Financial guidance and support, tailored for you.

Explore the benefits of working with a dedicated wealth team.

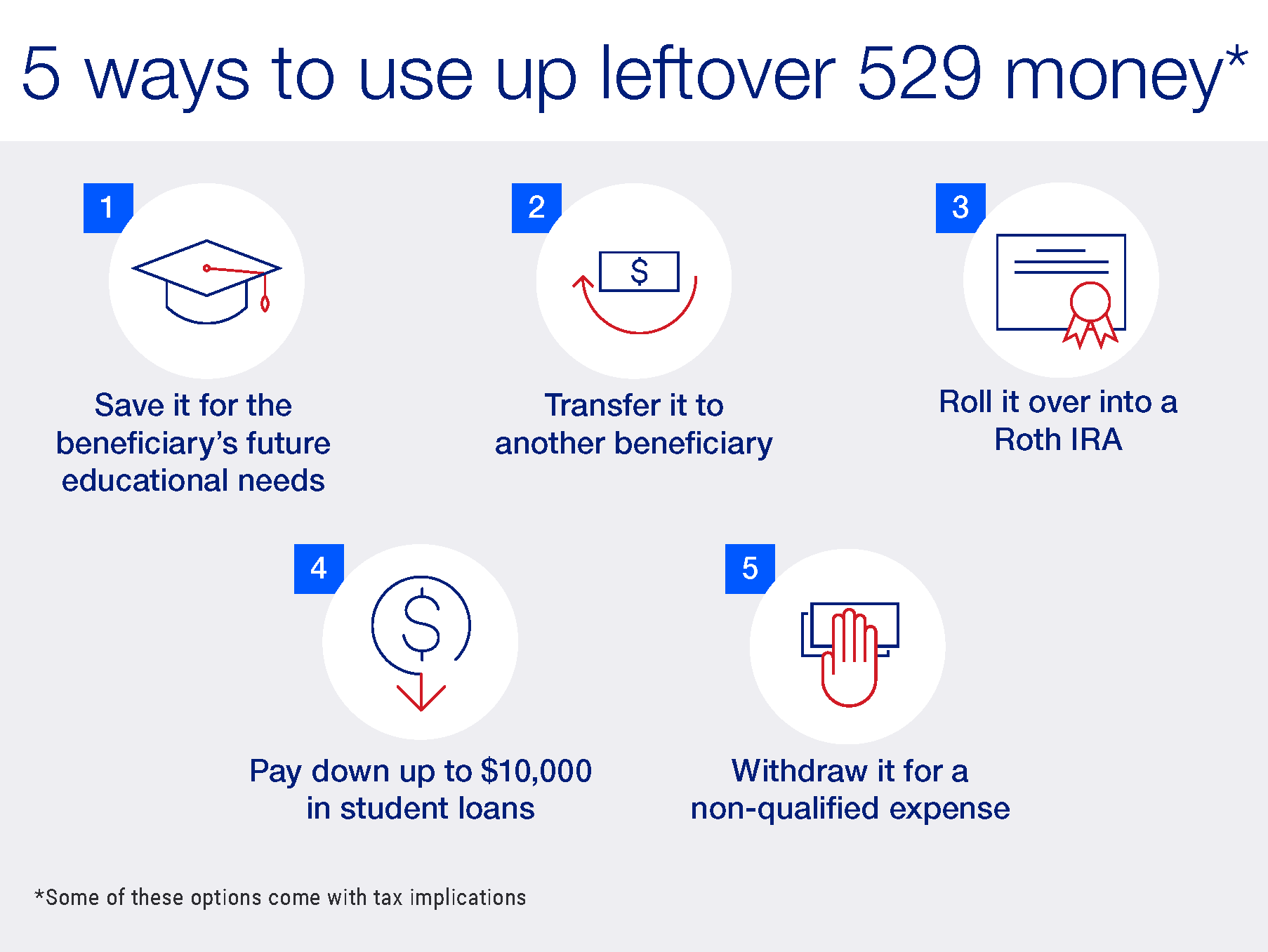

A scholarship, inheritance or choosing a more affordable school are all reasons you might have unused 529 funds.

