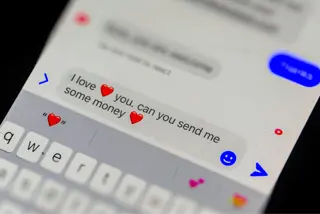

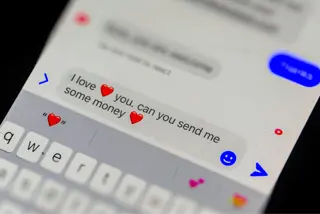

What to know about romance scams

Your go-to checklist for managing elderly parent's finances

January 16, 2025

Digital payment technologies are changing how we think about money. The explosive growth of digital wallets like Apple Pay and mobile payment apps such as Venmo, Cash App and Zelle® have made life easier, allowing you to send and receive money almost anywhere in the world. A global study projects the value of digital payments to reach $11.6 trillion in 2024.

At the same time, digital transactions attract scammers who can also exploit their speed and convenience. By one estimate, total losses from online payment fraud between 2023 and 2028 could total $362 billion.

“For many of us, the only time we worry about our digital transactions is when they don’t work,” says Charles Banks, vice president, Information Security at U.S. Bank. “But we need to stop and ask, ‘Is that payment app or website secure?’ We need to be careful about how digital access can be compromised and how traditional fraud can happen through online payments.”

Digital payment companies work to keep their products secure, but consumers must also take steps to ensure they are not leaving their payments and digital identities exposed. “Online payments can seem like magic, but they’re not,” Banks adds. “Fraudsters know this, so we need to educate ourselves and take steps to stay secure.”

Here’s what you can do to protect yourself from being scammed and keep your money safe.

While there are many ways to target online payments, fraudsters generally try to convince their targets to digitally send them funds or compromise online credentials and then siphon off the funds themselves. “Digital systems are now a vehicle for traditional fraud tactics,” Banks says. “Fraudsters online are still seeking to exploit trust and account access.”

Fraudsters will stop at nothing trying to trick you into giving them your personal information to gain access to your bank account — and your money. The most common methods include:

Knowing what to look for can help keep you and your money safe. Here are steps you can take to protect your online payments:

If you think something’s not right with your account, contact your financial institution right away. At U.S. Bank you can call the Fraud Liaison Center, 877-595-6256. Or call the number on the back of your U.S. Bank card or statement. Find out more about the U.S. Bank Digital Security Coverage.

Read more about ways to protect yourself from fraud and scams.

Related content