baustian says.

One income strategy to consider is a retirement bucket strategy, where you set aside a portion of your assets to meet your needs through various phases of your retirement. Baustian notes that financial professionals often look at ways to separate retirement assets into three “buckets” with the aim of avoiding selling assets that can fluctuate in value and are subject to loss in a down market.

This bucket carves out assets to meet your day-to-day needs for the first three to five years of retirement. This money should be kept in more liquid assets with minimal exposure to market fluctuations, such as cash-equivalent investments (CDs, money market accounts) and short-term bonds.

You can invest a portion of your assets more aggressively to meet your needs for years three to 10. “Use a disciplined asset allocation strategy with these investments so they can continue to grow,” Baustian says. “Some of the money is regularly shifted to replenish the ‘liquidity’ bucket.”

“The dollars in this bucket can be invested with future generations or key charitable causes in mind,” Baustian says. “There may be more flexibility to invest these dollars in assets outside of traditional stocks and bonds.” You can hold this money until the latter part of your life.

There are plenty of tasks to check off your retirement list.

“You should consider starting to position your assets for retirement about two to three years before you reach that date,” Baustian says. “It can even be initiated five years out. You’ll want to evaluate all the potential sources of income available to you.” These include Social Security, contributions from company pensions and deferred compensation.

Even before that, you should build a diversified portfolio that better weathers market volatility before and during retirement. This should include with a mix of investments, such as bonds, equities and diversified investments, that aligns with your risk tolerance.

As your retirement date approaches, evaluating sequence of returns risk becomes critical. “Understand what your investment portfolio is exposed to that could put your long-term financial security at risk in the event markets move in an unanticipated direction,” Baustian says.

She adds that it’s important to maintain a degree of flexibility. “Of course, increased life expectancy is a welcome social development, but it creates significant challenges in terms of the increasing costs of retirement over time,” she says. “Add to that the potential for unpredictable markets, and retirees need to be willing to make adjustments over time to maintain their long-term financial security.”

Learn how we can help you plan and create a retirement income strategy that accounts for sequence of returns risk.

Sequence of returns risk is the risk of negative market returns occurring late in your working years and/or early in retirement. At this stage of your investment life, market downturns can have a much more significant impact on your portfolio and your lifetime income strategy.

Positive investment returns in the early years of retirement can bolster your retirement nest egg. However, negative investment performance in the early years of retirement, combined with liquidation of assets to fund retirement, can deplete assets more quickly, which could reduce the length of time your assets will last in retirement.

A “bucketing” approach can help mitigate sequence of return risk.

Consider dividing your retirement savings into three buckets:

The bucketing approach is an effective strategy to avoid selling assets that can fluctuate in value and are subject to loss in a down market.

If you maintain a portfolio that’s fully invested in assets that can fluctuate in value, you should consider adjusting your income stream to account for this fluctuation as it could result in an income shortfall in years when markets are down.

A bucketing strategy can help protect assets from exposure to market fluctuations, allowing you to maintain a consistent income stream in retirement.