Also known as a virtual payment, a virtual credit card is a 16-digit credit card number generated for a specific supplier, an exact amount and coded with a short-term expiration date. Once processed, the account number deactivates and can’t be used again. Like traditional Purchasing and One Cards, virtual cards create rebate revenue opportunity. Virtual cards are one of the most secure forms of electronic payment.

Digital alternatives to traditional payment methods

Our virtual payment solutions meet a full range of payment needs – from planned corporate purchases to unexpected employee expenses and more.

Virtual Pay

Maximize efficiency, improve cash flow and reduce risk.

Gain B2B payment automation benefits, rebate revenue opportunity and cost savings while mitigating payment fraud risk with virtual cards.

Instant Card

Instantly pay for business expenses.

Easily and securely send a virtual card to a recipient’s mobile wallet for immediate use.

Travel Virtual Pay

Ease reconciliation of centralized business travel expenses.

Use single-use virtual credit cards to automate corporate travel booking, payment and reconciliation.

Corporate Payment Api Solutions

Build smart payments into your platform or experience.

Simplify payments, enhance security and support growth with our flexible and customizable API solutions.

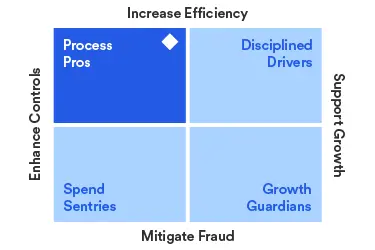

How does your Accounts Payable function stack up?

Take five minutes to see how your payables management compares to industry benchmarks. Get customized recommendations to unlock the full potential of your payments management program.

Optimize your payment process with virtual credit cards.

Virtual credit cards are a highly secure digital payment method that streamline the accounts payable process. Virtual card payments simplify reconciliation for you and your suppliers, reduce payment costs and create rebate revenue opportunity.

Create rebate revenue.

Switching from checks to virtual payments can enhance cash flow and create additional revenue through program rebates.

Enhance working capital.

Precisely timed and data-rich virtual card payments improve working capital by reducing costs and extending days payable outstanding.

Simplify reconciliation.

Virtual card payments simplify reconciliation by eliminating costly and time-consuming manual payments.

Improve payment visibility and control.

Virtual card payments provide detailed, timely data that improves expense tracking and forecasting, strengthens supplier negotiations and supports audit and regulatory compliance reporting.

Send real-time payments.

Connect to your internal systems through an application programming interface (API). Pay suppliers in real time, 24/7 without additional software, hardware or time-intensive staff training.

Protect against fraud.

Virtual credit cards use a one-time, temporary card number and include specific controls, like the amount and expiration date, to increase payment security.

Optimization services

Accelerate virtual credit card adoption.

We can help you make the shift to virtual payments. Our dedicated experts will analyze your corporate credit card and payables programs for virtual payment opportunities, develop enrollment campaigns for your suppliers and assist with supplier education and outreach.

AP Optimizer

Automate invoice-to-pay.

Streamline virtual card, ACH, wire and check payments with a single integrated payables solution. U.S. Bank AP Optimizer® automates B2B and B2C payments to maximize efficiency, reduce fraud risk and cut costs.

We have answers to your virtual credit card questions.

Virtual credit card transactions generate revenue for providers, who in turn share a portion with you in the form of a rebate. Common options include a tiered approach based on spend volume, a flat percentage, or a grid based on spend volume and average transaction size. Supplier participation is the primary determinant of program spend and resulting rebate revenue. That’s why it’s important to look beyond revenue-share percentages and evaluate the depth and breadth of a provider’s supplier enrollment capabilities.

Virtual credit card numbers are coded for a specific supplier and an exact amount, and you control payment timing. Each virtual card number serves as a unique payment identifier and payments contain detailed remittance information. This removes reconciliation guesswork for you and your suppliers. Electronic virtual payments also save time by removing paper documents from the reconciliation process.