Key milestone ages as you near and start retirement

Retirement advice: How to retire happy

As long as you’ve been working, you’ve been contributing to a retirement fund: Social Security. But while it may be an important part of your income in retirement—averaging about a third of it for Americans aged 65 or older—it’s intended to supplement your retirement income, rather than be your sole source of cash flow.

Here are some commonly asked questions about Social Security and its role in your overall retirement plan.

You may be surprised to hear that you can start receiving Social Security benefits as early as age 62 – but that doesn’t mean you should.

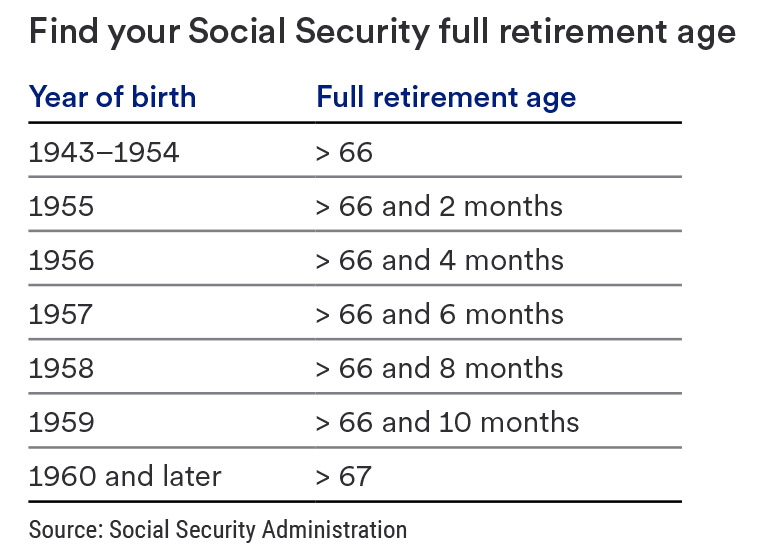

The longer you delay receiving benefits, the more you’ll get each month. The smartest thing to do is wait until at least your “full retirement age” before collecting benefits (see below). If you claim benefits before that, your payments will be reduced. And if you wait until you’re older than your full retirement age, the benefits will increase each month until you turn 70.

Your full retirement age depends on the year you were born. It’s currently 67 for anyone born in 1960 or later.

In short, you’ll receive less Social Security income. In fact, you could receive as little as 75% of what you would if you waited just a few years.

For example, if you qualify for a $1,000 monthly benefit at your full retirement age of 67 but decided to start claiming at 62, you would only get $700 a month. On the other hand, if you waited until you turned 70 to claim Social Security, you would receive $1,240 a month.1

Even if Social Security will only form a small portion of your income in retirement, waiting until at least your full retirement age will bring you a significant percentage more in benefits per month.

Yes, with some qualifications. If your spouse is a qualified worker, you’ll be able to collect one-half the amount that they do, as long as you wait until you hit your full retirement age. If you claim before that, your benefits will be reduced.

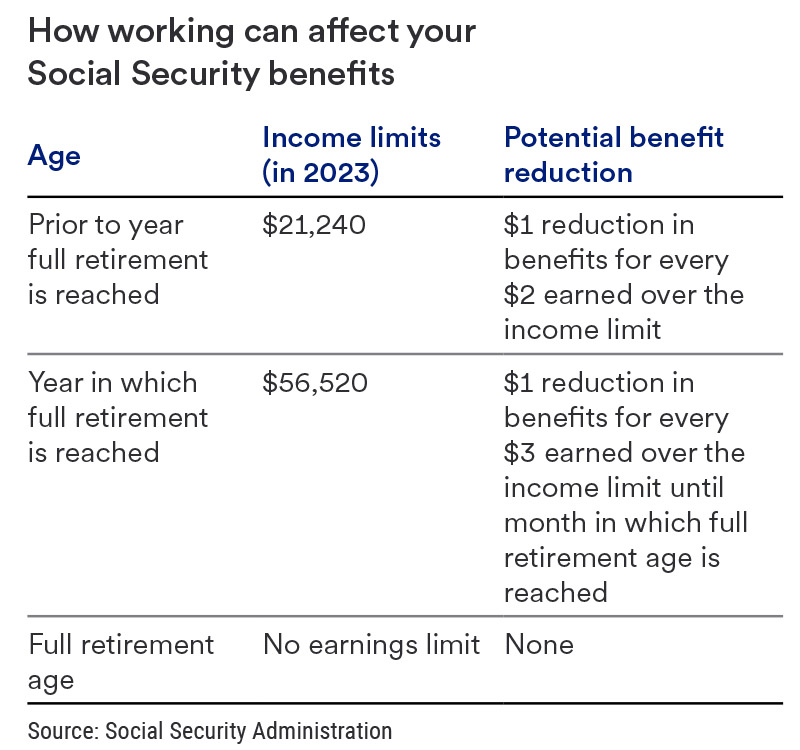

Again, yes, with some qualifications. If you expect to keep working right up until your full retirement age but would like to supplement your income with Social Security, you can—as long as you don’t exceed the income limits.

