A “low-hire, low-fire” economy reflects the labor market’s current state, with slower new job creation combined with near-historically low unemployment rates and relatively steady layoff activity. In the current economic environment, although employers are creating even fewer new jobs, they appear reluctant to initiate major workforce reductions. “The combination of slower job growth but still low unemployment reflects a sharp drop in both labor demand and labor supply,” says Matt Schoeppner, senior economist, U.S. Bank. “That leaves the labor market less dynamic and increasingly vulnerable to downside risk.”

Article

U.S. labor market: Low-hire, low-fire economy

October 22, 2025

Key takeaways

The U.S. labor market has entered an unusual phase characterized by limited hiring but overall job market stability.

In the summer of 2025, payroll growth stalled even as the unemployment rate remained historically low.

A major question today is how fragile the labor market is given current economic circumstances.

Even with the nation’s unemployment rate near historic lows, the U.S. labor market shows increasing signs of fragility. It has transitioned into an unusual phase, best described by Federal Reserve Chair Jerome Powell as a “low-hire, low-fire” economy. 1

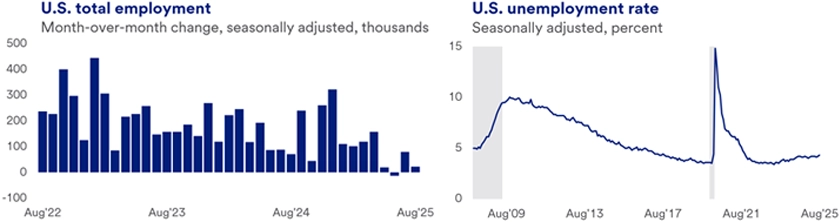

One of the most notable data points is the significant slowdown in payroll growth. New job creation averaged just 29,000 jobs per month over the summer, even before a large, pending downward revision to the data. At the same time, the nation’s unemployment rate trended modestly higher, but remains near historic lows. 2

Though fewer new jobs are being created, employers appear reluctant to initiate major workforce reductions. In August, the nation’s unemployment rate stood at 4.3% (September’s jobs data was delayed due to the federal government shutdown). 2 “The combination of slower job growth but still low unemployment reflects a sharp drop in both labor demand and labor supply,” says Matt Schoeppner, senior economist, U.S. Bank. “That leaves the labor market less dynamic and increasingly vulnerable to downside risk.”

Examine the issues

The low-hire, low-fire labor market: Stability on the surface, vulnerability beneath

Signs of potential fragility in U.S. labor market

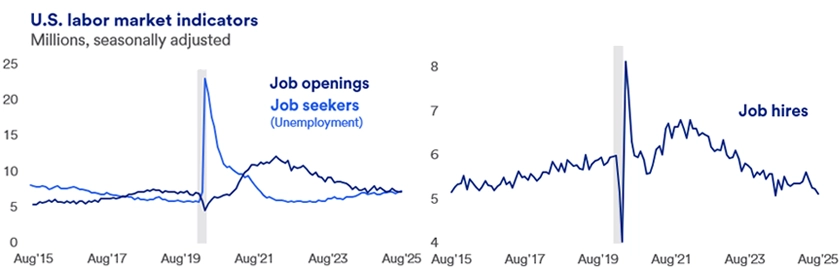

The labor market continues to adjust to dramatic changes that occurred in the wake of the COVID-19 outbreak. The economy virtually shut down after the pandemic began, resulting in millions of workers temporarily losing jobs. However, the economy quickly recovered, and the number of open positions outpaced available workers for an extended period.

Now, the ratio of job openings to job seekers has converged back to roughly one-to-one. This occurred not only because of the Federal Reserve's efforts to cool the economy and normalize labor market conditions, but companies have become more cautious about hiring while holding on to their existing workforce—focusing on retention over recruitment. Schoeppner warns that what looks on the surface like relative labor market stability could mask underlying fragility. “Even a modest shock could have an outsized impact on unemployment, growth, and policy decisions,” says Schoeppner.

The declining “breakeven” job growth rate

The “breakeven” employment growth rate —the monthly pace of job creation required to maintain a steady unemployment rate—is considered a key, labor-related economic measure. In recent years, that figure was estimated to be as high as 250,000 to 300,000 new jobs per month, driven by strong immigration and labor force gains. Today, with U.S. population growth slowing and labor force participation stalling, breakeven is estimated closer to just 75,000 new jobs per month or less.

“The lower breakeven rate partially explains how the unemployment rate can hold in the low 4-percent range even as new job creation flatlines,” says Schoeppner. “It also underscores a loss of labor market dynamism.” Schoeppner notes that even though job layoffs and discharges remain near historic lows, job openings are steadily declining, fewer workers are quitting jobs and hiring rate hovers near non-recession lows. “These are all classic, low-churn job market conditions,” says Schoeppner.

A recent survey by the New York Federal Reserve showed Americans’ expectations of finding a new job in the next three months at an all-time low, with only modest improvement in September. Worker job market expectations remain well below average. 3 “In our view, this mix is the hallmark of a low-hire, low-fire labor market, with stability and balance on the surface, but fragility underneath,” says Schoeppner.

What’s driving the U.S. labor market slowdown

The current labor market appears driven by both structural and cyclical forces. These include:

- Immigration policy shifts. Tighter controls on immigration result in reduced labor force growth, pulling breakeven job gains down and limiting labor market dynamism.

