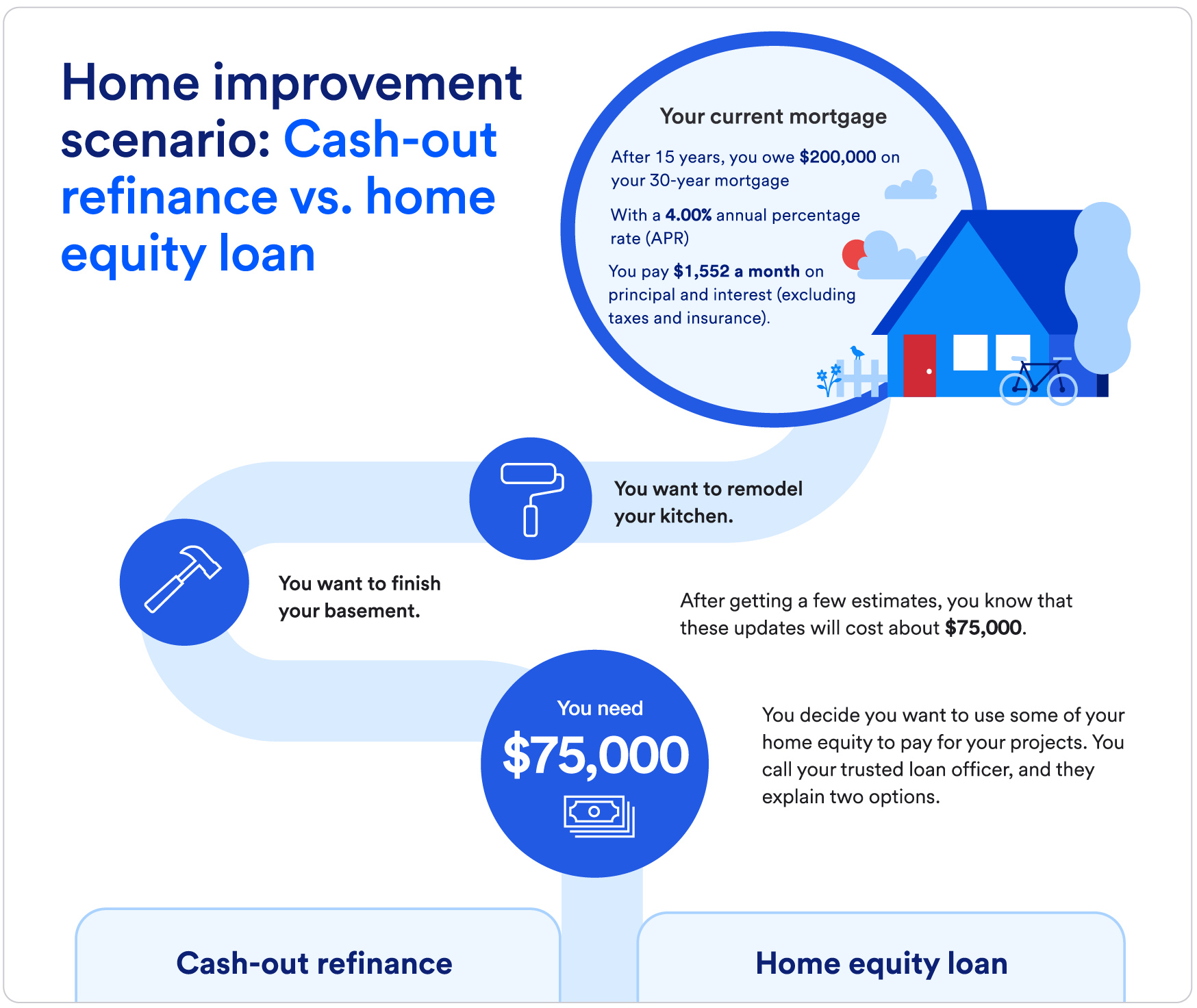

Home improvement scenario: Cash-out refinance vs. home equity loan

Your current mortgage

After 15 years, you owe $200,000 on your 30-year mortgage with a 4.00% annual percentage rate (APR). You pay $1,552 a month on principal and interest (excluding taxes and insurance).

You want to remodel your kitchen and finish your basement. After getting a few estimates, you know that these updates will cost about $75,000.

You decide you want to use some of your home equity to pay for your projects. You call your trusted U.S. Bank loan officer, and they explain two options.

Option 1: Cash-out refinance

A cash-out refinance lets you access the equity in your home to get cash at closing. You can get new mortgage terms and borrow funds for a one-time expense at the same time.

This option combines your current mortgage of $200,000 and the $75,000 you need for your project, which you’d get as cash out.

This would give you a new mortgage of $275,000 with a 6.375% APR over the course of the next 20 years. You’ll also pay an estimated $8,799 in closing costs, which is factored into your monthly payment amount.

Your new monthly mortgage principal and interest payment would be $2,165 (excluding taxes and insurance).

Option 2: Home equity loan

A home equity loan lets you use the equity in your home to take out a lump sum and keep your current mortgage. Along with your regular mortgage payments, you’ll pay back the new loan at a fixed rate over a fixed amount of time.

This option lets you keep your current $200,000 mortgage at 4.0% APR, which costs you $1,552 a month. You also take out a new home equity loan of $75,000 at 8.25% APR for a term of 20 years, which will cost you $639 a month. There are no closing costs.

Your current monthly mortgage payment and your new home equity loan payment together would be $2191 (excluding taxes and insurance).

These rates, APRs, monthly payments and points are current as of 03/27/2025 and may change at any time. They assume you have a FICO® Score of 740+ and at least 25% equity for a conventional fixed-rate loan. Interest rate and program terms are subject to change without notice.