Capitalize on today's evolving market dynamics.

With changes to taxes and interest rates, it's a good time to meet with a wealth advisor.

Earnings on bonds can often fail to keep pace with inflation.

Treasury Inflation-Protected Securities, or TIPS, are fixed-income securities that provide inflation protection. TIPS premiums increase when the Consumer Price Index rises and decrease when the CPI falls.

It’s important to understand the risks and consult with a financial professional before investing in TIPS bonds.

Inflation is a significant factor for investors who rely on a steady stream of income from bonds and other fixed-income instruments. Rising living costs can eat away at a bondholder’s purchasing power if income remains constant.

Treasury Inflation Protected Securities (TIPS) were created to help at least partially address fixed income portfolios’ inflation risk.

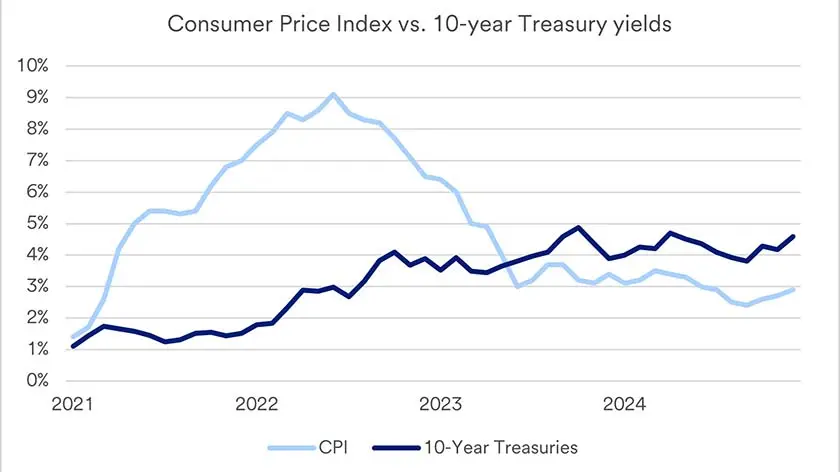

Let’s take a minute to look at inflation in recent years. The cost of living, as measured by the Consumer Price Index (CPI), started to rise in 2021 and peaked in mid-2022. During that period, inflation far outpaced typical 10-year U.S. Treasury bond yields.1 Bond investors found their portfolios losing ground to inflation.

“For a long-term investor, TIPS can offer an opportunity for an investment that keeps pace with living costs. If there are inflation surprises down the road, TIPS investors will have a degree of protection.”

Rob Haworth, senior investment strategy director, U.S. Bank Asset Management

However, by mid-2023, inflation tapered off, and bond yields rose, putting fixed income investors in a more favorable position.1

Recent experience highlighted TIPS’ potential benefits. Because TIPS earnings are essentially adjusted for inflation, TIPS investors saw income streams grow more significantly during the high inflation period. When inflation is more muted, income may rise, but not as significantly.

TIPS are issued by the U.S. government and, like other Treasury securities, are backed by the full faith and credit of the federal government. Unlike regular bonds, however, TIPS provide the potential to earn a total return that reflects inflation.

“For a long-term investor, TIPS can offer an opportunity for an investment that keeps pace with living costs,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management. “If there are inflation surprises down the road, TIPS investors will have a degree of protection.”

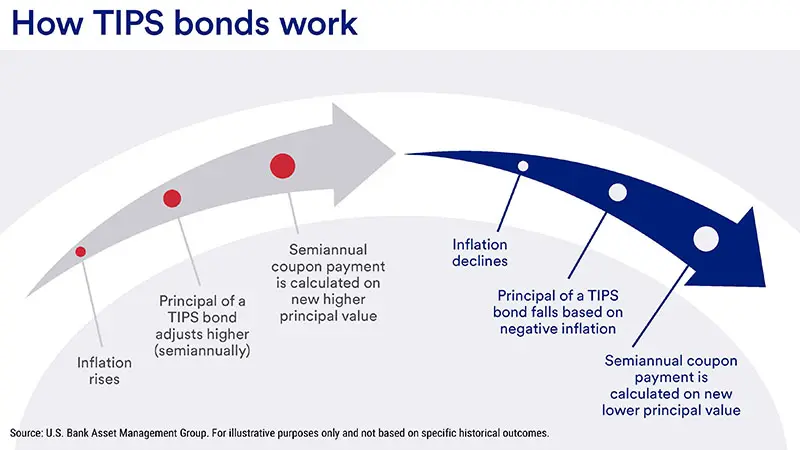

TIPS bonds account for inflation by adjusting the principal value of the security in line with the inflation rate. When CPI rises, the principal value of a TIPS bond also rises. If deflation occurs and CPI drops, the principal value of TIPS drops, too.

