Point-of-sale (POS) systems for restaurants include specialized software and equipment that helps streamline restaurant operations, from order processing and payment processing to inventory management and customer service. Key features of restaurant POS systems include:

Order processing

Menu management

Table management

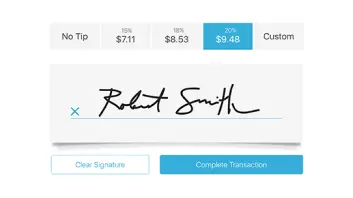

Payment processing

Inventory management

Staff management

Customer relationship management

Reporting and analytics

Online ordering

Mobile POS

Self-service kiosks