A tariff, also known as an import duty, is a government levy on goods imported into the country from other nations. Tariffs are collected when items clear through customs. Tariff rates vary by type of product and the originating country. In many cases, tariffs are applied to certain products or goods from specific countries to create a more competitive environment for domestic producers of similar goods.

Article

Trump administration’s economic plan: Potential impact on the broader economy and businesses

September 16, 2025

Key takeaways

Expanded tariffs remain a prominent global economic issue.

To this point, tariffs, on average, are not as stringent as initially anticipated, but remain significantly higher than previous levels.

Higher inflation may still result from ongoing tariffs.

The global economic environment continues evolving, fueled by President Donald Trump’s aggressive tariff stance and responses from trading partners. Soon after the President began his second term, his administration began implementing higher tariffs, impacting most trading partners. While tariff levels fluctuated with changes in President Trump’s stance, it seems that many businesses and countries have adapted to the new trade landscape.

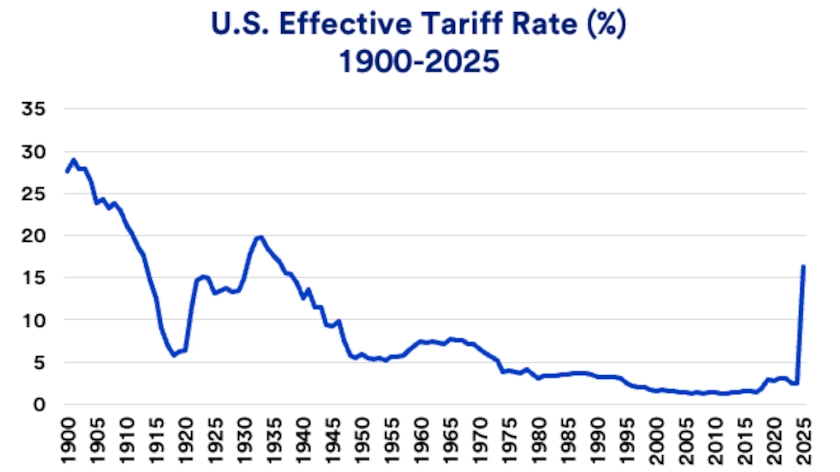

So far, there has been only a limited economic impact. “Our fear was the effective tariff rate might reach 30%,” Beth Ann Bovino, chief economist at U.S. Bank. “For now, the effective tariff rate settled around half that level, though it still far exceeds the 2.5% effective tariff rate in effect before 2025.” Bovino notes that some of the worst fears, about the potential for a full-scale trade war with steep retaliatory tariffs, have not materialized. "While a tariff war still exists, it doesn’t feel like an all-out war,” says Bovino. “Tariff levels are lower than we initially feared.”

“While a tariff war still exists, it doesn’t feel like an all-out war. Tariff levels are lower than we initially feared.”

Beth Ann Bovino, chief economist for U.S. Bank

As of September 2025, these include a 35% broad tariff on many Canadian goods; a 30% tariff on all Chinese imports; a 25% tariff on many Mexican imports; a 25% tariff on foreign-produced automobiles (excluding some vehicles made in the United Kingdom); and 50% tariffs on most steel, aluminum and copper imports.

While other countries imposed retaliatory tariffs on U.S. exports, many have been reduced or eliminated, reducing the potential impact on domestic producers.

Minimal trade balance impact

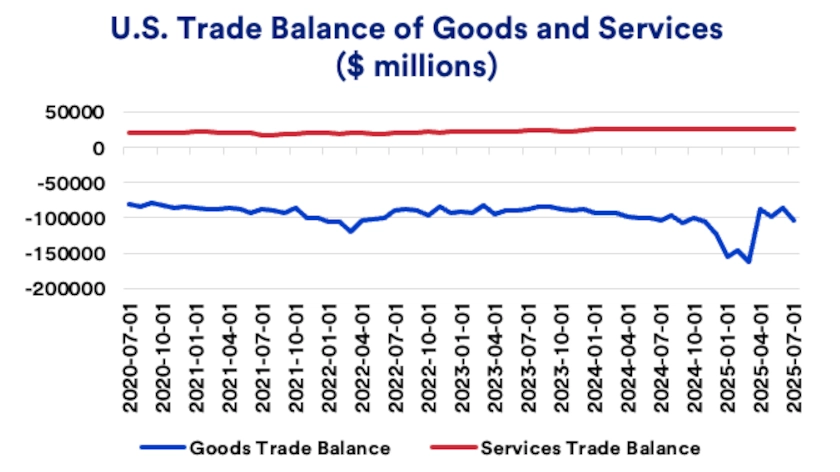

President Trump has repeatedly stated that his new tariffs are aimed at reducing America’s large trade deficit and onshoring manufacturing that had been outsourced to other countries. “The President’s complaints about America’s trade deficit largely relate to goods trade,” says Bovino. “What’s often overlooked is that we have a huge trade surplus in services, particularly driven by our technology advantages.”

