Capitalize on today’s evolving market dynamics.

With markets in flux, now is a good time to meet with a wealth advisor.

While most of your portfolio should be well diversified for the long term, thoughtful tactical adjustments could help you take advantage of changing market conditions.

Tactical asset allocation, dollar-cost averaging and portfolio rebalancing are three such approaches.

Review your portfolio periodically to help ensure your assets are properly positioned and consistent with your long-term financial goals.

Positioning your portfolio to meet long-term financial objectives requires strategic planning structured around your goals, time horizon and risk tolerance. Yet as capital market dynamics ebb and flow, opportunities may emerge to refine your portfolio’s positioning. Tactical asset positioning can help you take advantage such opportunities.

“There’s been a big, stock-bond performance gap and a disconnect between domestic equities and international equities. This may create an opportunity for investors to shift some assets to help better balance a portfolio consistent with one’s goals.”

Rob Haworth, senior investment strategy director, U.S. Bank Asset Management

Tactical asset allocation is a way to fine-tune a portfolio to take advantage of the fact that capital market results vary in the short term. In today’s market, for example, factors such as declining inflation, moderating interest rates and improving corporate earnings may represent opportunities to implement short-term portfolio adjustments. “Despite recent market volatility, the equity-investing environment is generally favorable,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management. “Given continued solid economic growth, stocks appear to have an edge over bonds.”

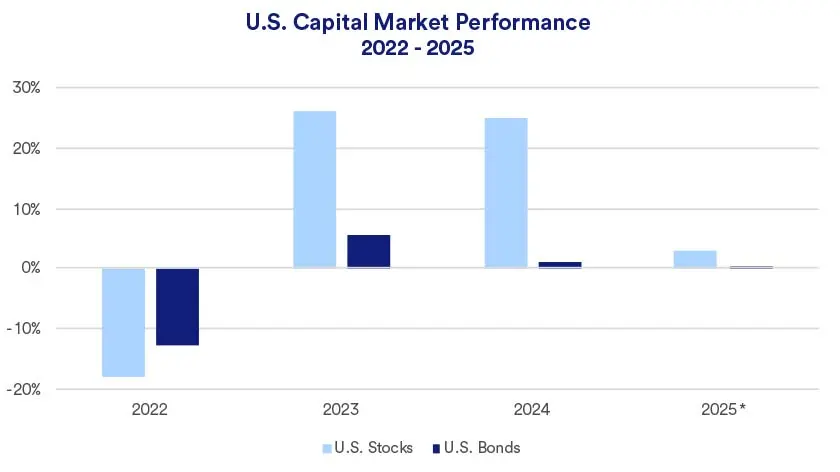

At the broadest level, investors have seen notable variation in recent years’ stock and bond performance.

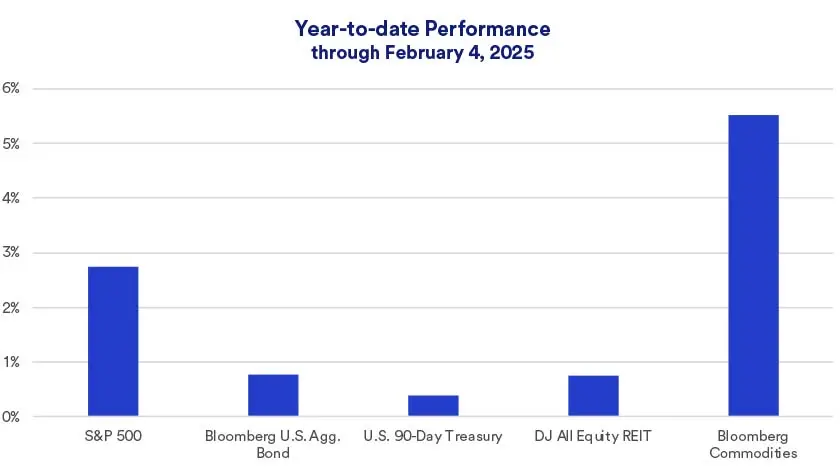

“In 2023 and 2024, the equity story was all about technology stocks,” says Haworth. Yet in January 2025, information technology was the only S&P 500 sector in negative territory.1 “Technology spending remains significant, however, which should support information technology stocks going forward,” he notes.

The fixed income market is off to a slower start. In early 2025, the benchmark 10-year Treasury yield approached 5%,2 tempering bond returns (bonds lose value as interest rates rise). By January’s end, bonds, as measured by the Bloomberg Aggregate Bond Index, achieved a modest total return (0.53%).3

In today’s environment, investors may wish to consider a less than neutral weighting in fixed income, with a greater emphasis on equities and a neutral allocation to real assets. Beyond that broad allocation strategy, Haworth says there are some tactical opportunities to explore.

The second situational strategy is dollar-cost averaging. As you accumulate cash in your portfolio, investing those dollars into asset classes with higher returns, such as equities, is key to meeting your long-term financial goals. During volatile times, dollar-cost averaging may increase your equity investing comfort level. This strategy involves investing a portion of your cash balance into the target equity portfolio at regular intervals (such as over a 6 to 12-month period), rather than investing in a lump sum.

