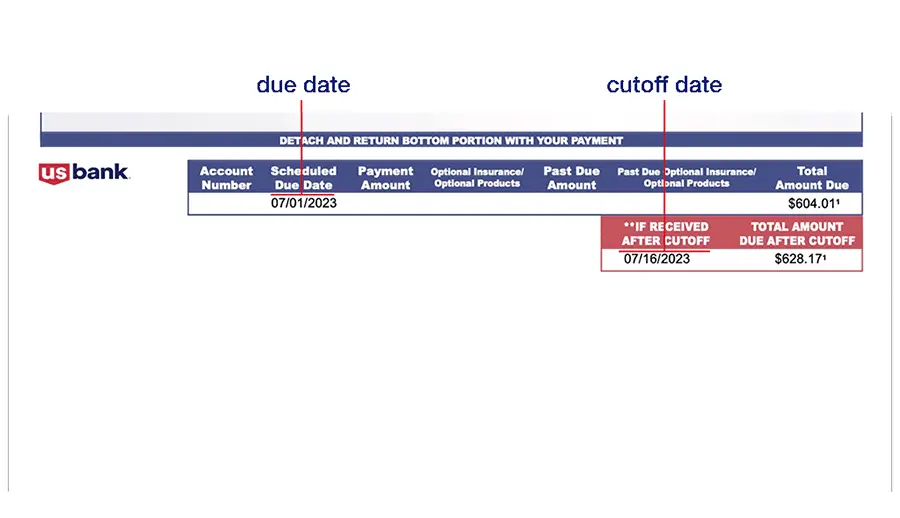

If you’re struggling to make your mortgage payment, we can help.

To get started, select Mortgage assistance from your mortgage account to let us know your current hardship status and how you’d like to proceed with your monthly payments.

If you have two or more mortgage accounts, log in to each mortgage account to request assistance. For home equity line of credit (HELOC), call us at 800-USBANKS (872-2657).

Find out more about mortgage help and repayment options.