Promo code Q1PRO26 MUST be used when opening a U.S. Bank Business Essentials® or Platinum Business Checking account. Limit of one bonus per business. A $100 minimum deposit is required to open one of the referenced accounts.

To earn a business checking bonus, open a qualifying U.S. Bank business checking account between 1/15/2026 and 3/31/2026. Make the required deposit(s) in new money within 30 days of account opening, maintain the same required daily balance through the 60th day, and complete 6 qualifying transactions based on posted date within 60 days of account opening.

- Business Essentials: $400 bonus with $5,000 deposits and daily balance

- Platinum Business Checking: $1,200 bonus with $25,000 deposits and daily balance

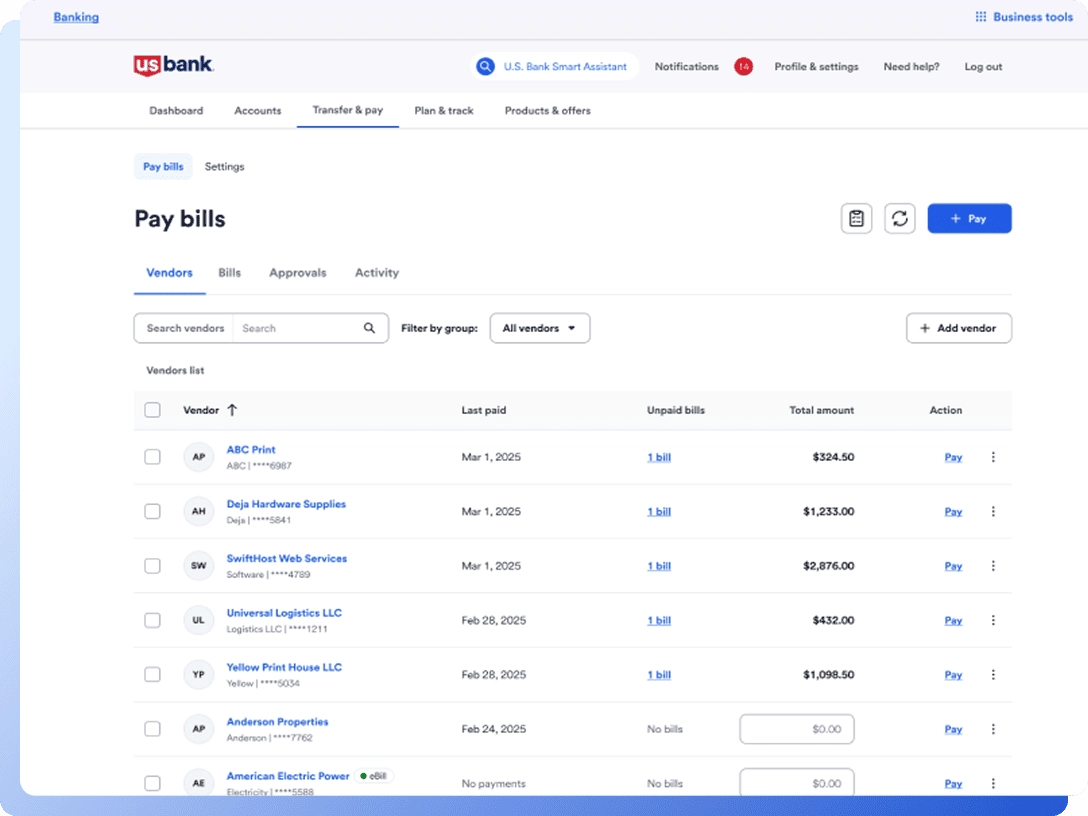

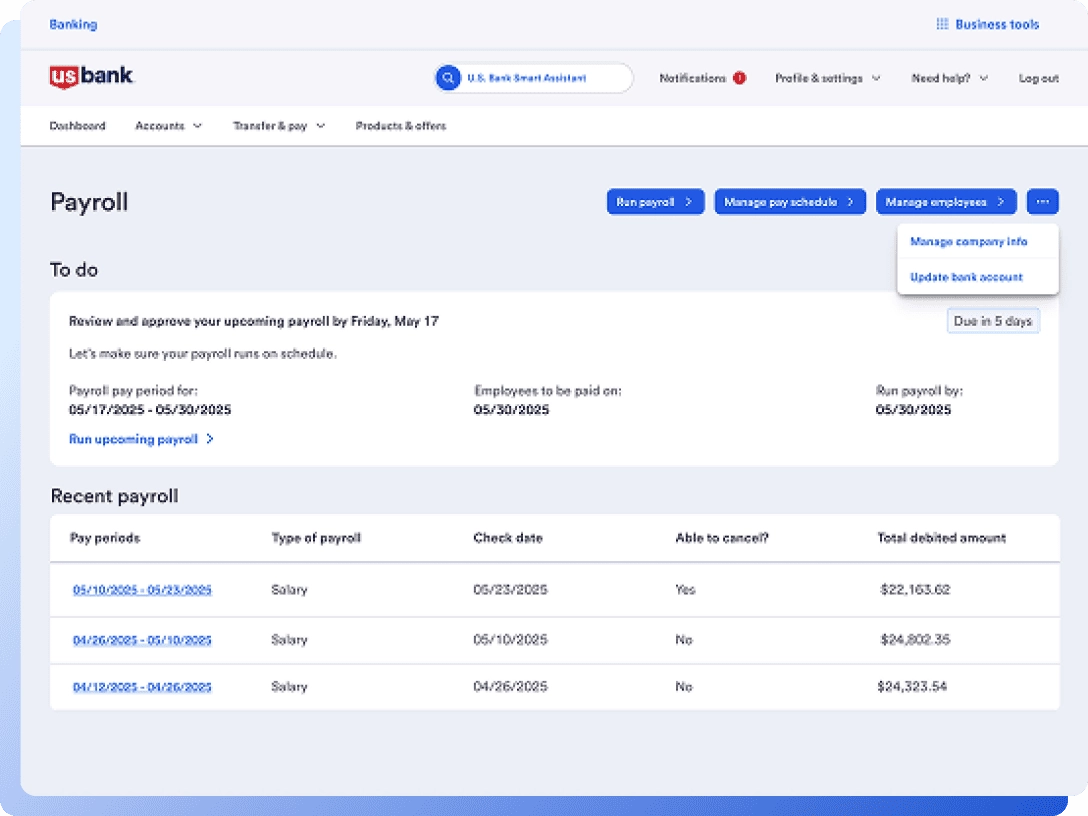

Qualifying transactions include debit card purchases, ACH and wire credits or debits, Zelle credits or debits, U.S. Bank mobile check deposit, electronic or paper checks, bill pay (excluding payments made by credit card), and payment received via U.S. Bank Payment Solutions. Other transactions, such as person-to-person payments, credit card transfers, or transfers between U.S. Bank accounts, are not eligible.

New money is defined as funds from outside U.S. Bank and cannot be transferred from another U.S. Bank product or a U.S. Bank Affiliate. For accounts opened on non-business days, weekends or federal holidays, the open date is considered the next business day. Account fees may reduce the required daily balance during the qualifying period.

Bonus will be deposited into your new eligible U.S. Bank business checking account within 30 days after the month-end in which all offer requirements are met, provided the account remains open with a positive available balance.

Offer may not be combined with other business checking bonus offers. Existing businesses with a business checking account or had one closed within the past 12 months, do not qualify.

All regular account-opening procedures apply. For full checking account pricing, terms and policies, refer to your Business Pricing Information, Business Essentials Pricing Information, and YDAA disclosure. These documents are available at any U.S. Bank branch or by calling 800.872.2657.

Bonus will be reported as interest earned on IRS Form 1099-INT and recipient is responsible for any applicable taxes. Current U.S. Bank employees are not eligible. U.S. Bank reserves the right to withdraw this offer at any time without notice.