Capitalize on today's evolving market dynamics.

With changes to taxes and interest rates, it's a good time to meet with a wealth advisor.

Because your approach to impact investing reflects your personal values, it’s unique to you.

Investors today can put money to work in ways that seek to make a positive impact without sacrificing the potential to earn competitive returns.

For example, investors can select investments that have clearly identified intentions related to environmental, social and corporate governance (ESG) considerations.

Like some investors, you may be interested in putting your money to work in a way that can affect global change you consider to be desirable, an approach often referred to as impact investing. Typically, this approach centers on investments selected with environmental, social and corporate governance (ESG) objectives in mind.

The size of the worldwide market for impact investments is now estimated at more than $1.57 trillion.1 “It’s possible for investors to build a diversified portfolio and follow broad ESG mandates,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management. “It’s a decision that goes back to the personal tastes of the investor.”

As you consider impact investing, it’s important to understand the opportunities as well as other considerations that may affect your decision.

Impact investing is defined as investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return.2 “Stated simply, it’s putting your money to work in a manner that reflects your values,” says Chad Burlingame, CFA, CAIA, head of impact investing for U.S. Bank.

“Once you’ve identified what values you want to be aligned with your money, we can identify the most effective ways to incorporate impact investing into your portfolio strategy.”

Chad Burlingame, CFA, CAIA, Head of Impact Investing at U.S. Bank

No two investors will have the same approach to impact investing. Whether you want to support companies or funds that are dedicated to promoting diversity or addressing climate change, you can now find investment opportunities aligned with your values.

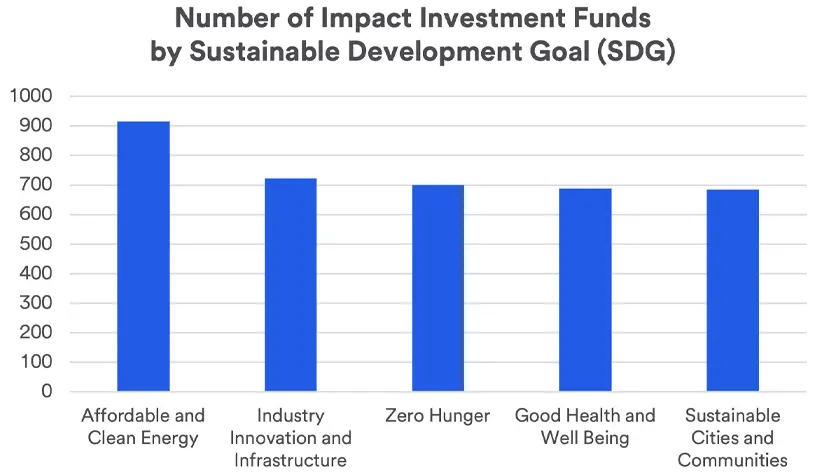

The universe of options within the context of impact investing expanded in recent years. Many mutual funds and exchange-traded funds (ETFs) offer a variety of ways for individuals to participate in this marketplace. Impact investing can also be directed toward private market equity or debt. In fact, it’s now possible to broadly diversify your entire portfolio – across a range of asset classes – through impact investing.

“In the real world, the definition of ‘impact investing’ is very much unique to each person,” says Burlingame. “Once you’ve identified what values you want to be aligned with your money, we can identify the most effective ways to incorporate impact investing into your portfolio strategy.”

Following very strong flows of money into the ESG market from 2019 to 2021, $13 billion of outflows in 2023 marked the first time in more than a decade that capital flows to U.S.-based ESG funds were negative. However, it should be noted that some exchange-traded funds (ETFs) garnered substantial net inflows in 2023, including two climate-focused funds.3 The trend of modest outflows continued through 2024’s first three quarters, though the pace of outflows slowed over the course of the year.4 “The numbers indicate a lack of momentum toward ESG investing, which existed earlier,” says Haworth. “We’re now watching to see what will be the next driver of increased ESG interest.”

ESG investing looks at three dimensions of a company:

Impact investing also seeks to support the efforts of businesses and organizations to complete projects aimed at having a positive benefit on society. A precursor to ESG and impact investing was socially responsible investing (SRI). This approach primarily focused on eliminating certain investments that did not match the investor’s ethical guidelines. A common example would be the avoidance of investing in stocks of tobacco companies.

When determining your own impact investing objectives, you can choose from two primary options:

The lack of performance history makes it difficult to definitively state that an impact focus outperforms other investment styles. Yet a recent survey shows that 79% of respondents reported that their financial expectations were met or exceeded. More than two-thirds of them indicated their expectation was to earn risk-adjusted, market-rate returns. In addition, 88% said their investments met or exceeded impact targets.5

While the number of available options claiming to meet the definition of impact investing has ballooned, to accomplish your specific objectives, a thorough assessment is required to clearly identify a fund’s ESG intentions. Most important is to sort through false promises and misleading claims, a concept broadly referred to as “greenwashing.” This term describes a company executive or investment manager conveying a false impression or providing misleading information about the merits of impact in its products or services.

“Funds must have a proven intention and ability to deliver on their impact investing objectives over an extended period of time,” says Burlingame. “Measuring the ‘non-financial’ benefits of an investment (its success in making an impact) can be more complex than measuring the financial return of an investment. Some aspects of ESG performance are easier to measure than others.”

Some environmental measures have become more readily available, such as a company’s carbon output. However, substantive information about gender diversity in a company’s workforce or other social governance metrics are less publicly accessible. In addition, impact ratings from the investment research firm Morningstar only date back to 2016. These factors make the investment selection process more challenging.

Professional guidance can help. Burlingame notes, “The process for identifying the right impact investments requires a combination of qualitative and quantitative analysis. As the industry evolves, new investment alternatives arise and the need for careful assessment becomes even more pronounced.”

A few examples of impact investing include:

Investors interested in impact investing as a type of investing strategy want to see their money both grow and deliver non-financial benefits to society and the environment.

According to a survey by the Global Impact Investing Network, 79% of respondents reported that their financial expectations were met or exceeded. More than two-thirds of them indicated their expectation was to earn risk-adjusted, market-rate returns.

An area to keep eye on may be the infrastructure buildout for renewable energy. While it’s still in the early stages, it will have both environmental benefits and may offer compelling returns for long-term investors.

Impact investing has a specific definition, but it can also be used as the umbrella term to capture the myriad of investment approaches, including environmental, social and governance (ESG) and socially responsible investments (SRI).

The ultimate objective of impact investing is for you to feel comfortable that the money you’re investing is designed to “do good” over the long run. You can meet investment goals by focusing on organizations that mitigate risks or seek to solve today’s environmental, social or governance challenges. Your values can be meaningfully incorporated into your investment strategy.

Companies worldwide may misrepresent their green credentials to deceive investors and consumers for economic gain or public favor.

Let us help you craft a portfolio that reflects your goals, time-horizon and values.