Start investing today with U.S .Bancorp Investments.

Investment products and services are: Not a deposit | Not FDIC insured | May lose value

In general, a bull market is characterized by stock prices rising a certain percentage, while a bear market happens when markets decline by a certain percentage.

Historically, bull and bear markets are often influenced by economic conditions and investor behavior, among other factors.

Maintaining a diversified portfolio, and working with a financial professional, may help you better weather market ups and downs.

Let’s start by understanding the terms. “Bull market” and “bear market” are often used to define the stock market, but they can apply to any asset that is traded, including real estate, commodities and currencies.

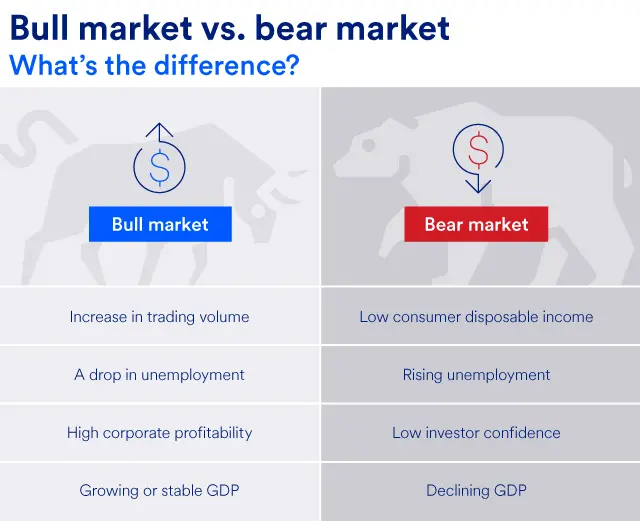

A bull market occurs when stock prices rise by 20% after experiencing a decline of 20% or more. Bull markets come in anticipation of or during periods of economic strength and typically last months or even years. They also often coincide with low unemployment, high corporate profitability and solid gross domestic product (GDP).

During a bull market, investor sentiment is optimistic and confident.

A bear market happens after the market declines by 20% or more from a recent peak. This type of market can take hold when the economy starts to weaken, as experienced during the early years of the COVID-19 pandemic.

During a bear market, broader economic indicators, like the GDP, start to decline. Unemployment may rise as companies start to lay off employees. Investor confidence is low, as many people are unsure about the future.

It’s important not to confuse a bear market with a market correction, which is defined as a drop of 10% or more in the stock market value. Market corrections are a normal event and can occur for a variety of reasons.

Even without calculating the rise or fall of markets in terms of percentages, there are general indicators of whether the markets are in bull or bear territory.

Stay up-to-date on what’s happening in the markets now.

Past performance is no guarantee of future results, but it can be helpful to look at the history of the market’s expansions and contractions to understand how these market phases have taken place.

The last significant bear market was in October 2007, during the Great Recession, and it lasted until about March 2009. During that time, the Dow Jones Industrial Average, Nasdaq Composite and S&P 500 suffered declines of more than 50% —the worst market crash since the Great Depression. The government approved a $787 billion stimulus package in 2009, which kicked off the most recent bull market. Running until 2020, it was one of the longest bull markets in Wall Street history.

A steep market plunge at the beginning of the COVID-19 pandemic signaled the start of a short-lived bear market in February and March 2020. Another short-lived bear market occurred in August and September 2022 due to investor anxiety around persistent high inflation and increasing interest rates.

The average bull market has lasted 8.2 years with an average cumulative total return of 270%.1

The average bear market has lasted 1.5 years with an average cumulative loss of -36%.1

Bull and bear markets are tough to predict, and it can be even tougher to estimate how long they’ll last. While investing in the market should be considered a long-term strategy, many investors move money out of the market in reaction to falling stock prices. A mass exodus, however, can cause the market to decline further.

In times of volatility, some investors may choose to stay invested in fixed-income securities, such as bonds, while others may also purchase stock at newly lowered prices. Still others may choose to purchase stocks in sectors that aren’t affected deeply by market trends; one example is companies producing items that are necessities in varied economic conditions, such as household products.

The day-to-day market movements — especially when they’re drastic — can be unnerving. Maintaining a diversified portfolio based on your financial goals, time horizon and risk tolerance may help you to confidently stay the course and better weather market ups and downs. Consider working with a financial professional to determine how, or if, you should adjust your strategy according to current market conditions.

How you feel about the market is the one factor you can control. Learn how to handle market volatility.

1 U.S. Bank Asset Management Group analysis, Shiller. Data: S&P 500 Index returns from 1/01/1920-12/31/2024.

These returns are based on monthly performance data. These returns were the result of certain market factors and events that may not be repeated in the future. Past performance is no guarantee of future results.