In early 2025, the goods trade deficit grew as American importers increased their purchases before new tariffs took effect. “The trade balance is now close to where it was in recent years,” says Matt Schoeppner, Senior Economist, U.S. Bank. “There’s no real improvement relative to the long-term trend.”

Economic impact of tariffs

The primary concern is whether a negative economic impact will result from a flood of new tariffs. In recent decades, conventional economic wisdom advised against steep tariffs. This view dates back to the Smoot-Hawley tariffs of the Great Depression era (through the 1930s), when efforts to support the economy by boosting tariffs resulted in other countries’ reciprocal actions, and a significant decline in global trade. That only appeared to worsen the economic crisis. Since then, tariffs have generally been considered a hindrance to economic advancement, though U.S. policy continuously included some form of tariffs. Since the 1940s, average U.S. tariffs diminished considerably, down to 2.5% in 2024. However, today’s effective tariff rate is approximately 16%. 1

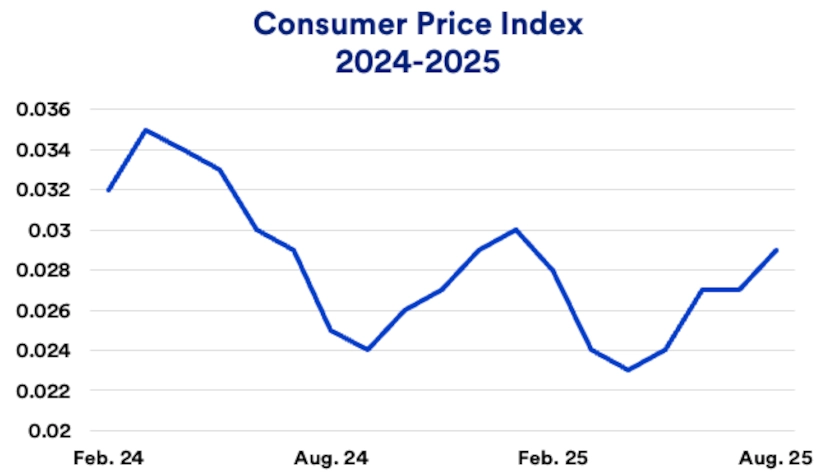

Elevated tariff levels could fuel higher inflation. In addition to buying goods in advance of tariffs, businesses have, according to Bovino, avoided passing higher costs to customers and have instead absorbed the costs. Nonetheless, in recent months, U.S. inflation as measured by the Consumer Price Index (CPI) has been trending upward.

“We expect tariffs to result in higher goods prices in the upcoming months,” says Schoeppner. “The inflationary impact was delayed, but those inventories purchased in the pre-tariff period are depleting. That’s showing in CPI’s upward trend.”

Awaiting a key Supreme Court ruling

The Trump administration unilaterally implemented tariffs currently in place, invoking the International Economic Emergency Powers Act (IEEPA). A successful court challenge to the President’s claim of such powers was mounted and upheld on appeal, while keeping the current tariffs in effect. The administration appealed the case to the U.S. Supreme Court, which is scheduled to hear it in November. Bovino doesn’t see court action as a likely obstacle to President Trump’s policies over the near term. “The courts left the administration with other avenues to pursue its trade policies, regardless of its main ruling.”

In the meantime, the tariffs in place can still be changed. The Trump administration has specifically used tariffs as a negotiation tool in pursuing other foreign policy goals, with mixed results.

Economic considerations of tariffs

While tariffs are designed to promote domestic industry and generate government revenues, questions revolve around the full economic consequences. Will today’s trade policies benefit or hinder economic growth? Will they prove to be inflationary? What industries are most susceptible?

Economic growth

Bovino says the potential negative economic results are manageable if the current economic plan is to keep the effective tariff rate close to the current 16% rate. “There could be a detrimental impact, but perhaps not as severe as many might expect given overall domestic economic content that originates in the U.S.” says Bovino. She notes that approximately 75% of U.S. economic activity is domestically driven, with only 25% tied to trade. “Nevertheless, higher prices are a concern,” says Bovino. “Lower-income households are particularly hard hit.”

Schoeppner notes that “initial reciprocal tariffs were extreme, but most countries have now backed off. That limits some of the potential economic pain.”

Inflation

One of the biggest concerns is how much tariffs will increase prices for businesses and consumers. Prices are likely to be pushed higher, with questions centered on whom the cost falls. “If importers try to absorb the costs, that squeezes profit margins,” says Bovino. “If they pass it on to households, that adds to consumer inflation, which is already elevated.”

