Improve receivables management with our scalable order-to-cash solution

Accounts receivable teams often struggle to manually determine buyer credit risk, move buyers to electronic invoicing, apply cash when payments are received and follow up when buyers don’t pay timely.

U.S. Bank Advanced Receivables simplifies the A/R process and equips teams to make smart decisions.

Reduce costs

Automation lowers the cost of manual tasks and processing.

Improve the buyer experience

Buyers enjoy better invoicing, preferred payment channels and automatic payment reminders.

Accelerate cash flow

Automated credit decisioning and faster payment channels help lower days sales outstanding (DSO).

Unlock financial insights

AI-powered insights can help improve efficiency and financial performance.

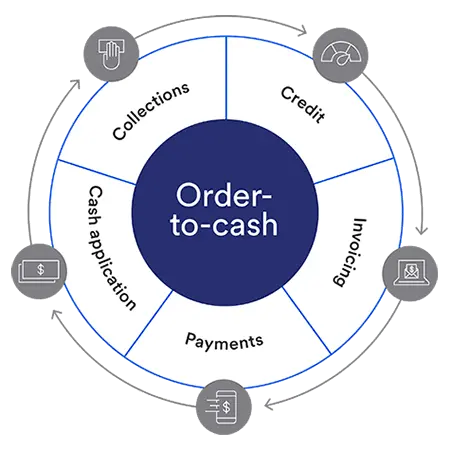

Advanced Receivables aligns with the traditional order-to-cash cycle

- Credit: Create custom credit applications, safely store sensitive credit data, make quicker credit decisions and keep teams informed.

- Invoicing: You and your buyers get flexible and automated delivery options that drive digital payments.

- Payments: Receive payments on your terms while offering a secure, convenient experience for buyers with preferred payment options.

- Cash application: Handle payments swiftly with seamless remittance data collection. Enjoy higher match rates and easier exception handling.

- Collections: Find buyers who need outreach the most. Automate repetitive tasks. Apply AI predictive insights to forecast cash.

Take your A/R processes to the next level

Rely on U.S. Bank to help you optimize the order-to-cash process with complete integrated receivables management services.

Start of disclosure content