As an example, say you own a TIPS bond valued at $10,000 with a coupon of 2%. Based on the initial principal value of $10,000, you would see income of $200 for the year.

Now let’s look at what would happen in the case of inflation or deflation:

Note that the coupon rate (2%, in this example) remains constant, and changes in CPI do not affect the coupon rate. The inflation-adjusted principal value is not realized until the issue matures or is sold. At that time, the investor receives the higher of the adjusted principal value or the original principal value. You will never receive less than the original principal value.

TIPS Inflation Index Ratios2 are provided by the U.S. Treasury department to help calculate the impact on bonds.

First, you should be aware that TIPS typically pay a lower yield than comparable Treasury securities. In essence, you trade off current yield for inflation protection.

In terms of the interest rate’s impact, Haworth notes that just as with other Treasury securities, TIPS are at a disadvantage when rates rise, or during periods of modest inflation.

“When interest rates are rising, prices of TIPS are subject to a loss in value just as is the case with other types of bonds,” he says. “The impact of inflation is still reflected in the price of TIPS, but they’re also subject to changes in the broader interest rate environment.”

As you think about how TIPS might fit into your portfolio, it can be helpful to weigh the opportunities they provide along with the risks.

These are also good talking points when meeting with a financial professional.

TIPS are issued at various times throughout the year and are sold in $100 increments. You can purchase TIPS through the U.S. Treasury website with maturities at auction of 5, 10 or 30 years. You can also purchase bonds with interim maturities through a bank or brokerage firm, or directly online. Certain mutual funds and exchange traded funds (ETFs) may also invest in TIPS, an approach that can provide tax advantages (see “Are TIPS bonds taxed?” below).

“TIPS tend to perform best in periods when the interest rate environment is relatively stable but inflation is suddenly moving higher,” says Haworth. “In periods like these, the inflation adjustments in TIPS can provide some advantages.”

After a period of elevated prices, inflation recently dropped below 3%, closer to its long-term average. “In this environment, TIPS’ potential benefits are less evident,” says Haworth. He notes that given the recent yield environment, TIPS may look competitive with traditional government bonds.

Haworth says in today’s environment, investors seeking yield advantages may also consider non- government agency issued residential mortgage-backed securities, collateralized mortgage obligations (CMOs) or, where appropriate, reinsurance pools.

TIPS pay interest every six months until the bond’s maturity. The rate of interest is fixed and based on the underlying principal value. Since the principal value can change, the interest amount can change as well. This is unlike a conventional Treasury bond, which pay a constant income stream regardless of market or inflationary conditions.

Tax treatment of TIPS is a significant consideration. Interest payments from TIPS are subject to federal tax but are exempt from state and local taxes. In addition, if the principal value increases, the amount of that increase is taxable at the federal level in the year it occurs. “It’s best to own TIPS through a mutual fund or exchange traded fund (ETF),” says Haworth. “If you purchase TIPS directly, you’ll owe taxes on the imputed interest inflation adjustment.” This is an effect referred to as “phantom income.”

The inflation-adjusted principal value isn’t realized until the bond issue matures or you sell it. At that point, you would receive the adjusted principal value or the original principal value, whichever is higher.

You will never receive less from a TIPS bond than the original amount you paid for it.

TIPS Inflation Index Ratios2 are provided by the U.S. Treasury Department to help calculate the impact on bonds.

Before buying TIPS bonds, you should assess current inflation expectations or consider the degree of inflation protection you need in your fixed-income portfolio. A financial professional can help you determine if TIPS are a good fit for your investment portfolio.

Based on our strategic approach to creating diversified portfolios, guidelines are in place concerning the construction of portfolios and how investments should be allocated to specific asset classes based on client goals, objectives and tolerance for risk. Not all recommended asset classes will be suitable for every portfolio. Diversification and asset allocation do not guarantee returns or protect against losses.

Indexes mentioned are unmanaged and are not available for investment.