Once you hit your full retirement age, there is no limit to what you can earn from other sources.

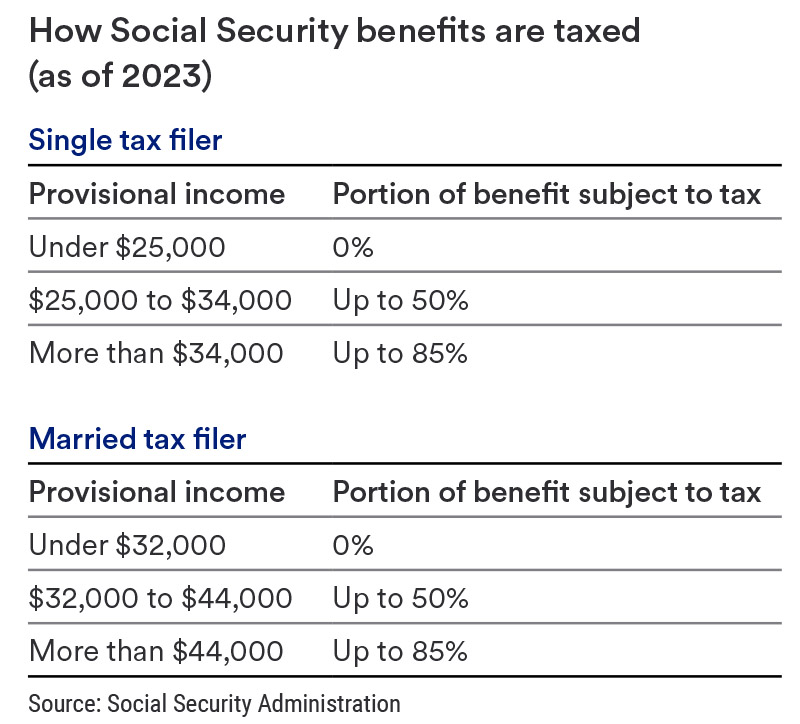

It depends on what your combined income is once you start claiming Social Security benefits. If your combined income is $25,000 or more per year (for individual filers) or $32,000 per year (for joint filers), you could be taxed on at least 50%, and up to 85%, of your benefits.

However, if your combined income is less than $25,000 (for individual filers) or $32,000 (for joint filers), you won’t pay tax on your Social Security benefits.

To figure out your combined income, you’ll add your adjusted gross income, any nontaxable interest and half of your Social Security benefits together.

A tax professional can help you figure out the tax rate for your individual circumstances.

Yes, if:

The rules are slightly different if you are disabled or caring for a child under age 16. In these cases, you can claim for spousal benefits no matter how long you were married to that ex-spouse.

It’s worth noting that if you claim for spousal benefits, your ex-spouse will not be notified to protect your confidentiality. It also won’t affect their own benefits.

The answer depends on several factors.

If you’re married when you die, your spouse could begin receiving survivor benefits once they turn 60, or once they turn 50 if they are disabled.

If you were divorced at the time of your death, your ex-spouse could still claim benefits if:

As far as how much of your Social Security benefit your surviving spouse would receive, the rules are as follows:

For more information, see the Social Security Administration’s hub page for survivor’s benefits.

It’s worth saying again: Social Security is not intended to be the whole of your retirement income. For a comfortable retirement, you should be building savings in other ways, such as through a 401(k) and/or an individual retirement account (IRA).

A financial professional can help you design a comprehensive retirement plan and determine the proper role for Social Security in your retirement and the most effective timing to begin collecting benefits.

You may be asked for the following documents while applying:

This checklist can help you gather information and documents you may need to apply. If you don’t have all the documents, don’t worry. In many cases, your local Social Security office can help you find the information.

There are several factors in determining your Social Security benefits. These factors include:

Visit ssa.gov/planners/calculators for calculators to help you make an estimate of your benefits.

You can initiate the process with whichever of the following options you prefer.

Next steps to consider: