U.S. Bank Smartly® Savings account

Open a Bank Smartly Savings account to earn more money on your money.

Calculate today’s savings interest rates and see how total rates may increase as your Combined Qualifying Balance grows. Your options update according to the information you provide. The displayed Annual Percentage Yield (APY) and interest rates are effective as of for ZIP code (Edit ZIP code) and are accurate for accounts opened on today's date.

For higher relationship rates, you’ll need a U.S. Bank Smartly® Checking, Safe Debit or Bank Smartly™ Visa Signature® Card account. Do you have one?

Select your answers and calculate your rate to see how your savings rate grows.

Savings + Checking

When you open a Bank Smartly Savings and Bank Smartly Checking account together you:

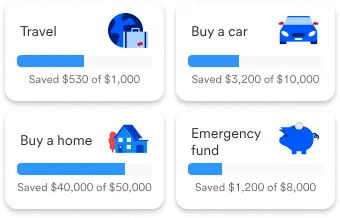

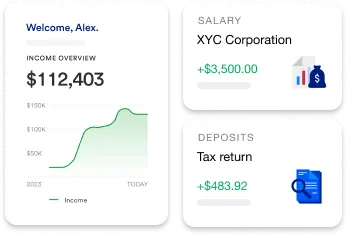

Bank Smartly Savings gives you access to our easy-to-use digital budgeting tools to help you monitor all your accounts (even ones at other banks) and set clear financial goals.

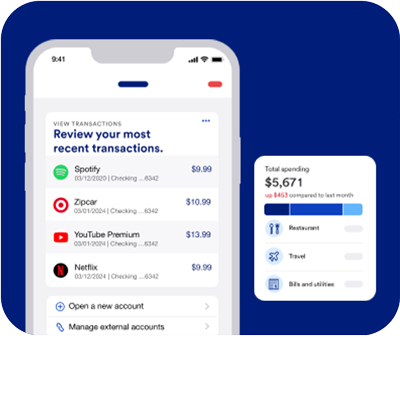

Set multiple savings or investment goals and use our convenient mobile app to monitor your spending and help you decide when it's time to move money around.

Use our digital tools to automate your savings to stash away a little (or a lot) with every paycheck. As your Combined Qualifying Balance grows, you may be able to earn higher rates.1 Set up recurring transfers when you switch your direct deposit in minutes.

Yes, you can open a Bank Smartly Savings account online in just minutes. Get started with an opening deposit of $25.

The minimum balance for opening a Bank Smartly Savings account is $25. Open a Bank Smartly Savings account in minutes online or at your local branch in minutes. Apply now or schedule an appointment.

Yes. You can open a joint savings account online. Simply select the joint option when applying online. If in a branch, you must both be present. Family members and couples who want to manage shared finances commonly open a joint savings account together. Both parties will need the following:

Teaching your kids about money is an important part of being a parent. To open their own savings account the minor must be age 13 through 17. If the child is under 13, opening a joint account can help them learn about saving, budgeting and spending responsibly.

A savings account offers many advantages, including earning interest on your money, liquidity (meaning you have access to the funds if an emergency or short-term need arises) and financial peace of mind in the event of an unforeseen emergency. In addition, a U.S. Bank savings account is FDIC-insured, ensuring your money is safe and secure. You’re covered under the standard deposit insurance coverage limit of $250,000 per depositor, per ownership category, per FDIC-insured bank.6 U.S. Bank gives you multiple ways to easily save a little extra for the future.

A typical savings account earns a modest amount of interest on the money you deposit. A relationship savings account earns you a higher interest rate when you have more than one type of savings, checking, credit card or investment account. For example, when paired with a checking account, you'll earn a higher interest rate on your Bank Smartly Savings Account.1

Yes. Another way to get a higher savings interest rate is to pair your Bank Smartly Savings account with a Bank Smartly Checking, Safe Debit or Bank SmartlyTM Visa Signature® Card account.1 This unlocks higher relationship rates that grow as your CQB grows. Open an account in minutes with a $25 opening deposit.

The following products offered by U.S. Bank and, its affiliates, are eligible for inclusion in your CQB:

Note: Business and commercial products are never eligible.

Qualified Balance: Funds on deposit in an eligible product where you have an ownership interest are counted towards your CQB.

Conversely, funds on deposit in an eligible product that do not grant ownership interest, are not counted towards your CQB.

Bank Smartly Savings offers competitive rates right from the start, even without any other U.S. Bank account. However, to enjoy a higher annual percentage yield on your savings, you'll need a Bank Smartly Checking, Safe Debit or Bank SmartlyTM Visa Signature® Card account.

Your Smartly Interest Rate Bump tier is based on your CQB and determines the amount of an interest rate bump you may earn on your eligible Bank Smartly Savings account. See the current Bank Smartly Savings account interest rates which are accurate for accounts opened on today's date.