You’ll need to provide your U.S. Bank deposit account type (checking or savings), account number and routing number, Social Security number and other required information.

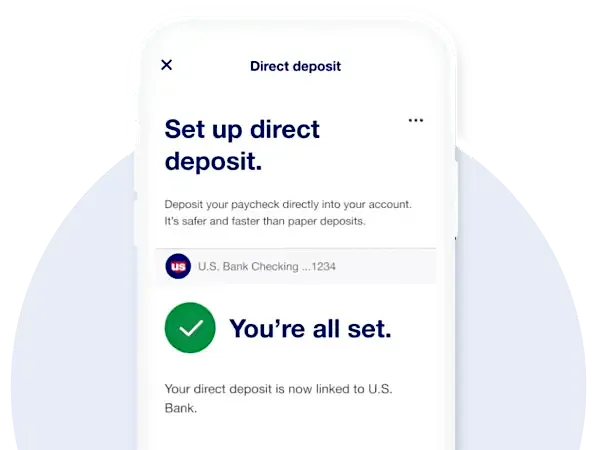

Set up direct deposit in minutes.

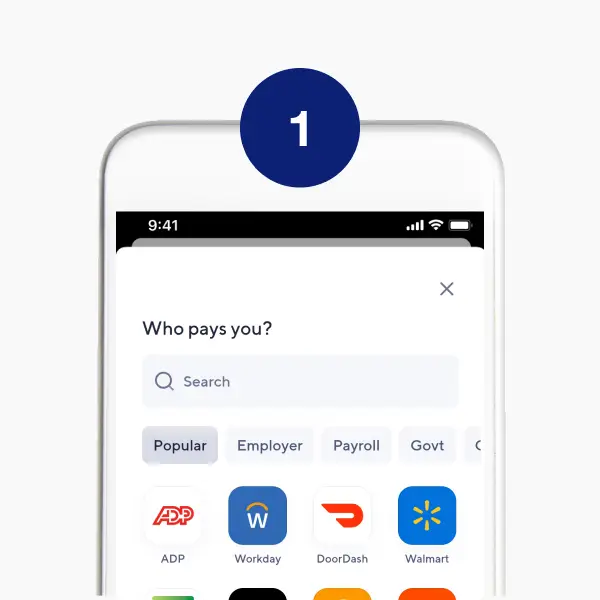

With our automated setup, enrolling is as easy as 1-2-3. You can use this service for paychecks as well as Social Security and a variety of other government payments. Your direct deposit update is seamless, secure and verified in real time.

Search for your payment provider.

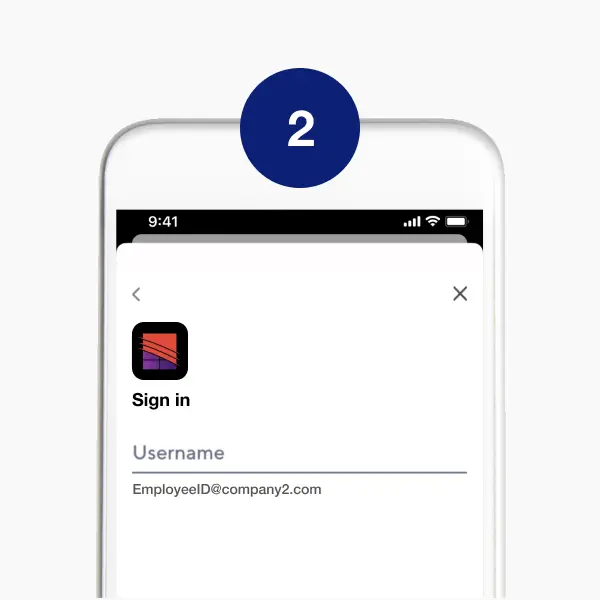

Log in with your existing account.

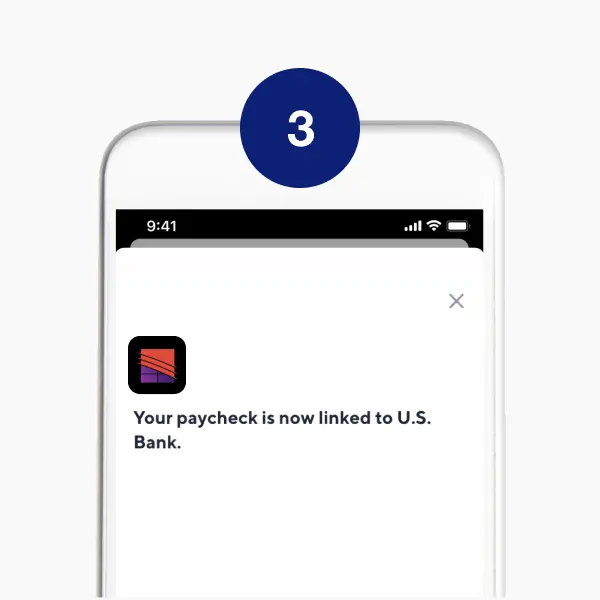

You’re all done!

Other ways to set up direct deposit

Have employee paychecks?

If you can’t find your payment provider listed, U.S. Bank provides a prefilled PDF with the information you’ll need to complete direct deposit setup.

Log in to download a prefilled PDF. Or, you can download and fill out a blank direct deposit authorization form.

For in-person help, visit your local U.S. Bank branch.

Have federal payments?

If you don’t see your federal payment type listed in our DIY direct deposit setup, check godirect.gov for next steps.

You can also visit your local Social Security Administration (SSA) office.

Don’t have a U.S. Bank checking account?

U.S. Bank Smartly® Checking offers perks from day one, dollar one. Once you have an account, you’ll be able to deposit your paycheck directly into it. Plus: When you meet one of several criteria, including a total monthly direct deposit of $1,500 or more, you’ll get the $12 monthly maintenance fee waived.1

Apply today – it’s fast, easy and secure.

Frequently asked questions

Whether you’re setting up or changing your direct deposit to a different bank or account, it can take one to two pay periods for the change to take effect. However, this can vary by workplace or provider.

Most payment providers allow you to recover your login credentials when setting up your direct deposit through U.S. Bank. However, depending on your provider, you may be required to complete the recovery process outside of the DIY direct deposit setup.

You will get a confirmation from U.S. Bank if the direct deposit setup was successful. You can also log in directly with your workplace or provider and verify the update.

To make any changes or edits, you’ll need to go through your workplace or provider. You won’t be able to edit or change your preferences through the U.S. Bank DIY direct deposit feature.

At U.S. Bank, we protect your information with the highest levels of security, encryption and firewalls. Learn more via our security center.