It’s fast.

Send or receive money in minutes.1

There’s no need for a separate Zelle® login to get started.

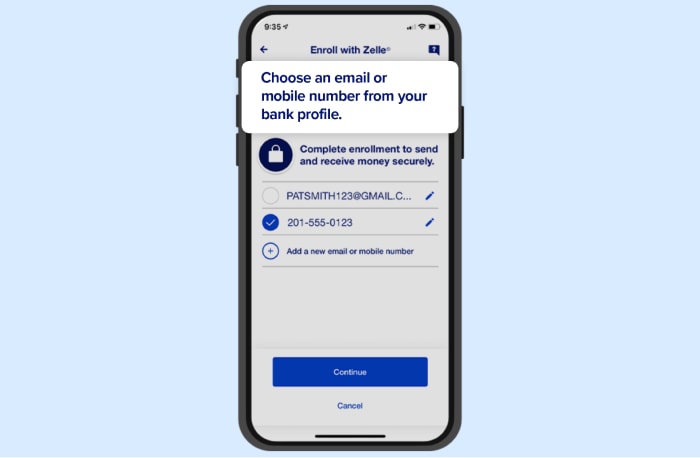

Choose the United States mobile phone number or email associated with your U.S. Bank account. Follow the simple directions.

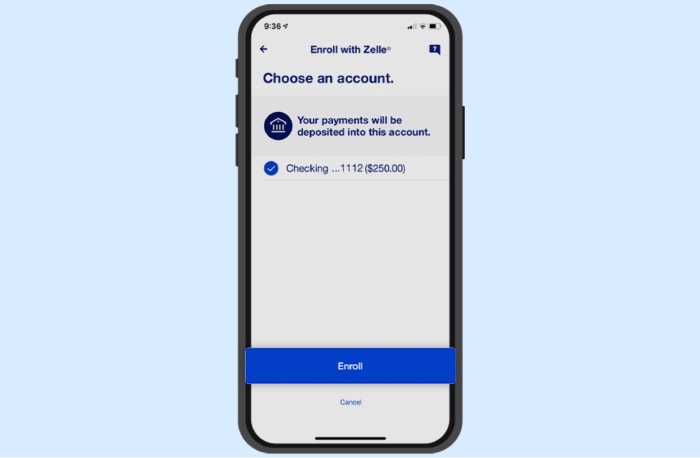

Choose your account and start sending money to friends, family and others you know and trust.

Treat Zelle® payments like you would cash. Only send money to people you know and trust.

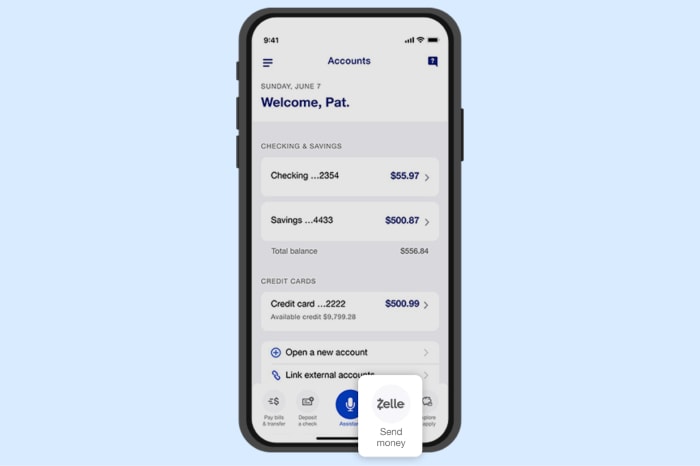

Select Send money from your dashboard, then select Send money once more. Choose your recipient or add a new one.

Share the United States mobile phone number or email address associated with your bank account.

It’s easy to split the cost of a large purchase or activity with up to 10 people.2

Stay on top of your household bills, like rent, and other shared costs with Zelle® by setting up recurring payments.

Tired of asking a restaurant to split the bill multiple ways? Just pay the bill on your card and receive Zelle® payments from friends and family for their portions.