“With the U.S. equity market near all-time highs, investors may experience regret if they invest just before the market pulls back.” Haworth says dollar-cost averaging smooths out “not just the market’s bumps, but potential feelings of regret.”

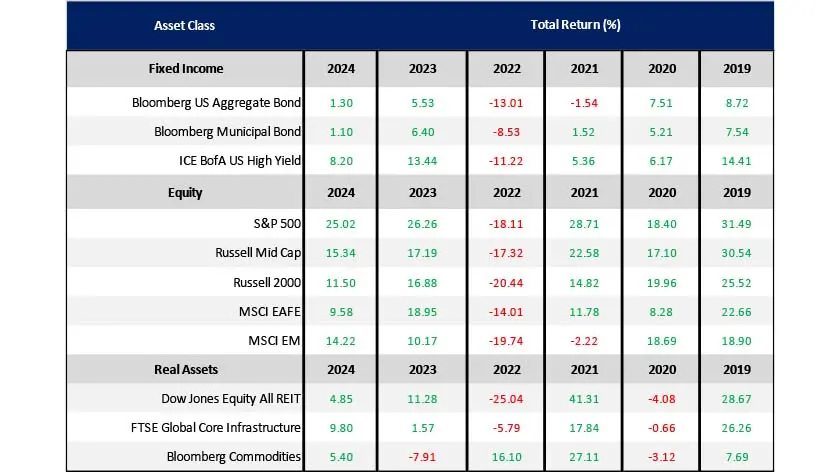

The third situational strategy addresses times when asset prices move in different directions and at different speeds. These return variations can cause your initial portfolio allocations to drift from your long-term strategy. Rebalancing your portfolio from time to time may help you achieve your investment objectives.

“There’s been a big, stock-bond performance gap and a disconnect between domestic equities and international equities,” says Haworth. “This may create an opportunity for investors to shift some assets to help better balance a portfolio consistent with one’s goals.”

“If you have significant positions in assets that have become expensively valued, you may help manage portfolio risk by repositioning those holdings,” says Haworth.

The table below details annual performance for the past six years across a variety of asset classes (represented by market indices).

Situational strategies such as tactical asset allocation have their place, but the primary driver of your asset mix should be long-term, strategic positions that are designed to be held over time to meet your specific investment objectives.

The core components of a diversified portfolio likely include:

Tactical asset allocation is an active portfolio management approach that frequently adjusts asset mixes to take advantage of perceived market opportunities. It requires that you pay careful attention to this portion of your portfolio and make frequent adjustments to reflect changes in market conditions. Typically, you should only make tactical changes to a modest portion of your portfolio.

If managed properly, incorporating tactical approaches for a small portion of what is essentially a long-term portfolio can be effective. However, investors should pursue such short-term tactical moves carefully. “Specific tactical moves designed to capture a market opportunity within specific asset classes require investors to be nimble and willing to move quickly in and out of specific positions,” says Haworth.

Tactical adjustments, dollar-cost averaging and rebalancing your portfolio positions can align your asset mix with your goals, time horizon and risk tolerance.

A wealth management professional can help you blend and select situational strategies to keep your portfolio on target to help meet your long-term investment plans and goals.

The S&P 500 Index consists of 500 widely traded stocks that are considered to represent the performance of the U.S. stock market in general. The Russell Midcap Index measures the performance of the mid-cap segment of the U.S. equity universe and is a subset of the Russell 1000 Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. The Russell Midcap Growth Index measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell Midcap Value Index measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap Index companies with lower price-to-book ratios and lower forecasted growth values. The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index and is representative of the U.S. small capitalization securities market. The MSCI EAFE Index includes approximately 1,000 companies representing the stock markets of 21 countries in Europe, Australasia and the Far East (EAFE). The MSCI EAFE Value and Growth Indices covers the full range of developed, emerging and All Country MSCI Equity Indices. The MSCI Emerging Markets Index is designed to measure equity market performance in global emerging markets. The Dow Jones Equity All REIT Capped Index is designed to measure all equity REITs in the Dow Jones U.S. Total Stock Market Index, as defined by the S&P Dow Jones Indices REIT/RESI Industry Classification Hierarchy, that meet the minimum float market capitalization (FMC) and liquidity thresholds. The FTSE Global Core Infrastructure 50/50 Index and FTSE Developed Core Infrastructure 50/50 Index give participants an industry-defined interpretation of infrastructure and adjust the exposure to certain infrastructure sub-sectors. The constituent weights for these indexes are adjusted as part of the semi-annual review according to three broad industry sectors — 50% Utilities, 30% Transportation including capping of 7.5% for railroads/railways and a 20% mix of other sectors including pipelines, satellites and telecommunication towers. Company weights within each group are adjusted in proportion to their investable market capitalization. The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities. The Bloomberg U.S. Municipal Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar denominated, fixed tax-exempt bond market. The index includes state and local general obligation, revenue, insured and pre-refunded bonds. The ICE BofAML U.S. High Yield Index tracks the performance of U.S. dollar denominated below investment grade corporate debt publicly issued in the U.S. domestic market.

A fresh look at managing your cash and investments in today’s changing interest rate environment can help support your pursuit of the goals that matter most to you.

We can partner with you to design an investment strategy that aligns with your goals and is able to weather all types of market cycles.