Considerations for conservative investors with lower risk tolerance

If you’re trying to generate income to meet current cash flow needs, you may find yourself facing significant challenges in a higher inflation/rising interest rate environment. Here are two tactics to consider.

Gradually shift money out of cash

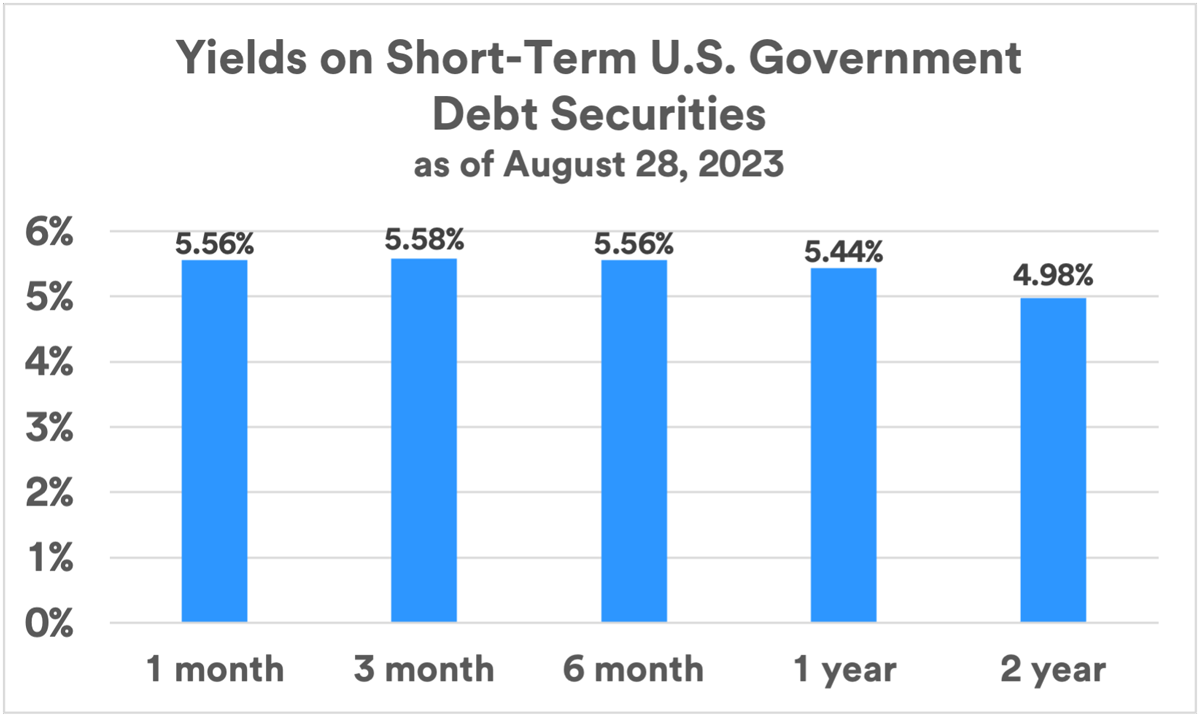

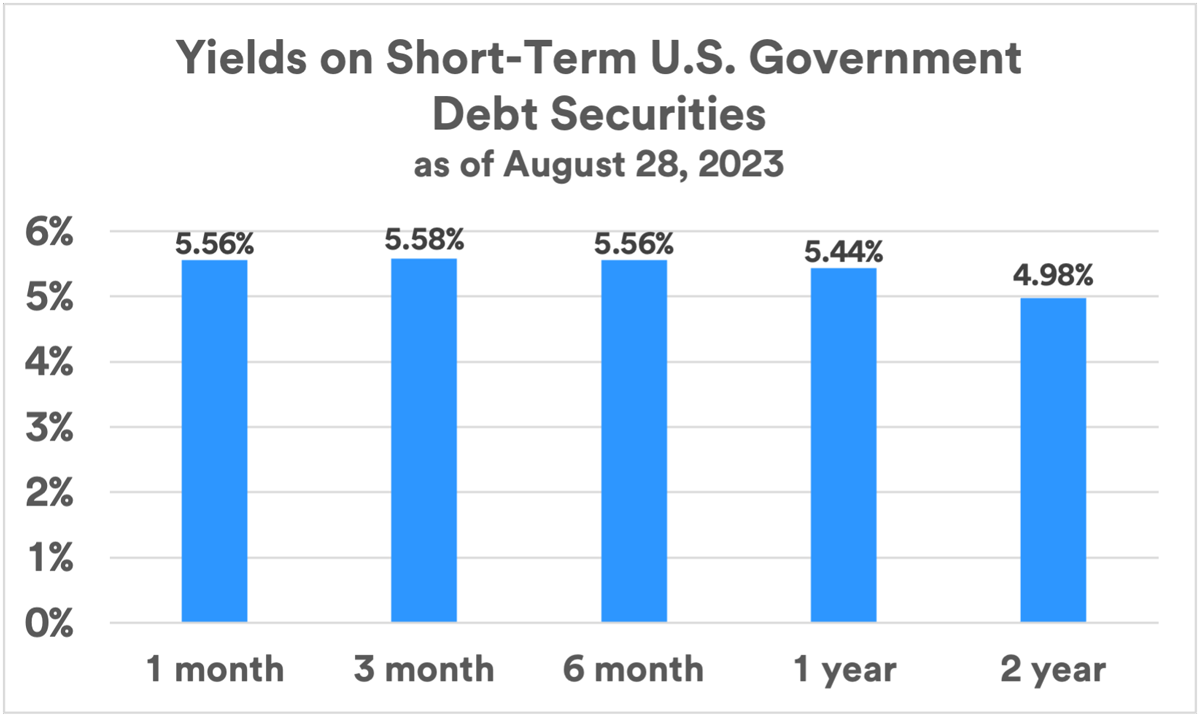

If you have significant cash holdings, it may be beneficial to move some of those dollars incrementally into certificates of deposits (CDs), U.S. Treasuries, bonds and other types of securities that offer more attractive yields. Certain cash-equivalent investments you choose won’t necessarily have the liquidity of a checking or savings account, but other options may offer a higher rate of return, or yield, mitigating some lost purchasing power owed to inflation.

Source: U.S. Department of the Treasury, Daily Treasury Par Yield Curve Rates.

In addition, investors may wish to consider shifting cash and cash-equivalent securities into bonds, which offer the potential of locking in higher yields available today for an extended period of time (1-5 years or longer).

Reconsider trust strategies

“In a rising interest rate environment, some wealth transfer strategies may offer more appealing options while others may be less effective than was the case when interest rates were lower,” says Timothy Paul, senior vice president and trust advisor at U.S. Bank Wealth Management. Certain wealth transfer strategies involving trusts, such as Grantor Retained Annuity Trusts (GRATs) and sales to Intentionally Defective Grantor Trusts, may in the current environment produce less favorable long-term results. “That doesn’t preclude these strategies from still being beneficial, but the performance of the assets being transferred may have to clear a higher hurdle to provide the desired tax benefits,” says Paul. Certain other wealth transfer strategies, however, become more attractive as interest rates rise. Here are three examples:

Charitable Remainder Trusts

A Charitable Remainder Trust allows a person to contribute assets to a trust and retain the right (for life or a term of years) to receive an annual income stream from the trust. At the trust’s expiration, remaining assets pass to a designated charitable organization. The grantor of the trust can claim a charitable tax deduction at the time of the gift equal to the present value of the charitable remainder interest. “With today’s higher interest rates, the IRS’s prescribed interest rates used to determine the value of the gift to charity is also higher,” says Paul. “The higher the deemed value of the interest preserved for charity, the larger the grantor’s income tax deduction.” That deduction is claimed at the time the trust is funded.

