Capitalize on today's evolving market dynamics.

With changes to taxes and interest rates, it's a good time to meet with a wealth advisor.

While one of the largest sectors in the S&P 500, Healthcare produced lackluster results for investors in recent years.

This trend continues in 2025.

However, there are areas of investor appeal that include weight loss, data analytics, tools and diagnostics, robotics, medical devices, and insurance.

Healthcare in the U.S. represents a large and intricate ecosystem, characterized by its size, complexity, and influence on the national economy. The Healthcare sector is also one of the largest sectors in the S&P 500, representing roughly 10 percent of the market capitalization of the index, thus affording investors with ample opportunity to invest in the sector. Despite wide-ranging opportunities, the Healthcare sector generated lackluster results for investors over the past three years, posting returns of -3.6, 0.3 and 0.9 percent in 2022, 2023 and 2024 respectively. Muted returns continued in 2025, with Healthcare one of four S&P 500 sectors in negative territory, retreating 4.1 percent as of the market close on May 30. This discrepancy, between the compelling underlying backdrop and subpar returns, leaves many investors wondering how to best invest in and around the Healthcare sector. This commentary highlights some of the opportunities and challenges impacting performance of the Healthcare sector, diseases driving spending across the Healthcare sector, and areas of investment appeal, including Artificial Intelligence (AI) in Healthcare.

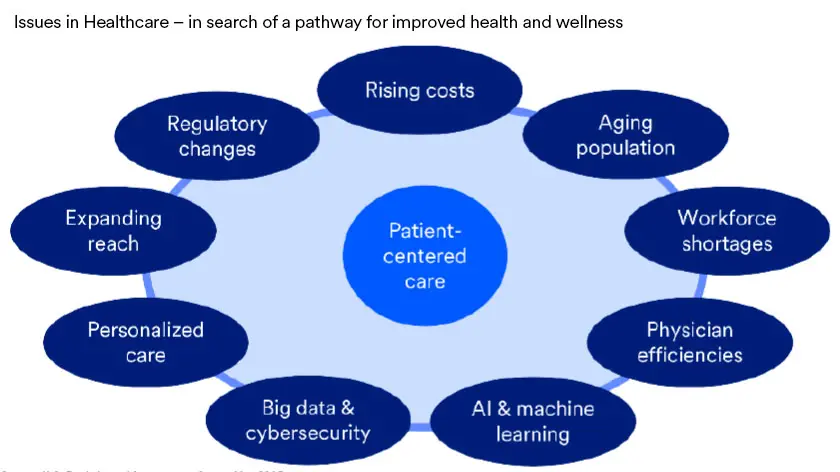

Fundamental drivers such as an aging population and the rising prevalence of chronic diseases fuel demand across the diverse sub-groups of the Healthcare sector, ranging from pharmaceuticals and medical devices to health services and technology. However, this growth potential also faces unique challenges, including escalating costs, persistent workforce shortages, and a dynamic regulatory environment. Managed care companies such as United Healthcare Group (UNH) aim to reduce the cost of providing healthcare and insurance while improving the quality of that care. Recent corporate news from UNH regarding higher medical utilization trends and public scrutiny around business practices have cast a spotlight on the inherent risks within the segment, particularly concerning government programs and vertical integration strategies. Additionally, the rapid advancement of Artificial Intelligence (AI) is emerging as a powerful force to revolutionize operational efficiencies, patient care, and profitability across the industry. Understanding these dynamics is paramount for investors seeking to position capital in this vital and evolving market.

