News

Introducing U.S. Bancorp Impact Finance

New name but same commitment from U.S. Bank subsidiary delivering impact-focused financial solutions

U.S. Bank announced today it will establish U.S. Bancorp Impact Finance as the new name for its subsidiary that leads tax credit investments and syndications, lending and other impact-focused financial solutions, and works across the company to facilitate sustainable finance opportunities to meet customer needs.

This new name more accurately reflects an expanding range of products and services designed to meet customers’ evolving needs and drive business growth for the company. It also provides a unique identity to reinforce its industry-leading role in financing projects nationwide that help build thriving communities and drive inclusive economic growth.

“U.S. Bancorp Impact Finance is a new name for an integral and growing part of our business, delivering financial solutions that help meet customers’ evolving needs, and in the process helping U.S. Bank grow and meet our own commitments as a company,” said Terry Dolan, U.S. Bank chief financial officer. “And it’s a name that underscores what we’ve known for 35 years doing this work: It’s possible to leverage our purpose and strengths to help create lasting impact.”

U.S. Bancorp Impact Finance replaces the U.S. Bancorp Community Development Corporation name, which the group has publicly operated under since 2002.

“It’s a time of tremendous growth and new opportunities for our organization, and we’re excited about what the new name represents,” said Zack Boyers, chairman and CEO of U.S. Bancorp Impact Finance. “It encompasses the full spectrum of work we’re known for and have always delivered, including affordable housing, economic development, historic rehabilitation, environmental finance, our growing syndications platform and new sustainable finance role. And importantly, it and gives us room to evolve and grow our products and services as customers’ needs change.”

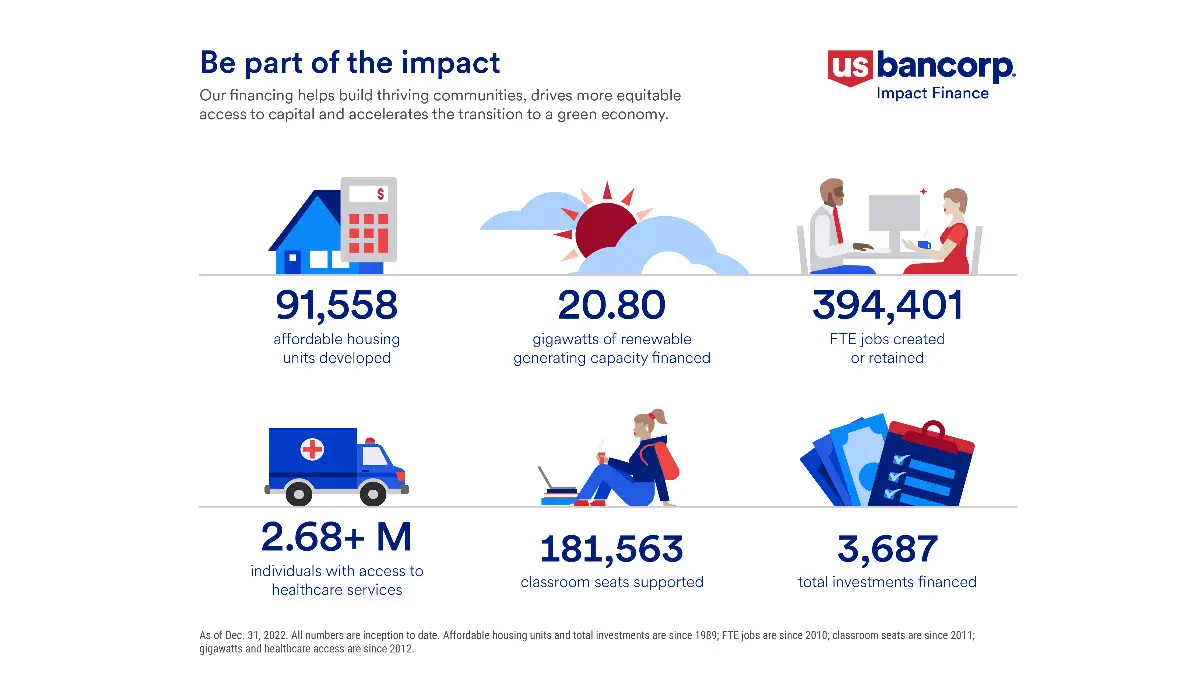

U.S. Bancorp Impact Finance’s work is a key contributor in helping U.S. Bank deliver on a variety of public commitments it’s made, including U.S. Bank Access Commitment™, Net Zero and our $50 billion environmental pledge, and $100 billion Community Benefits Plan. It finances projects in all 50 states and U.S. Territories. Across its products, U.S. Bancorp Impact Finance is a national leader in:

- Investing and lending to new construction and renovation of affordable rental housing.

- New Markets Tax Credit (NMTC) investments, financing projects that support business growth, job creation and economic development in disinvested or distressed communities; as well as a leading Historic Tax Credit (HTC) investor.

- Renewable energy investments, including a new transition finance debt product.

- Lending to Community Development Financial Institutions (CDFIs) and support organizations making a difference on the ground in communities; as well as the largest national lender to Low Income Housing Tax Credit (LIHTC) syndicators.

- Tax credit syndications, providing investors predictable streams of tax benefits across multiple credit types to offset income tax liability, while also aligning to their social impact, sustainability and Community Reinvestment Act (CRA) goals.

A new Sustainable Finance team was also recently created within U.S. Bancorp Impact Finance to help ensure U.S. Bank is positioned to continue meeting customers’ growing appetite for sustainable investing and financing opportunities that can help them meet their social and environmental goals, including new products and services.

The new name is effective immediately and will begin appearing in print and marketing materials in the weeks and months ahead.

Tags:

Media center

Press contact information, latest news and more

Learn more

Company facts, history, leadership and more

Work for U.S. Bank

Explore job opportunities based on your skills and location