Charitable remainder trusts can be supercharged if you contribute appreciated assets such as real estate or small business stock. In the year in which assets are granted into a trust, you can claim an income tax deduction equal to the present value of the charity’s remainder interest at the time of contribution. In addition, the trust can later sell contributed assets with no immediate income tax liability. In summary, notes Paul, when an appreciated asset is sold within a charitable remainder trust, it creates a significant income tax deferral opportunity. It also generates an income stream, with proceeds later going to desired charities.

Qualified Personal Residence Trust

Like gifts to Charitable Remainder Trusts, gifts to Qualified Personal Residence Trusts (“QPRT”) are split between a retained portion and a portion treated as a taxable gift to another person. A QPRT is a trust in which a person contributes a primary or secondary residence in trust and retains the right to unfettered use of the residence for some period of time. At the end of the trust term, the home passes to the designated beneficiary of the trust (generally a child, grandchild, or a trust for the benefit of the child or grandchild). The strategy is a way to remove a major asset from the grantor’s estate. If the contributor to the trust wishes to remain in the home after termination of the QPRT, they can rent the home from the beneficiary at fair market value, potentially further reducing the size of the taxable estate (and thus estate taxes). The present value of the gift is determined by reducing the total value of the residence by the retained interest. When interest rates rise, the value of the retained interest increases, reducing the taxable gift to heirs.

QPRTs were not an attractive option in the pre-2022 period, when interest rates were near historically low levels. Yet the potential for significant asset appreciation inside the trust may make this a timely opportunity. Consider an example from the last time interest rates spiked, in 2007 and 2008. An individual who funded a QPRT with coastal property worth $300,000 in 2007, in effect removed an asset from the taxable estate that is now valued at $3.5 million, potentially reducing an estate tax liability to heirs by more than $1 million.

