Capitalize on today's evolving market dynamics.

With changes to taxes and interest rates, it's a good time to meet with a wealth advisor.

Supply chain issues mostly remain under control and aren’t creating inflation issues.

Risks of a dockworkers strike that might have affected product flows were quelled by a recent contract settlement.

Investors are watching to see if proposed tariffs could have a supply chain impact.

Supply chain issues that arose as part of COVID-19’s economic disruption remain mostly under control. “Our problem in 2020 and 2021 was that we couldn’t obtain supplies fast enough,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management. “Then we had a period where supplies were backed up at ports and couldn’t get through, but that’s all largely behind us at this point.”

Periodic risks arise, but one of the biggest concerns going into 2025 was the possibility of the dockworker’s strike. However, in mid-January, the International Longshoreman’s Association union and the U.S. Maritime Alliance of ports and shipping companies reached a tentative agreement on a six-year contract.1

What is the potential that higher tariffs exacerbate supply chain issues? “The key is whether we have other suppliers ready to replace items affected by tariffs. If it can be replaced, the next question is how quickly can that occur? If it can’t be replaced, what are the cost implications?”

Rob Haworth, senior investment strategy director, U.S. Bank Asset Management

While most supply chains appear to be running smoothly, investors are closely monitoring the potential impact of tariffs now under consideration by the Trump administration. President Donald Trump has suggested higher tariffs might be applied to imports from China, Mexico and Canada, three primary U.S. trading partners. “The fact that President Trump requested further study on tariff changes and did not immediately implement them was welcomed by the markets,” says Haworth. “It seems as though the can is getting kicked down the road.” In the early days of trading after President Trump’s inauguration on January 20, stocks gained ground.

The implementation of higher tariffs could affect availability of some products and materials from supplier countries. What is the potential that newly-implemented tariffs could exacerbate supply chain issues? “The key is whether we have other suppliers ready to replace items affected by tariffs,” says Haworth. “If it can be replaced, the next question is how quickly can that occur? If it can’t be replaced, what are the cost implications?”

As President Trump’s second term begins this week, no new tariffs have yet to be implemented, but the issue remains front-and-center and one that is frequently mentioned by Mr. Trump.

Significant global conflicts have complicated the geopolitical landscape since early 2022 when Russia invaded Ukraine. Both Russia and Ukraine are major commodity producers, raising the potential for supply disruptions. More recently, tensions rose in the Middle East, with Israel invading the Gaza Strip following the October 7, 2023, attack on Israel by Hamas. Other Middle East hotspots flared up since. With the Middle East a major source of the world’s oil supply, conflicts led to concerns that supplies might not keep pace with global demand. Yet in recent years, U.S. oil production reached record levels, resulting in the U.S. becoming the world’s leading oil producer.

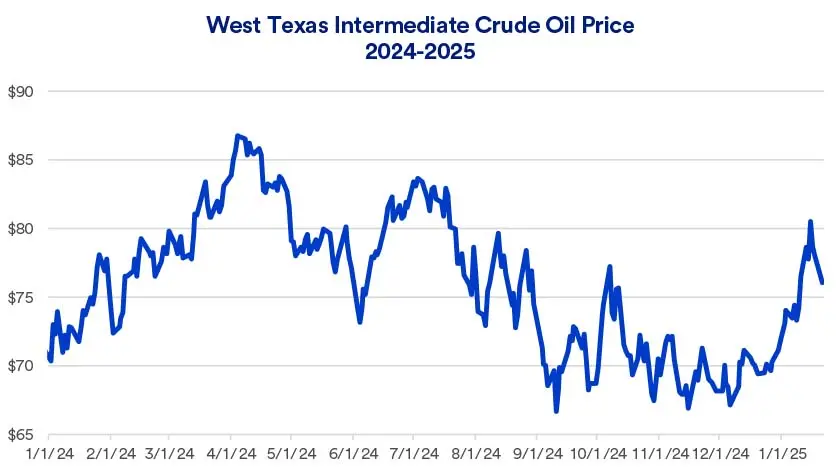

Even as conflicts raged, throughout 2024 and so far in 2025, oil prices stayed in a trading range, generally between $65 and $85.2 “Between efforts to encourage more U.S. production and the likelihood that Organization of Petroleum Exporting Countries (OPEC) countries will soon boost output, it establishes the potential for lower prices,” says Haworth. Upside price potential could be triggered by U.S. government efforts to refill the nation’s Strategic Petroleum Reserve, which is at slightly more than half of its capacity of more than 700 million gallons.

Falling energy prices played a major role in inflation’s decline from a peak of 9.1% for the previous 12-month period as of June 2022, to 2.9% for the 12-months ending in December 2024, as measured by the Consumer Price Index.3

Supply issues are less likely to develop if, as is the case today, goods demand remains diminished. This is far different from the COVID-19 pandemic’s early days, when consumers ramped up goods spending. At that time, the global economy faced a shortage of commodities, parts or products that led to supply-demand imbalances. “Higher inflation reflected a restricted supply of goods at the same time that there was strong demand for many of those same goods,” says Tom Hainlin, national investment strategist with U.S. Bank Asset Management.

The worst of these challenges have subsided. Manufacturer supplies improved and consumers today find most goods readily accessible. The economy also transitioned from one driven by demand for goods to increased spending on services, including travel and entertainment.

As the chart indicates, the rate of U.S. goods spending, which in 2020 jumped significantly, in recent times increased at a more modest pace.4

Although supply chain challenges may be elevated, “We’re not at the same point we were during the peak of supply chain issues a few years ago,” says Haworth, “but there are some risks.” Haworth notes that while goods demand is relatively flat, “We also aren’t seeing stockpiling of inventories, so if demand suddenly picked up, it might require a production ramp-up.”

Persistent consumer demand and a strong job market continue to influence economic growth. Investors will closely monitor these data points in the months ahead to determine the impact on corporate profits and stock prices.

Talk with your wealth planning professional to determine how economic developments such as inflation trends may impact your own investment strategy and your long-term financial goals.

If disruptions in the supply chain result in a situation where demand for products or services outstrips available supplies, it can result in significant price increases for affected items. For example, consumer demand for goods soared in 2020 and 2021, during the early months of the COVID-19 pandemic when activities (such as entertainment events) were limited. Manufacturers were not able to meet demand for a variety of reasons, including increased consumer demand and shortages of available materials. As a result, costs for some items jumped, and the broader inflation rate surged. This affected monetary policy (higher interest rates) that may have had a dampening effect on the economy.

Specific sectors of the market can be subject to supply chain issues. If supplies for certain items are restricted for a period of time, it can impact the ability of companies within related sectors to meet customer demand. That could result in lower revenues and earnings, a development that could potentially be reflected in lower stock prices.

If specific types of products become scarce due to supply chain disruptions, consumers may not be able to readily obtain them or will have to pay an inflated price for them. This is similar to the issue that occurred with building supply prices in the early days of the COVID-19 pandemic. Demand for housing and home renovations surged, straining available supply, resulting in major price increases for lumber and related materials.

Persistently elevated inflation continues to vex consumers and policymakers alike.

We can partner with you to design an investment strategy that aligns with your goals and is able to weather all types of market cycles.