According to the Center for Disease Control, obesity, heart disease, diabetes, high blood pressure, kidney disease, chronic respiratory diseases, cancer, mental health disorders, arthritis, and Alzheimer's disease are the 10 most common health conditions in the U.S. These ailments are far-reaching and often impact quality of life and longevity. Over 40 percent of adults in the U.S. and 16 percent globally are considered candidates for some weight loss, according to reports from the Center for Disease Control1 and the World Health Organization2. Heart disease is the leading cause of death in the U.S. accounting for one in five deaths annually; cancer is the second leading cause of death in the U.S.3 with the most common types including breast, lung, prostate and colorectal cancer4. Diabetes affects over 11 percent of the U.S. population5. Nearly half of all adults in the U.S. have high blood pressure6. Mental health disorders affect millions of Americans annually7. Companies focused on providing cures or lessening the impact of these health conditions are among investment candidates worth considering.

The pathway for improved health and wellness revolves around patient-centered care, an approach that emphasizes individual patient’s needs, values and preferences in all aspects of their treatment, which increasingly leverages technology. For instance, practitioners use AI in many aspects of healthcare, ranging from disease diagnosis and treatment planning to drug discovery. This can provide quicker discovery of cures and free physician’s time which ultimately delivers more patient-centered care and positive outcomes. Potential AI-related technology use cases include: 1) drug discovery and development where technology can assist in new drug advancement by analyzing vast amounts of data and identifying potential targets and compounds; 2) disease diagnosis and treatment planning which factors in patient data, medical history, and symptoms; 3) medical imaging analysis, such as X-rays, CTs and MRIs, to identify abnormalities and assist in diagnosis; 4) patient monitoring and management that enables real-time alerts to healthcare providers; and 5) improved operational and administrative efficiency through data management, workflow automation and resource allocation, helping cut costs in one of the key drivers of healthcare inflation. Consulting firm McKinsey & Company estimates for every $10 billion in revenue, AI could help health insurers save between $150 million and $300 million in administrative costs, and up to $970 million in medical costs8. AI's capacity to streamline administrative processes, enhance diagnostic accuracy, and personalize treatment plans presents compelling opportunities for improved profitability and patient outcomes, in addition to improved prospects for more favorable returns for equity investors. These technological advancements continue to evolve, and in a highly regulated sector like Healthcare we should expect transformations to occur at a more measured pace relative to other sectors.

“Weight loss, data analytics, tools and diagnostics, robotics, medical devices, and insurance are among areas we regard as having the highest investment appeal,” says Terry Sandven, chief equity strategist, U.S. Bank Asset Management Group. Weight loss is a worldwide challenge. Eli Lilly is favorably positioned to solve the burdening weight problem with its GLP-1 drugs Mounjaro (for diabetes) and Zepbound (weight loss). Similarly, healthcare’s rich data provides a significant opportunity for data analytics companies. Veeva, NVIDIA, Meta Platforms, Alphabet, Oracle, Amazon, Microsoft, and Palo Alto Networks are among technology-related companies with products or groups that extend into healthcare. Additionally, robotics and medical devices are among companies positioned to offer solutions for improved patient outcomes, workforce shortages, and physician efficiencies. Companies that operate in these areas include Intuitive Surgical, Medtronic, Stryker, Insulet and GE Healthcare.

“Weight loss, data analytics, tools and diagnostics, robotics, medical devices, and insurance are among areas we regard as having the highest investment appeal.”

Terry Sandven, chief equity strategist, U.S. Bank Asset Management Group

In short, the Healthcare sector presents a paradox for equity investors. It is a sector fraught with volatility and risk, influenced by the success/failure of new drugs, persistent regulatory pressures, escalating costs, and technological disruption. It also is comprised of immense growth potential, driven by fundamental demographic shifts and an increasing burden of chronic disease. Additionally, AI stands out as a transformative force, offering substantial efficiency gains and enabling new care delivery models. Investors who focus on innovation, technological advancements and emerging care models may be well positioned to capitalize on the sector’s next phase of growth. Consider consulting with your financial professional to determine how Healthcare investments can work within the context of your overall financial plan.

Read the weekly analysis for insights about capital markets, the economy and more.

We can partner with you to design an investment strategy that aligns with your goals and is able to weather all types of market cycles.