Realize benefits throughout your purchasing process.

The U.S. Bank Purchasing Card provides a cost-effective alternative to traditional purchase orders and existing paper-based, labor-intensive processes.

Streamline purchasing processes.

Reduce the number of steps in your purchasing process and make your entire procure-to-pay process more efficient. Use the U.S. Bank Purchasing Card to secure a variety of goods and services instead of initiating purchase requisitions or check requests.

Lower costs.

Reduce the costs and time associated with purchase orders and existing paper-based, labor-intensive processes, like invoice processing and reconciliation.

Manage your supply chain effectively.

Analyze spending patterns and identify opportunities that can assist you with vendor negotiations and drive savings to your organization’s bottom line.

Integrate with financial systems.

Embed the U.S Bank Purchasing Card into your eProcurement system or integrate with your ERP system to improve your reporting and tracking efficiencies.

Gain more control of your spend.

The U.S. Bank Purchasing Card has several built-in features that can help you track spending and increase purchase program control.

- Cap the number of transactions and dollar limits per day, month or other period specified by your organization.

- Restrict the amount of a single purchase made by your cardholders.

- Set a maximum dollar amount authorized for a cardholder within a billing cycle.

- Block the purchase of specific commodities and services at the point-of-sale.

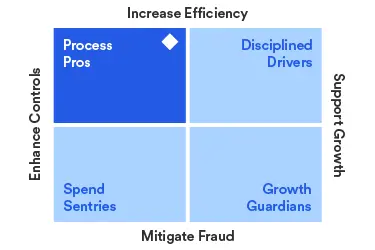

See how your AP strategy measures up

Take a short assessment to uncover how your payables operations stack up. Get tailored insights to help you drive efficiency and scale with confidence.

Extend the value of your credit card program.

Enhance working capital, increase rebate revenue opportunity and streamline your payment process with U.S. Bank Virtual Pay.

Innovative solutions for Purchasing Card management and payments

Our technology is built to make purchasing card use easier, safer and more efficient – so you can stay focused on your business.

Access® Online

Access Online provides you and your cardholders one secure, easy-to-use system to manage corporate cards efficiently.

Access Online Mobile App

The Access Online Mobile App lets you handle payments, view account details and track spending – all from your mobile device.

Mobile payments

Add your U.S. Bank corporate credit card to your phone or device – and pay securely while on the move.