Monthly Economic Outlook

Economic forecast: February 2026 trends and analysis

Macroeconomic insights and outlook from the U.S. Bank Economics Research Group to help guide your business strategy

February 2026

Economic outlook at a glance

Economic weather report: Sunny growth, cloudy jobs, sticky showers

Our February 2026 U.S. economic outlook highlights an economy that ended 2025 with surprising resilience, even as underlying pressures continued to build. Real GDP accelerated through the middle of the year and is tracking close to a solid 3% annualized rate in Q4 – despite a policy environment shaped by shifting tariffs, tighter immigration constraints and fiscal uncertainty.

Beneath the surface, however, the labor market has softened, with hiring constrained by limited labor force growth and firms adopting a cautious ‘low‑hire, low‑fire’ stance amid weakening job perception metrics. Meanwhile, inflation is cooling only gradually, with price levels still elevated for essentials and firms planning to pass tariff‑driven cost increases to consumers. These persistent cost headwinds support our expectation for slower consumption in 2026 and reinforce the Fed’s patient, data‑dependent stance.

Key takeaways:

Growth: Economic activity remains broadly intact, supported by resilient consumer spending and steady business investment. Despite a year marked by policy uncertainty, we expect 2025 growth to finish near 2.2%. As uncertainty fades and fiscal support builds, our 2026 forecast has been revised up to 2.5%, signaling modest but sustained expansion.

Labor market: Despite cooler hiring and unemployment at 4.4% through December, labor conditions remain orderly, with limited layoffs and steady wage growth. We expect unemployment to move into the upper‑4s by mid‑2026, reflecting gradual normalization rather than sharp deterioration.

Inflation: Core PCE is estimated to have risen 3.0% over the 12 months through December, with elevated readings driven largely by goods‑sector price pressures linked to tariffs, while disinflation continues across most services categories. We expect core PCE to hover close to 3% through mid-2026 before gradually converging toward the Fed’s 2% target by late 2027.

Federal Reserve: The Fed held rates steady in January and emphasized a patient, data‑dependent approach, noting that policy is now near the upper end of ‘loosely neutral.’ With labor signals mixed but stable and inflation still above target but gradually easing, we continue to expect two cuts in 2026 – likely June and December – bringing the policy rate to 3.00–3.25%.

Risks

Downside risks remain elevated, with our near‑term recession probability now at 30%. Softer consumer sentiment – shaped by concerns around job stability and affordability – adds fragility, while uncertainty across fiscal, trade and immigration policy, along with the potential for a policy misstep by the Fed, continues to cloud the outlook.

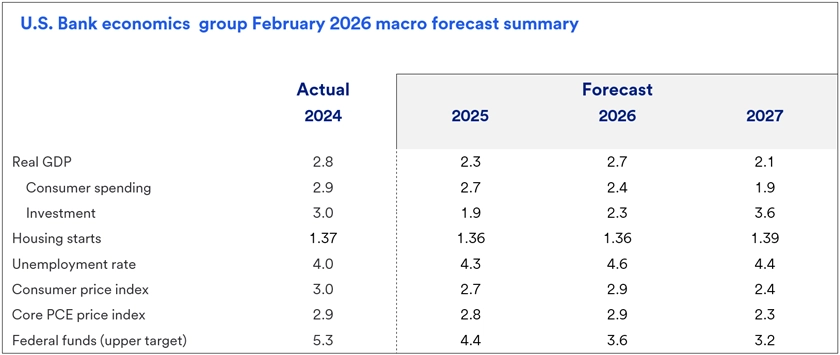

Macroeconomics forecast at a glance

Produced by the U.S. Bank Economics Research Group, our in-depth economic forecast examines the trends and economic indicators shaping business decisions this year and into the future.

February 2026 Report

Go beyond the highlights. Download the full monthly forecast for a comprehensive view of the economy, including all supporting data tables, charts and insights from the U.S. Bank Economics Research Group.

Get more business-focused economic analysis

For additional insights, see our weekly economic highlights and Chief Economist Beth Ann Bovino’s latest economic commentary.

If you have questions about any of the topics above or want to learn more, please contact us to connect with a U.S. Bank corporate and commercial banking expert.

Not currently a subscriber? Sign up to get our economic insights delivered to your inbox weekly.

Sources: U.S. Bank Economics, Bloomberg, Yale Budget Lab, U.S. Bank Economics calculation

Tags:

U.S. Bank Economics Research Group

Beth Ann Bovino

Chief Economist

Ana Luisa Araujo

Senior Economist

Matt Schoeppner

Senior Economist

Adam Check

Economist

Andrea Sorensen

Economist

Subscribe to our economic insights newsletter

Not currently a subscriber? Sign up to get our economic insights delivered to your inbox weekly.

Learn more

If you have any questions about any of these topics or want to learn more, please contact us to connect with a U.S. Bank Corporate and Commercial banking expert.