There are several ways to use up leftover 529 funds, including transferring them to another beneficiary or rolling them over into a Roth IRA.

It’s best to consult a financial professional, as there could be tax impacts related to some of these options.

Tax-advantaged 529 education savings plans are a great way to start saving for your child’s higher education—especially considering the sharp rises in tuition over the years. But what happens to the 529 funds if they’re not used?

If your child received an unexpected scholarship, attended a more affordable in-state school or received an inheritance that went toward their education, you may wind up with leftover 529 plan funds in your account.

The good news is that you have options for your unused 529 funds. 529 plans are quite flexible as there's no time limit on when the funds must be withdrawn from the account. However, there are some tax-related nuances to keep in mind.

529 plans are quite flexible as there's no time limit on when the funds must be withdrawn from the account.

One of the most obvious ways to use your unused 529 funds is to save them for future educational needs. If your child earned a bachelor’s degree, for example, they may want to enroll in a graduate school program and use the funds to cover some or all of that tuition.

You may also be able to use 529 funds to pay for the beneficiary’s other educational expenses, including:

Of course, restrictions apply.

But if your child isn’t interested in adding more degrees to their resume, there are other ways to use up the funds left in a 529 account. Here’s how those different options work and the pros and cons of each.

If your child decides not to go to college or only uses part of the total funds while in school, you can transfer the remaining funds to another family member who is planning to attend college.

Alternatively, you could designate yourself as the beneficiary to use for any type of higher education, trade school or community college, as well as licensing or credentialing programs and fees required for your profession.

While there’s no timeframe for when the money has to be withdrawn, you can only change the beneficiary twice a year, and the new one must be related to the original beneficiary. To ensure account continuity, you’ll also want to name a successor-owner. That way, the account will remain operational even if something were to happen to its initial owner.

As of 2024, through a provision of the Secure 2.0 Act, you can roll a portion of the unused 529 funds into a Roth IRA for that 529 named beneficiary. This can be a good way to turn leftover funds into a retirement savings boost.

There are a few restrictions with this option, including:

Be sure to check with your financial professional before making this move.

If the 529 plan beneficiary has an open student loan balance, you can use up to $10,000 of the leftover 529 funds to pay off their federal and private student loans. You can also use the leftover funds to pay off student loans borrowed by a sibling(s) without having to change the name of the beneficiary.

The leftover 529 funds can’t be used for other types of consumer loans (such as cards or personal loans).

If you’re in the middle of a home remodeling project or planning on a big purchase, the leftover funds in your 529 can be used to cover some or all that expense. The money comes out prorated between contribution money and earnings, which means that only the “earnings” portion of the withdrawal is taxed. That earnings amount is subject to ordinary income tax and a 10% penalty.

The non-education withdrawal isn’t penalized if your child receives a scholarship (in other words, the money can be withdrawn to offset the scholarship amount), attends a U.S. military academy, becomes disabled or passes away.

Regardless of how you plan to liquidate the funds remaining in your 529 account, consulting an experienced financial professional can help you make the right choice for your specific situation. There are numerous guardrails, rules and regulations concerning 529s; a financial professional can walk you through these complexities, explain any gift tax consequences and help you better understand how a 529 plan operates within the context of your overall financial planning.

Learn how our team-based planning approach can help you review financial opportunities from all perspectives.

Unlike a traditional IRA, a Roth IRA allows you to contribute after-tax dollars now and withdraw contributions tax-free in retirement. Get details on Roth IRA contribution limits, Roth IRA income limits and Roth conversions.

We can help you identify and prioritize your financial goals and design a plan to work toward them, making adjustments as your needs evolve.