According to Schoeppner, the economic scenario to date has played out as planned. “We forecasted slower economic growth, gradually rising unemployment, sticky inflation and persistently high long-term interest rates,” says Schoeppner. “To date, that seems consistent with what’s actually occurred.”

Industries

Most tariffs impacted imported goods. Manufacturing firms, including automobile companies, may be feeling the biggest tariff burden, with sentiment readings, like Empire Manufacturing, in contraction territory. “In some cases, specific industries, such as steel and aluminum producers, benefit from duties on foreign steel and aluminum," says Schoeppner. “On the negative side, automobile manufacturers rely on many foreign-made parts. Similarly, electronics manufacturers face the same issue and are dealing with rising costs.” Additionally, higher lumber tariffs could increase construction costs, and reduced demand for U.S. agricultural goods might harm domestic farmers.

A change in direction

In the post-World War II era, efforts were made to promote international trade. Economically linking countries was considered a way to avoid military engagements. This approach began to peak in the late 20th and early 21st century. U.S. policymakers created NAFTA, reducing trade barriers between the U.S., Canada, and Mexico. During the first Trump administration, this treaty was replaced by USMCA, which still maintained open trade but with some modifications. Trade with other partners, including previously off-limit countries such as China, flourished until the first Trump administration, when President Trump began to pursue more aggressive Chinese import tariffs. President Joe Biden retained most of those tariffs, and now Trump is again pursuing more restrictive trade barriers.

“These moves put what had been favorable trading relationships with other countries at risk,” says Bovino. “New tariffs raise some challenges in maintaining economic efficiencies that existed under a freer trade environment.”

Bracing for tariff impacts

Based on current tariff levels, business owners relying on foreign products need to be prepared for increased costs. This may mean managing costs by considering other supplier resources not subject to new tariffs. Short of that, higher tariffs on goods will either reduce profit margins or require that some or all added costs be passed on to customers. Business owners should continue monitoring tariff developments, which, under Trump administration policy, often change rapidly.

Consumers also need to be prepared for the potential that rising tariffs could result in higher prices for a wide range of goods, from groceries to pharmaceuticals to durable goods such as automobiles and appliances. “It’s notable that tariffs are considered a transitory, one-time inflation push,” says Bovino. “Price levels may stay high, but inflation rates don’t keep going up assuming tariff rates remain level.”

To this point, the extent to which new trade policies could affect businesses and consumers is far from clear. Expect the story to continue evolving in the months and years ahead.

FAQ

In the U.S., tariffs are applied as a percentage of the price a domestic buyer pays a foreign seller. The U.S. Customs and Border Protection Agency collects tariffs at various U.S. ports of entry. In 2024, the average tariff applied to all imported goods was 2.5%, though tariff rates varied significantly depending on the product or its originating country. Tariffs serve as a revenue source for the government. Typically, tariffs are applied to deal with a trade imbalance or in response to another nation’s trade policies.

The end user, typically consumers, bears the ultimate cost of a tariff. While the government collects tariffs from importers in the recipient country, this cost is often passed on to the potential buyer of the product. Responsibility for paying the tariff does not reside with the countries from which the products originate or the companies producing the items.

From an economic perspective, the conventional wisdom is that tariffs are counterproductive. While the U.S. applied much higher tariffs up to World War II, tariffs have generally decreased since then. Greater emphasis was placed on opening up avenues of free trade. President Donald Trump has proposed a number of significant new tariffs on various trading partners. Even if these tariffs are added in the coming months, Beth Ann Bovino, chief economist, U.S. Bank, says the potential negative economic consequences are marginal. “There could be a detrimental impact, but perhaps not as severe as many might expect,” says Bovino. She notes that approximately 75% of U.S. economic activity is domestically driven, with only 75% tied to trade. The higher the tariffs go, the greater the potential economic damage. Bovino worries that the risk of an extended tariff war with retaliation from our trading partners could leave wounds and currently places the recession risk for the next 12 months at 35%. A larger concern is the potential inflation impact. “If inflation becomes persistent, it’s more challenging to turn around. That can keep pricing pressures higher for longer,” says Bovino.

Tags:

U.S. Bank Economics Research Group

Beth Ann Bovino

Chief Economist

Ana Luisa Araujo

Senior Economist

Matt Schoeppner

Senior Economist

Adam Check

Economist

Andrea Sorensen

Economist

Subscribe to our economic insights newsletter

Not currently a subscriber? Sign up to get our economic insights delivered to your inbox weekly.

Learn more

If you have any questions about any of these topics or want to learn more, please contact us to connect with a U.S. Bank Corporate and Commercial banking expert.