- Tariff cost pressures. The Trump administration’s implementation of higher tariffs on many trading partners have added to costs and fueled uncertainty. This mix that can discourage or delay hiring, particularly in goods-related sectors.

- Federal spending cuts. Reductions in federal government spending in some areas have resulted in large layoff announcements, localized shocks, and dampened expectations among federal contractors. An extended federal government shutdown could amplify these fiscal headwinds by disrupting operations and confidence.

- Consumer spending softness. Lower- and middle-income households face challenges as poor affordability and diminished purchasing power constrain discretionary spending.

- Artificial intelligence impact. Demand for entry-level technology jobs may be subsiding.

Together, these factors create conditions for an increasingly brittle labor market.

Layoffs: the last defense

The current firewall between a soft patch and a downturn is that layoffs remain at low levels. Firms continue to hoard labor to avoid the costly, post-pandemic rehiring scramble. “Businesses learned that mass layoffs can be expensive to reverse,” says Schoeppner, “so instead, they are adjusting at the margins through hiring freezes, shorter hours and cuts to temporary help.”

"The combination of slower job growth but still low unemployment leaves the labor market less dynamic and increasingly vulnerable to downside risk.”

Matt Schoeppner, senior economist, U.S. Bank.

Weekly initial jobless claims remain comfortably below the 250,000 level, signaling a still-subdued layoff environment. Continuing unemployment claims, after steadily rising through mid-summer, had started to ease and were at their lowest levels since May 2025 prior to the government shutdown on October 1. But ongoing claims remain elevated, indicating that many workers are having a harder time finding new jobs and are forced to maintain unemployment benefits.

If layoffs rise even modestly, the current, “low hire” environment means the unemployment rate could rise quickly. Today’s hiring rate is approaching recession-era lows. Any shock—such as weakening demand, fiscal disruption, or declining confidence—that forces cost-cutting could result in rising layoffs. History shows that once layoffs begin to climb, they accelerate quickly as firms follow one another’s lead. In the months to come, the “low fire” scenario may be tested.

The soft-landing scenario stands, but…

Even with weak hiring, under the current low layoff scenario, the economy appears positioned to skirt a recession, at least in the near term. The Fed’s recent decision to lower the federal funds target rate, and plans to cut further before the end of 2025, demonstrate its increasing focus on the fragile labor market. The potential downside risk of overly tight Fed interest rate policy in a vulnerable labor market is more apparent.

Several factors support our expectation that the economy can achieve a soft landing and avoid a recession:

- Subdued layoffs. This key “firewall” has helped sustain steady economic growth. While job-finding has slowed, employers aren’t yet aggressively cutting jobs and are more inclined to retain employees.

- Moderating wage growth. Wage growth has slowed, but hasn’t collapsed. The Atlanta Fed’s Wage Growth Tracker shows pay gains easing toward a 4% annual rate, consistent with cooling inflation but still supporting consumer incomes.

- Fed interest rate easing. The Fed is keeping its options open and appears prepared to further ease monetary policy should labor conditions deteriorate, reducing the risk of a monetary-induced recession.

The economy on the edge

A complication in projecting the economy’s direction is the lack of fresh government data on labor market activity due to the shutdown. In their absence, attention shifts to what remains. Private data sources—such as ADP’s National Employment Report and Indeed Job Postings—are filling some gaps, but substitutes for ‘hard’ data remain limited. Until the shutdown ends, decision-makers will be stuck navigating with partial signals rather than a full picture.

As we assess available data, it is apparent that the economy’s margin for error appears razor thin. An extended government shutdown, a sharper consumer spending pullback, or another adverse surprise could tip the balance. The next few months will determine whether the “low-fire, low-hire” labor market persists, or the dominant story reflects Fed Chair Powell’s economic fragility warnings.

FAQ

The “breakeven” employment growth rate —the monthly pace of job creation required to maintain a steady unemployment rate—is considered a key, labor-related economic measure. Today, with U.S. population growth slowing and labor force participation stalling, breakeven is estimated at approximately 75,000 or fewer new jobs per month. In recent years, that figure was estimated to be as high as 250,000 to 300,000 new jobs per month, driven at the time by strong immigration and labor force gains. “The lower breakeven rate partially explains how the unemployment rate can hold in the low 4-percent range even as new job creation flatlines,” says Matt Schoeppner, senior economist, U.S. Bank. “It also underscores a loss of labor market dynamism.”

The unemployment rate has remained rather steady even in a weaker job market due to a variety of factors. While companies have tempered hiring, they also appear increasingly reluctant to reduce their workforces. As a result, the unemployment rate remains near historically low levels. Companies may be holding on to workers partially due to a slowdown in labor supply growth. Given current demographic trends, approximately 75,000 new jobs are required monthly to keep pace with population growth. That’s down considerably from breakeven rate peaks of 250,000 to 300,000 per month in past years.

Tags:

U.S. Bank Economics Research Group

Beth Ann Bovino

Chief Economist

Ana Luisa Araujo

Senior Economist

Matt Schoeppner

Senior Economist

Adam Check

Economist

Andrea Sorensen

Economist

Subscribe to our economic insights newsletter

Not currently a subscriber? Sign up to get our economic insights delivered to your inbox weekly.

Learn more

If you have any questions about any of these topics or want to learn more, please contact us to connect with a U.S. Bank Corporate and Commercial banking expert.