Family loans to a trust

Another wealth transfer strategy is to loan a lump sum of money to a trust, which freezes the value of the amount loaned to the lender’s estate. The trust repays interest at a rate defined by the IRS. While that rate is higher today than it was previously, the trust benefits because this is still a competitive interest rate compared to other forms of borrowing. “The trust or a family member can use the loan proceeds to, for example, invest in a family business, creating the opportunity for appreciation in value of the borrowed amount,” says Paul. At the same time, the lender has locked in the value of the loaned amount as it pertains to their estate, avoiding appreciation and potential estate taxes that may result from that.

Other estate planning considerations

Paul notes that high net worth individuals need to be aware of the current, favorable lifetime unified gift and estate tax exemption totaling close to $13 million per person (nearly $26 million for a married couple). “Under current law, these historically high exemption rates expire at the end of 2025,” says Paul. “Then the exemption rate would be cut approximately in half at that time.” Paul suggests some individuals may want to consider expanded lifetime gifting strategies to capitalize on the current law. “Estate tax exemption amounts have regularly changed, and we don’t know exactly what might happen going forward,” says Paul.

However, he recommends that estate plan reviews may prove beneficial. “If your estate plan hasn’t been looked at closely for several years, it’s important to meet with professionals who can help you assess whether any changes are appropriate,” says Paul. “Decisions regarding the disposition of an estate are very personal, with a number of opportunities worth considering.”

Planning strategies should consider your specific goals, family dynamics and financial situation. Changes in the economy and markets, tax laws, and other external factors can also have a significant impact on how effectively strategies work when implemented. U.S. Bank and U.S. Bancorp Investments and their representatives do not provide tax or legal advice. Your tax and financial situations are unique. You should consult your tax and/or legal advisor for guidance and information concerning your specific situation prior to establishing any trust.

Considerations for aggressive investors with higher risk tolerance

If you seek to generate portfolio growth, you should be aware that today’s higher inflation and rising interest rates can impact the performance of various investments. Here are some tactical considerations to keep in mind:

Maximize 401(k) savings strategies

If you typically “max out” your contributions to workplace savings plans, you may be able to invest additional sums through employer matches and after-tax contributions for a current maximum of $66,000 ($73,500 for those 50 and older).

Consider Roth IRA conversions

A Roth IRA is a retirement vehicle funded by after-tax contributions that can grow tax deferred with the potential for future cash-free withdrawals. Significant amounts held in traditional IRAs and certain 401(k)s can be converted to a Roth IRA. Tax on appreciated value is due in the year the conversion occurs, based on ordinary income tax rates. Converting a 401(k) or traditional IRA to a Roth IRA is often more attractive during down market periods. This is because you convert an equal number of shares to the same investments, but the cost to do so (paying tax on the accrued capital gain) is reduced due to stock price depreciation. Once you convert a 401(k) or IRA to a Roth IRA, you generate tax-free growth of earnings for your retirement when inflation and/or taxes might be higher, provided you’ve met qualifying holding period requirements. “Individuals shouldn’t automatically assume that they will be in a lower tax bracket in retirement, but that is one consideration when determining the value of a Roth IRA conversion,” says Paul. “Another consideration is the ability to convert assets that may be somewhat depressed in value from their peak levels, which will reduce the current capital gains tax hit and create the opportunity for the asset to recover with growth that is potentially tax-free in a Roth IRA.”

Additional steps to consider

Beyond the considerations mentioned above, here are some additional tips you may wish to explore:

- Pay down credit card debt. Look for ways to eliminate debts with high interest rates to avoid facing higher expenses associated with this type of borrowing. “Paying off high interest debt can be one of the best investments you make,” says Paul.

- Seek more affordable borrowing options. If you can’t pay off all your debt, focus on reducing balances on higher interest loans and look to consolidate debts using a less expensive form of borrowing.

- Invest in your own growth. Pursuing education or experiences that can enhance your ability to boost earnings can be a valuable way to protect your long-term financial position.

- Harvest your eligible investment losses. Tax-loss harvesting is a strategy that may be used when selling taxable* investment assets such as stocks, bonds and mutual funds at a loss to help lower your tax liability. You can apply such losses against capital gains elsewhere in your portfolio, which reduces the capital gains tax you owe.

*Note: Tax-loss harvesting does not apply to tax-advantaged accounts such as traditional, Roth, and SEP IRAs, 401(k)s and 529 plans.

Take action that’s appropriate for you

Current economic and market dynamics may not require dramatic alterations to your own financial strategy or estate plan. However, some adjustments may be worth considering. Now may be an opportune time to meet with your financial professional and tax advisor to explore strategies supporting your goals, time horizon and risk tolerance.