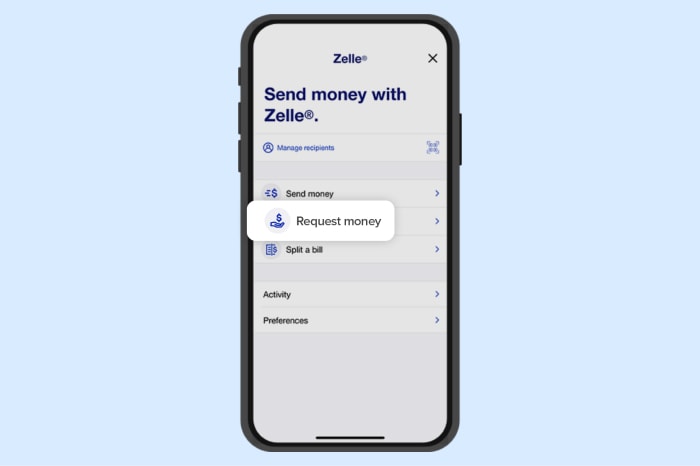

You can send, request or receive money with Zelle®. To get started, log in to the U.S. Bank Mobile App or online banking and navigate to Send money with Zelle®. Select an email address or United States mobile number that friends will use to send you money, enter a verification code if you receive one, select the receiving account and select Enroll. You’re ready to start sending and receiving money with Zelle®.

You can send money to friends, family and others you trust.1 Always ensure you’ve used the correct email address or United States mobile number. That’s easy to do when you select your recipient from the Zelle® ready contacts list on your Select a recipient screen within Zelle®.

Money you send with Zelle® can be in your recipient’s account in minutes,1 making Zelle® an ideal way to share the cost of expenses between friends or send the gift of money.

If they sent the money to an email address or United States mobile number that you have already enrolled with Zelle®, you don’t need to take any further action. The money will move directly into your bank account, typically within minutes.1

If someone sends money to an email address or United States mobile number you have not yet enrolled with Zelle®, follow these steps:

Your email address or United States mobile phone number may already be enrolled with Zelle® at another bank or credit union. If that’s the case, we’ll alert you when you try to enroll and move your Zelle® enrollment to your account with U.S. Bank. As soon as you make the switch, you’ll be able to start sending and receiving money with Zelle® through the U.S. Bank Mobile App and online banking.

If you like, you can enroll your United States mobile number at U.S. Bank and your email address at another bank or credit union (or vice versa). By giving people one or the other, you can choose where you receive money from each individual.

To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution's online or mobile banking experience. If you want to pay a small business, just ask if they’re enrolled with Zelle®.

You can find a full list of participating banks and credit unions enrolled with Zelle® on the Zelle® website.

If your recipient’s bank isn’t on the list, don’t worry. The list of participating financial institutions is always growing, and your recipient can still use Zelle® by downloading the Zelle® app for Android and iOS.

To enroll with the Zelle® app, your recipient will enter their basic contact information (an email address and United States mobile number) and a Visa® or Mastercard® debit card with a United States-based account (does not include U.S. territories). Zelle® does not accept debit cards associated with international deposit accounts or any credit cards.

Zelle® is only available for customers with an account held at a United States bank and United States registered mobile number and can’t be used to send money overseas.

When modifying a Zelle® payment, it needs to be in a pending status. Otherwise, it cannot be cancelled.

To change the payment, re-schedule a new one with the updated information. Your recipient will receive notice of the activity as well.

Sending, requesting and receiving money with Zelle® is always free for U.S. Bank clients.

Keeping your money and information safe is a top priority for U.S. Bank. When you use Zelle® within our mobile app or online banking, your information is protected with the same technology we use to keep your U.S. Bank account safe.

Once a request to send money using Zelle® has been processed, it cannot be modified or canceled.

Neither U.S. Bank nor Zelle® offers a protection program for any issues with authorized payments made using Zelle®, such as not receiving an item you paid for or the item not being as described or expected.

U.S. Bank is only responsible for resolving unauthorized transactions and errors as required by applicable law and rules. If you notice something’s not right with your account, contact U.S. Bank immediately at our Fraud Liaison Center (877-595-6256).

To find more information related to reporting errors and unauthorized transactions visit Your Deposit Account Agreement (PDF) and the Digital Services Agreement page.