You contribute taxable income into a Roth IRA, and any investment growth accumulates tax-free and is not taxed upon withdrawal. In comparison, any income your Traditional IRA investments earn will not be taxed until you start taking distributions. Learn more about types of IRAs.

Boost your retirement savings

When you open an IRA, you’re taking the first step in working toward your retirement. Investing in an IRA means more of your money is working harder for you with either tax-free or tax-deferred possible growth.

Here's more about why you should consider opening a traditional, SEP or Roth IRA:

- The type of IRA you choose to open depends on your retirement goals and when you prefer to pay taxes on the accumulated funds.

- With a traditional or SEP IRA, you may qualify for annual tax deductions now, but you'll pay taxes when you withdraw money in retirement. With a Roth IRA, you pay taxes now, but you won't pay taxes when you withdraw the money. This means your investments grow tax-free.

- An IRA is a great choice and can often provide you with more flexibility and a larger number of investment options than a 401(k). Learn more about the benefits of an IRA vs. 401k and how having both could lead to more money for your future.

- Your IRA takes advantage of compounding growth, meaning you have the opportunity to earn money on the previously gained growth of your portfolio.

Your future starts now

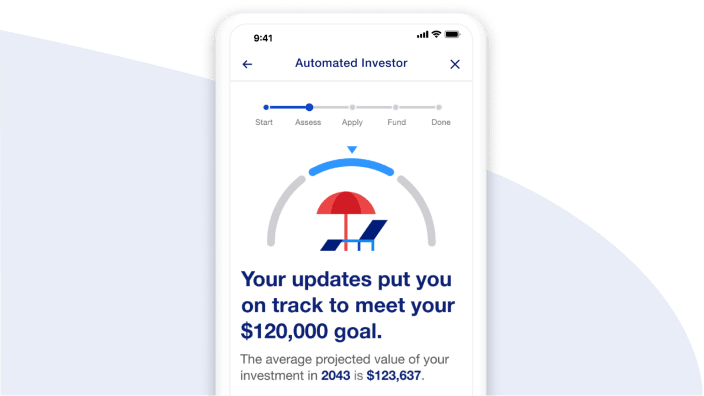

Whether you’re just starting to plan for your retirement or well on your way, opening an IRA with Automated Investor is a smart way to invest in yourself.

Easily get started in minutes with just $1,000. Based on your selections, Automated Investor will match you with a portfolio designed with your retirement goals in mind. It then uses smart technology and industry insights to manage your investments for you and help keep you on track. These benefits plus low annual fees of just 0.24%, billed quarterly,1 mean that your money is working harder for you toward the future you envision.

Automated Investor is currently exclusively for customers of U.S. Bancorp Investments and its affiliate U.S. Bank. Not a customer yet? We can help you get started. Just call 866-758-8655.

Why choose an IRA managed by Automated Investor

An easy way to invest.

You tell us your retirement goal and time frame and in minutes we’ll match you with an Automated Investor IRA portfolio that’s been specifically designed by our experts to work toward your goal. Your portfolio is then monitored and adjustments are made when needed to help keep you on track.

Start investing with $1,000.

With a low minimum investment, you can get started working toward retirement as soon as you are ready. All you need is $1,000 and just a few minutes to open an account, and you’ll be ready to start building your retirement wealth today.

Pay low account fees.

Your money is invested in low-fee exchange-traded funds (ETFs).2 Annual fees are 0.24% of invested assets, billed quarterly. That means for every $1,000 invested, you will pay only $0.60 every three months (based on a rate of $0.20 per month).

Human support is just a phone call away

Though Automated Investor uses smart investing technology to manage your portfolio, you’re not on your investing journey alone. A highly skilled financial professional is available to talk with you when you need the live support that only another person can provide.

Get your questions answered and gain confidence in knowing how your investments are being handled. Call 866-758-8655 to speak with a member of our investment advisory team.

Get more information about IRAs

How does an IRA work?

Learn how IRAs work, including IRA tax advantages and other IRA benefits, and understand the difference between an IRA and 401(k), with our at-a-glance guide to individual retirement accounts.

IRA vs. 401(k): What's the difference?

The three most common types of retirement investment accounts are a 401(k), traditional IRA and Roth IRA.

Types of IRA accounts

An individual retirement account (IRA) can be a key element of a retirement plan, but the first step is to determine which type or types of IRA accounts fit your situation.

FAQs about IRAs

Only U.S. Bancorp Investments customers or customers with an account with our affiliate U.S. Bank who have a customer login can apply to Automated Investor online. We can help you get started quickly with a customer login – just call 866-897-3929.

Your Automated Investor IRA will be invested in a mix of ETFs. The ETFs cover a broad range of asset classes, giving you a diversified portfolio to help you reach your retirement goals. The funds chosen for your portfolio are hand-selected by the Asset Management Group, a team of specialists from our affiliate U.S. Bank.

- Online with Automated Investor which invests and rebalances your portfolio automatically for you

- Online with a Self-directed brokerage account where you choose the specific investments

- With an advisor who will set up an account for you

Yes, you can easily do both.3 Learn how we make rollovers easy.

“Compounded” investment gains means that you earn money off the gains you earned earlier. Here’s an article that explains this a bit further: Why compounding matters.