Earn up to $450.

Open a new U.S. Bank Smartly® Checking account and complete required activities to qualify for your bonus. This offer is valid through June 15, 2026.1

Together, we’ll set you up to seize the big moments to come. Here are some of the ways we can help you achieve your short-term and long-term dreams:

Open a new U.S. Bank Smartly® Checking account and complete required activities to qualify for your bonus. This offer is valid through June 15, 2026.1

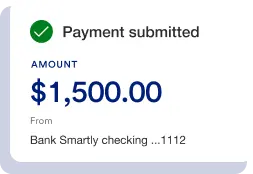

Earn up to $450 by opening a new U.S. Bank Smartly® Checking account, adding funds to your account and completing other required activities.1

Open your checking account online through this page by June 15, 2026 with an opening deposit of $25 within 30 days. Then, within 90 days of account opening, enroll in the U.S. Bank Mobile App or online banking and make at least two direct deposits.1

Your bonus is determined by the total amount of your direct deposits:

Note: Use the Apply button above and we’ll apply the promotional offer to your application for you. If you apply for your checking account from a different page, you won’t be able to get the offer. As a part of this program, you get a special perk – your $12 monthly maintenance fee is waived automatically.2

Set your sights on success with the help of a goals coach. Our goals coaches are available to help you reach your goals, with free financial and non-financial goal-setting strategies and budgeting tools.

Our Goals Coaches regularly host webinars through your employer on a variety of financial and non-financial topics. Missed one? You can watch recordings when it’s convenient for you or register for upcoming live sessions.

Being smart about your finances starts right now, and changes what your future looks like. U.S. Bank is here to help you learn how to make the right choices at the right time.

Welcome to the Financial Wellness Center, your hub for bite-sized financial lessons, powered by Zogo. From saving and budgeting, to building credit and career growth, each lesson is quick, interactive and designed to build your real-world confidence.

The Financial Wellness Center is built to fit your learning needs and can also reward you for your efforts. You can even earn points redeemable for gift cards right in the app or learn and earn anytime online.

To earn and learn, download the app

Enter Code USBWPB

With the Greenlight debit card and money app, kids learn about smart spending with real-world experience managing their money. Parents can send money instantly, set flexible controls, and get real-time notifications of all money activity. Best part? It’s complimentary3 with an eligible U.S. Bank Smartly Checking account.

U.S. Bank is your partner for life’s milestones, offering solutions to save on checking fees, build budgets, set goals, invest wisely and support your home-buying journey.

Ready to get more from your money? U.S. Bank Smartly® Checking gives you more control, insights, and support than ever before. Open an account with a minimum deposit of $25 to enjoy these benefits:

Discover hassle-free banking. Open a Safe Debit Account,10 the streamlined debit account with no checks and no overdraft fees and a wealth of features to help you mind your money wisely.

Smart Rewards® is complimentary with your Bank Smartly® Checking account and you’re eligible for benefits like:

As part of the Financial Wellness Program, you get even more perks as you automatically level up in the Smart Rewards® program by combining balances from eligible accounts.

Save and earn more from day one with U.S. Bank Smartly Savings, offering competitive rates from your first dollar deposit. Set goals, grow your money, and take advantage of a complete view of your savings. Get started with a minimum $25 opening deposit and enjoy the following benefits:

With our Elite Money Market Account, you’ll enjoy easy access to your funds, but with tiered interest rates that may pay more for higher balances than a standard savings account.

Whether you’re a first-time homebuyer, a seasoned professional or somewhere in between, you have unique needs. We have solutions to meet them.

Whether you’re into cash back, travel rewards or a low introductory APR, U.S. Bank has credit cards for every lifestyle.

Make everyday simple with online and mobile banking.

View, track and pay your bills securely with the top-ranked U.S. Bank bill pay.

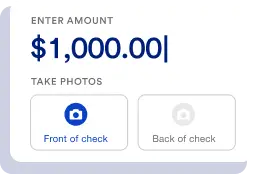

Take a photo with your mobile device and upload it through the mobile app.

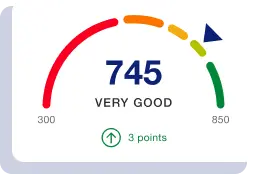

Check, monitor and improve your credit for free.21

Yes. The U.S. Bank Mobile App makes it easier to manage your money, with easy-to-use tools in one place including:

Yes. You can quickly link all your accounts, even ones at other banks, using the U.S. Bank Mobile App. Then, use our budgeting tool and personalized insights to get a clear picture of your finances.

Yes. With our automated setup, enrolling in direct deposit is easy.

Get answers to other frequently asked questions and learn more about account services, features and benefits on our Checking customer resources page.