The financial intelligence and financial crimes investigations teams partner closely together to identify illicit movement of funds and provide information to law enforcement

Math can do many things, including help catch criminals.

The U.S. Bank Financial Intelligence Unit develops statistical models and performs analytics to identify potentially suspicious activity – namely, individuals trying to move illicit funds through the U.S. banking system with the appearance of legitimacy.

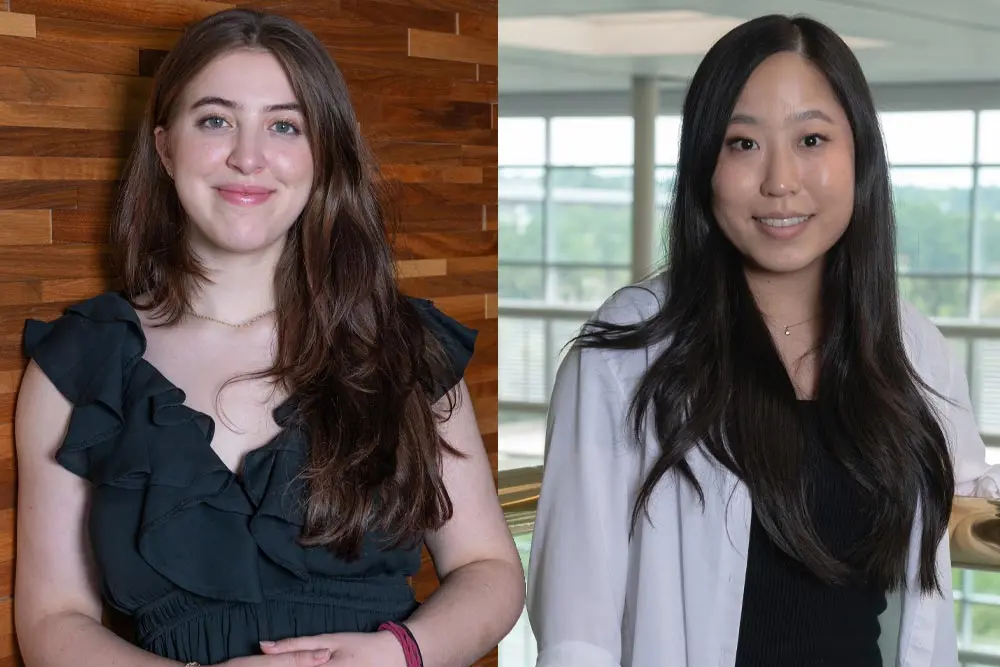

Carrie Gilson, director of the Financial Intelligence Unit (FIU), leads a team of data scientists and analysts who are responsible for creating and refining tools that flag activity that appears to indicate a financial crime like money laundering, human trafficking, drug trafficking or terrorist financing.

“It is really satisfying for my team when we can build something that cuts through the noise – the activity that is normal and expected – and narrows in on the activity that may be unusual,” Gilson said. “We employ a variety of analytical techniques ranging from rules-based logic to machine learning algorithms.”

The downstream recipient of the information gleaned from those analytical tools is the financial crimes operations team, led by Jon Roper. Roper has two investigative teams, Anti-Money Laundering and External Fraud, that focus efforts on using myriad investigative resources, including data from the FIU, to further review unusual transactions and determine what must be reported through required channels.

These processes are in place to protect the bank and its customers from those who seek to exploit the financial industry to commit or support illegal activity, money laundering and other criminal purposes.

Money laundering is the process of taking funds obtained through criminal acts and attempting to hide the true source by making those funds appear legitimate.

“When people ask me what I do and I tell them I work in financial crimes for U.S. Bank, I usually get a puzzled look. Then I give a shout out to a few popular shows that have heavy components of money laundering – and then they get it,” said Roper, director of Financial Crimes Operations. “My team plays a key role for U.S. Bank where fulfilling our regulatory requirements may help law enforcement catch criminals and other nefarious individuals who are using the financial industry in a way that isn’t allowed.”