When switching banks, start by thinking about the type of account you need – like a checking account, savings account or both. Decide if you want an account with or without paper checks. You’ll also need to choose between opening an individual or a joint account. Consider the minimum account opening balance along with factors like fees, interest rates and access to mobile and online tools.

Switch your personal bank accounts in three simple steps

Step 1

Open your account

- Apply for a bank account online in under five minutes or apply at a branch.

- Get your government-issued ID and Social Security number ready. Most accounts can be opened with a minimum of $25.

- Add money to your new account – move money online or at a U.S. Bank branch.

Step 2

Transfer recurring deposits & payments

- Update automatic payments and subscriptions to your account and make sure pending payments have cleared.

- Set up or move direct deposits in the US. Bank mobile app or online banking.

Step 3

Close your old account

- Download bank statements and records before closing the account.

- Withdraw any remaining money and make sure to confirm your account closure.

- Get the U.S.Bank Mobile App or enroll in online banking if you haven’t already.

Understand your options before switching bank accounts

Checking accounts

Compare personal checking accounts to find the one that’s right for you.

Savings accounts

Compare personal savings accounts to grow your money.

Get Smart Rewards®, too

Earn rewards without lifting a finger. Open a U.S. Bank Smartly® Checking account and you automatically get U.S. Bank Smart Rewards® for free – no sign-up needed. From day one, dollar one, you’ll be eligible for discounts, fee waivers and other perks that continue to grow as you move up in this five-tiered program.

Tips to manage your money when you switch to U.S. Bank

Switch your paycheck direct deposit in minutes

Find new ways to save towards your goals

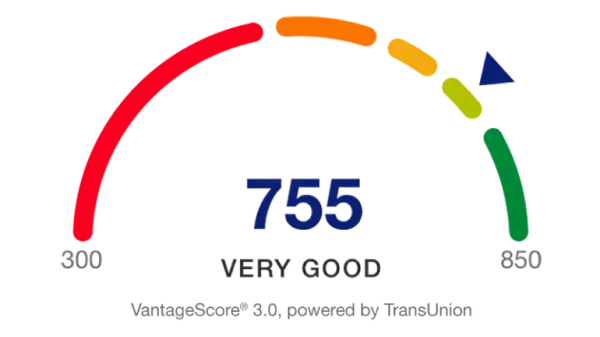

Set yourself up for credit success

Frequently asked questions: How to switch banks

You might consider switching banks if your current bank doesn’t offer the services you need – or if you’d like to save on fees or find a better interest rate on savings accounts. Some people change banks to gain access to more ATMs and branch locations, or to find a bank with 24-hour banking and round-the-clock customer service. The right bank for you should provide the access, support and value that fits your financial goals.

Making the switch can be simple with U.S. Bank. Here are a few key things to remember:

- Keep your old account open and funded if you’re transitioning direct deposits. Be sure all pending payments have cleared before closing your account.

- Follow up on your request to close your old account and get written confirmation once it’s officially closed.

- Order a new debit card, if necessary.

- Download the U.S. Bank Mobile App or enroll in online banking to manage your account anytime.

There are many benefits, including our award-winning mobile app. The U.S. Bank Mobile App has provided 2 billion personalized insights to customers about spending trends, saving opportunities and more.

Our Digital Security Guarantee sets us apart, too. U.S. Bank customers are protected from unauthorized online transactions if they notify us right away. We also offer automatic alerts, payment fraud protection and FDIC insurance.

Our customers also appreciate the convenience and access of our more than 2,000 branches in 26 states. Check our ATM and branch locations.

We sure do. The U.S. Bank Mobile App is a convenient way to manage your money all in one place.

Yes. You can connect a variety of different accounts. Learn how to link your bank accounts.

We offer the U.S. Bank Mobile App, online banking, Smart Rewards®, as well as added benefits and rewards for members of the military (veterans and active duty), students, seniors and more.