Capitalize on today's evolving market dynamics.

With changes to taxes and interest rates, it's a good time to meet with a wealth advisor.

While investors assessing their investment options often focus on an asset’s return potential, an equally important consideration is how to manage portfolio risk.

One key to managing risk is to follow the adage, “don’t put all your eggs in one basket.”

Diversification is the practice of building a portfolio with a variety of investments that have different expected risks and returns. The goal is to provide a smoother path for achieving your goals over time.

A diversification strategy is the process of putting money to work in a mix of assets with differing characteristics. Building your portfolio in an appropriately diversified manner can help spread the risk of negative performance in a specific investment or market segment, with the potential to enhance investment results.

No matter how strongly you feel about the prospects for a specific investment, a variety of factors can affect its performance. These could include unforeseen economic changes (i.e., high inflation, a recession); changes in the competitive market landscape; or other factors that can impact a security-issuing business or entity.

By owning different types of investments that typically generate varied performance across different environments, you can position your portfolio to be more resilient during challenging market periods. Over your investment time horizon, diversification can help provide a degree of stability to your portfolio.

A diversification strategy can help protect you against circumstances that can negatively impact specific investments.

By owning different types of investments that typically generate varied performance across different environments, you can position your portfolio to be more resilient during challenging market periods.

As an example, let’s look at industry-specific risk found in energy stocks. If the price of oil falls, your holdings in the oil and gas industry may see their share prices fall. If you’ve invested in other industries or other types of assets, the potential decline in energy stocks’ value may be offset by gains in other parts of your portfolio.

Diversification does not guarantee returns or protect against losses and can help mitigate some, but not all, risk. For example, systematic risks – which include inflation, interest rates or geopolitical events – can cause widespread economic and market instability, negatively affecting asset classes across a broad range.

Correlation indicates the concurrent performance patterns of two securities or asset classes. It’s important to consider asset correlation as you structure your portfolio. For example, if you own many different investments that are positively correlated, it means they all are likely to trend up or down at the same time. In that event, while you may own different assets, your portfolio isn’t appropriately diversified.

Consider, for example, that high-yield bonds are positively correlated with stocks. Therefore, a portfolio made up entirely of high-yield bonds and stocks is not effectively diversified.

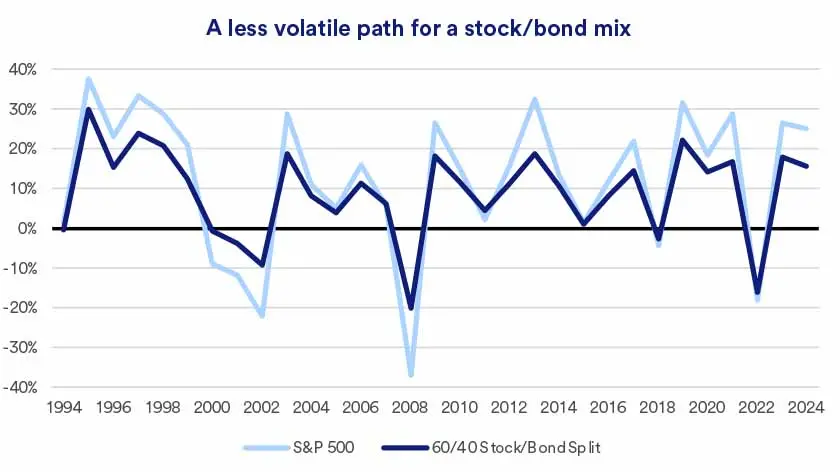

Historically, a mix of stocks and bonds provides a level of diversification that can smooth investment performance. Less volatile returns over time can result from a portfolio featuring a combination of 60% stocks (based on the S&P 500) and 40% bonds (represented by the Bloomberg U.S. Aggregate Bond Index), compared to an all-stock portfolio. Maintaining more consistent performance year-over-year is likely to help individuals keep assets actively invested.

As an investors, your portfolio can be constructed utilizing several primary asset classes, including:

These asset classes tend to generate different returns and are subject to varying levels of risk. Including investments across asset classes is an important first diversification step. A diversified portfolio will include representation from at least two asset classes.

Further diversification is possible within asset classes. You can seek to diversify by:

It’s also a good idea to consider global exposure as a part of your diversification strategy.

For example, if you only own U.S. securities, your entire portfolio is subject to U.S.-specific risk. Foreign stocks and bonds can increase a portfolio’s diversification but are subject to country-specific risks, such as foreign taxation, currency risks, and risks associated with political and economic development. However, in periods when U.S. stocks face headwinds, global markets may perform better.

If you’re seeking additional diversification, other types of assets should be considered:

Even the most diversified portfolio requires periodic rebalancing. Over time, certain investments will gain value, while others decline. Rebalancing is a negotiation between risk and reward that can help your portfolio stay on track amidst the market highs and lows.

There are certain situations that might trigger rebalancing, including market volatility and major life events. Read more about when to rebalance your portfolio.

Your views about investment risk can impact your diversification strategy. Generally, the longer your investment timeframe, the more you can weather short-term losses and capitalize on the potential to capture long-term gains.

Try to realistically assess your risk profile and invest appropriately based on that.

A diversification strategy is designed to help your investment portfolio generate more consistent returns over time and protect against market risks. Review your portfolio to determine if it's appropriately diversified for your financial goals, risk tolerance and time horizon.

Whether you want to invest on your own or with personalized financial guidance, we have investing options to meet your needs.