Debit card with contactless payments

$0 Monthly Maintenance Fees, just for being you

For young adults and students (18 - 24 years old), we always waive the $12 Monthly Maintenance Fee.1

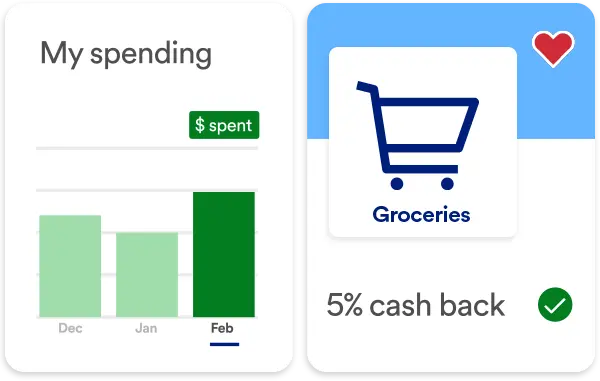

Grocery budget? Rent? Manage it all on the go.

Take control with our mobile app built for students and young adults. Included financial tools help keep you on budget and on track to your goals.

Set up automatic bill pay, direct deposit and linking to external accounts for visibility. Then, activate your cash-back deals to earn money whenever you shop.

All your hard work, rewarded

Enjoy the benefits of Smart Rewards - cash-back deals, account fee waivers and more - from the day you open your checking account.

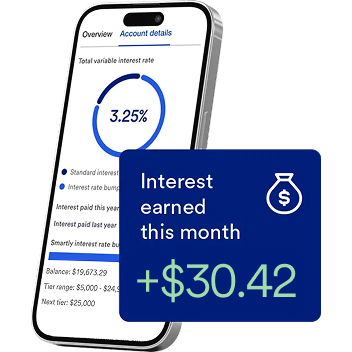

Save now. Grow faster.

As a student or young professional, now is the perfect time to start earning more on your money. Open a Bank Smartly Checking and U.S. Bank Smartly® Savings account together to automatically benefit from higher yields as your balances grow.

And opening an account is super easy.

Here’s what you always get with Bank Smartly Checking for young adults.

Simple money tips for young adults & students

Your financial IQ is going to go through the roof.

budget smarter

How to make a budget (and stick to it).

Once you understand your monthly spending habits, you’ll be able to empower yourself to save for the future. Establishing a monthly budget is your first move.

FAQs for students & young adults

Yes! You can apply online in under five minutes if you’re 18 or older. For ages 13–17, accounts must be opened jointly with an adult, either online or at a branch.

Yes, you can open a U.S. Bank Smartly® Checking account at 17 with a parent or guardian as a co-owner. This allows you to start building financial independence early while still having support. Once you turn 18, you can manage the account independently and continue enjoying benefits tailored to young adults.

To open a U.S. Bank Smartly® Checking account for students and young adults (18 to 24 years old), you’ll need:

- Social Security Number (SSN) or Taxpayer Identification Number (TIN).

- Minimum Opening Deposit: $25, which can be funded via debit/credit card, transfer from another account, or an existing U.S. Bank account.

- Identification: A valid government-issued photo ID (driver’s license, state ID, or passport) if you are opening in a branch.

- If you’re 13–17, you can open a joint account with an adult either online or in a branch.

If you're between the ages of 18 and 24, you automatically qualify for no monthly maintenance fees on a U.S. Bank Smartly® Checking account. Other ways to waive the fee include maintaining a minimum balance or having qualifying direct deposits.1

U.S Bank offers overdraft protection3 options that can link your checking account to a savings account or credit line. This helps prevent declined transactions or fees. With Bank Smartly Checking, you can also set up alerts and use budgeting tools to avoid overdrafts altogether.

Absolutely. Every student checking account comes with a U.S. Bank Visa® Debit Card, which you can use for purchases, ATM withdrawals, and digital wallets like Apple Pay or Google Pay. You can even choose from eco-friendly or school-themed card designs.

Yes. U.S. Bank provides a top-rated mobile app that lets you:

- Deposit checks remotely

- Track spending and set savings goals

- Pay bills and send money with Zelle®

- Lock/unlock your debit card and set up alerts

The app is available for both iOS and Android and has earned industry recognition for ease of use and security.

No minimum balance is required for young adult and student checking accounts. Plus, monthly maintenance fees are waived for account holders 24 years old and younger, so you can focus on managing your money without worrying about extra charges.