Welcome to the San Francisco State University Branch.

Let’s talk about financial independence.

Meet over the phone, virtually or at the branch.

Connect how you want. Two-way video streaming and cobrowsing technology allows you to see your local banker, virtually. We can also meet in person at the campus branch to sit down and talk about your banking needs.

Which service can we help you with today?

Enter your address, city, state or ZIP code.

Build smart money habits.

Financial education leads to financial freedom. Check out our Financial IQ articles to gain tips and tools to build a bright money future.

Smart money moves: How to build wealth at any age

You can build wealth in your 20s, 30s, 40s, 50s and 60s if you build on good money habits. This guide from U.S. Bank has smart money moves for each decade to help with your long-term financial security.

Retirement planning toolkit

Planning for retirement is an ongoing journey. Whether you’re just starting to save or already retired, we’re here to help you work toward the retirement you want.

Why year-round giving is important

It isn’t unusual for people to wait until the final weeks of the year to express their financial support for their favorite charities. But there can be a better way.

Bank when and where it’s convenient for you.

Bank when and where it’s convenient for you.

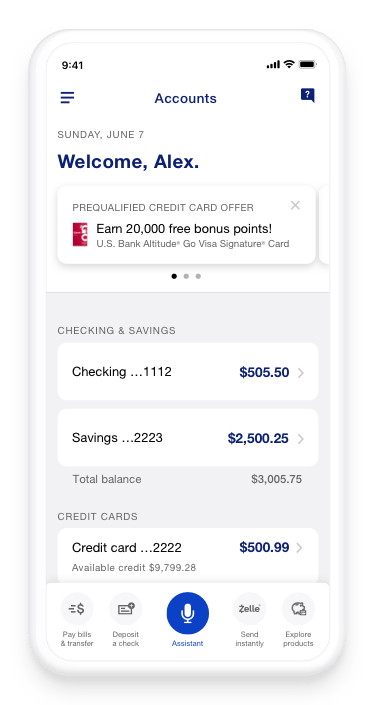

Open an account today. Manage and pay bills. It’s secure and easy. The U.S. Bank mobile app makes it simple to do all your banking, right here or wherever you go.

Nearby branches

Daly City Branch

Daly City, CA 94015

Excelsior Branch

San Francisco, CA 94112

Sunset Branch

San Francisco, CA 94122

Banking that’s simple and convenient. Learn how.

You’ll need the following personal information and general requirements.

Forms of Identification:

- If you’re a U.S. citizen, you’ll need your social security number – and a state-issued photo ID like a driver’s license, passport or military ID.

- If you’re not a U.S. citizen, you’ll need a W-8BEN with supporting documents – and a foreign passport, Visa or I-9.

Additional requirements:

- A minimum opening deposit of $25 is needed to activate your account (once you’ve been approved). This can be paid with a prepaid, debit or credit card, a transfer from another U.S. Bank account or a transfer from another financial institution.

- You must be 14 years or older to open a checking account. Those under the age of 18 must have a co-applicant.

When you book an appointment, you’ll select the date and time, the purpose of your visit and if you’d like to meet at the branch, over the phone or virtually. Additional services include:

- Online banking

- Setting up direct deposit

- Ordering debit cards

- Notarizing documents (appointment required)

- Mobile app help

- Opening a checking or savings account

- Transferring money and more

What you’ll need will depend on the reason for your visit. For most appointments, you’ll need proof of your identity, such as:

- Valid driver’s license

- State-issued photo ID

- Valid passport

Find more specifics and get answers to other common questions under support for appointment scheduling.

Here’s what you can do at most U.S. Bank ATMs, besides withdraw cash:

- Check your bank account balances

- Deposit cash and checks

- Transfer money between accounts

- Make payments

- Reset your card PIN

Contact customer service by following these steps:

- Log into your U.S. Bank account.

- Select Customer Service at the top of the dashboard.

- Call us, choose from the list of applicable departments.

- Select email us on the right side of the page in More options.

- Navigate to Common answers for additional information.

Visit the U.S. Bank branch locator and enter your current city, state or ZIP code.

You may also select Locations in the upper right corner of the U.S. Bank home page to start your search.

Disclosures

Investment and insurance products and services including annuities are:

Not a deposit • Not FDIC insured • May lose value • Not bank guaranteed • Not insured by any federal government agency.U.S. Bank, U.S. Bancorp Investments, U.S. Bancorp Advisors and their representatives do not provide tax or legal advice. Each individual's tax and financial situation is unique. You should consult your tax and/or legal advisor for advice and information concerning your particular situation.

For U.S. Bancorp Investments:

For U.S. Bancorp Advisors:

For U.S. Bank:

U.S. Bank is not responsible for and does not guarantee the products, services or performance of U.S. Bancorp Investments, Inc or U.S. Bancorp Advisors LLC.

U.S. Bank does not offer insurance products but may refer you to an affiliated or third party insurance provider.

Mortgage, home equity and credit products are offered by U.S. Bank National Association. Deposit products are offered by U.S. Bank National Association. Member FDIC.

The creditor and issuer of U.S. Bank credit cards is U.S. Bank National Association, pursuant to separate licenses from Visa U.S.A. Inc., MasterCard International Inc. and American Express. American Express is a federally registered service mark of American Express.

Equal Housing Lender