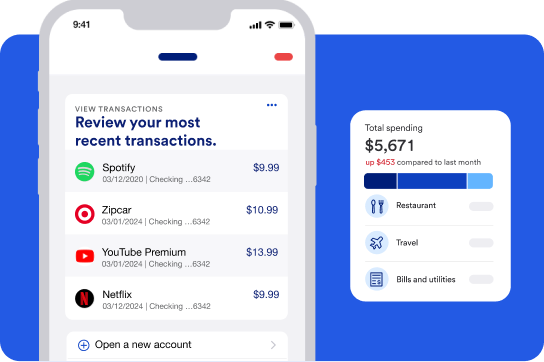

The major difference is how you access your account:

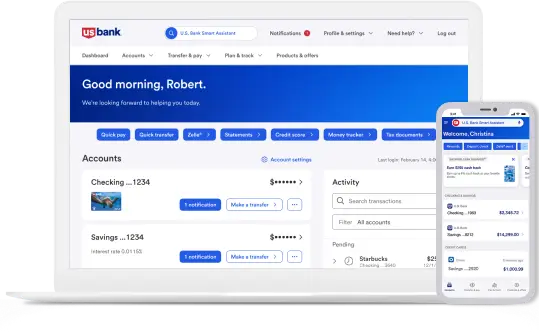

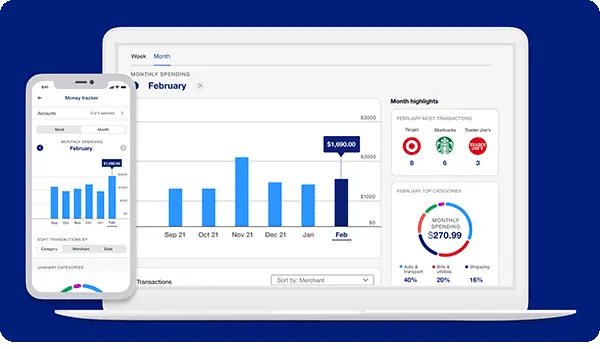

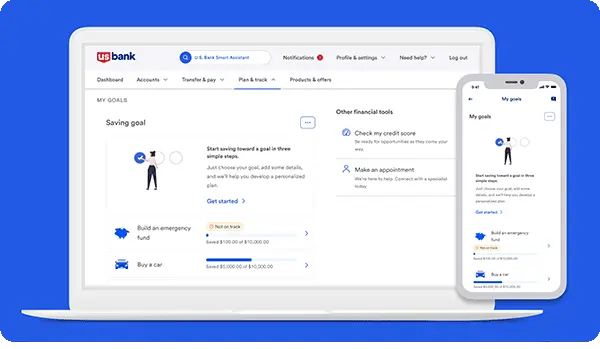

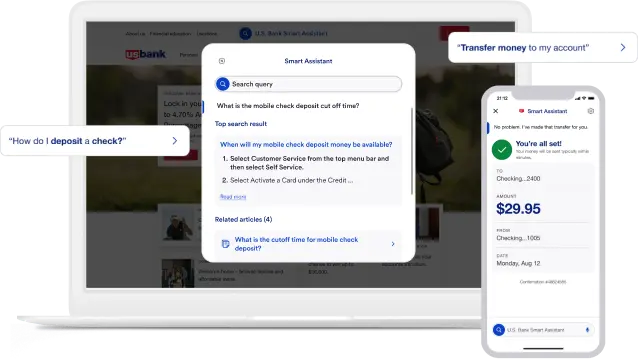

Mobile banking is accessed through a dedicated app on a smartphone or tablet.

Online banking is generally accessed via a browser.

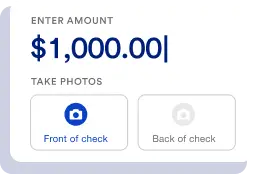

Another difference between the two is that the mobile app allows you to deposit checks using your mobile device or tablet.