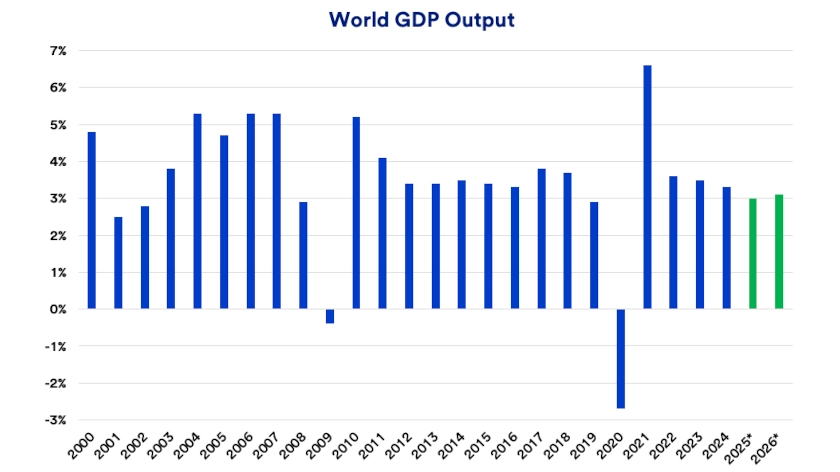

Since 2022, the global economy has grown by more than 3% per year, as measured by Gross Domestic Product (GDP). 1 However, growth is projected to be 3% in 2025, according to the International Monetary Fund. This primarily reflects concerns that growing trade tensions could temper economic activity. U.S. President Donald Trump has pursued aggressive new tariff policies, far exceeding previous tariff protocols. The primary concern is the impact of dramatic new tariffs that the U.S. has already applied and additional tariffs under consideration.

Article

Can the global economy continue growing?

September 16, 2025

Key takeaways

Despite increasing trade and geopolitical tensions, the global economy remains resilient.

Most countries continue to experience positive economic growth.

Increasing tariff burdens remain a variable that could impact the economic landscape.

As concerns about escalating trade wars diminish, the global economy in 2025 still seems on course for continued growth. Several factors appear to contribute to positive economic news, including increasing European government-led investments.

“The reality is that trade wars have not escalated as they might have,” says Beth Ann Bovino, chief economist for U.S. Bank. “The tariff impact is still felt, but it’s less painful than was feared earlier."

Nevertheless, economic uncertainty remains, mainly due to trade tensions, but also linked to other factors like inflation threats and ongoing geopolitical conflicts. “Under current circumstances, we still project a one-in-three chance of a U.S. recession,” says Bovino. “That’s considered high, and it’s far from clear that the Federal Reserve (Fed), in managing monetary policy, can still successfully engineer a soft landing.”

Bovino says primary risks stem from the fact that tariffs raise costs for consumers and businesses. Higher prices reduce purchasing power. If prices rise, central banks are forced to consider keeping interest rates higher to help fight inflation, resulting in elevated borrowing costs. These trends could potentially dampen economic activity.

At the same time, central banks often try to lower interest rates to counteract slower economic growth. Monetary policymakers might face this dilemma in the coming months.

Economic growth moderates

In its economic projections released in April 2025, the International Monetary Fund (IMF) projected slower 2025 global growth than initially anticipated. According to the IMF, “The swift escalation of trade tensions and extremely high levels of policy uncertainty are expected to have a significant impact on global economic activity.” 1

“Under current circumstances, we still project a one-in-three chance of a U.S. recession. That’s considered high, and it’s far from clear that the Federal Reserve, in managing monetary policy, can successfully engineer a soft landing.”

Beth Ann Bovino, chief economist for U.S. Bank

The IMF says between 2000 and 2019, global economic growth, as measured by Gross Domestic Product (GDP), averaged 3.7%. Since the onset of the COVID-19 pandemic in 2020, GDP has been less stable. The IMF initially predicted a global growth rate of 3.3% in 2025 and 2026. Now it has adjusted that rate lower, to 3.0% in 2025 and 3.1% in 2026. 1

IMF projects advanced economies growing at only 1.5% in 2025, while emerging markets are projected to grow by 4.1%. 1

The stagflation threat

With the risk of recession, in the background, Bovino and other economic analysts speculate that for the U.S. at least, stagflation could be a more challenging concern. Stagflation, the simultaneous rise in inflation and unemployment rates, is an unusual occurrence. “We experienced significant stagflation in the late 1970s and early 1980s,” says Bovino. “The numbers at that time were far more challenging than what exists today.”

Between 1979 and 1981, the annual inflation rate, as measured by the Consumer Price Index (CPI), topped 10%. In November 1982, the nation’s unemployment rate peaked at 10.8%. 2 “At that time, it forced the Fed to raise interest rates dramatically, sending the U.S. into a deep recession,” notes Bovino. It’s a scenario most analysts feel could be painful and should be avoided.

Stagflation is a significant monetary policy challenge for the Fed. While the U.S. central bank’s dual mandate is to maintain moderate inflation and full employment, its policy tools are in tension during an environment where both inflation and unemployment are high and rising. To curb surging inflation, the Fed typically raises the federal funds target rate, which guides overnight lending between large financial institutions. This was the core of Fed monetary policy in 2022 and 2023 as U.S. inflation surged to more than 9%. When a weaker economy results in higher unemployment, the Fed typically lowers the fed funds rate, similar to what it did in early 2020 as the COVID pandemic began. “When both inflation and unemployment rise, the Fed faces a dilemma in how to respond effectively,” says Bovino. “The Fed’s toolkit to lower inflation also weakens the jobs market, and vice-versa. This is one of the challenges of a stagflation environment.”

Trade tensions are the key variable

Although tariffs are more moderate than what President Trump initially proposed, they are still significantly higher than those in place when the President’s term began in January. U.S.-imposed tariffs have heightened tensions with a number of global trading partners, raising more concerns about the potential economic effects.

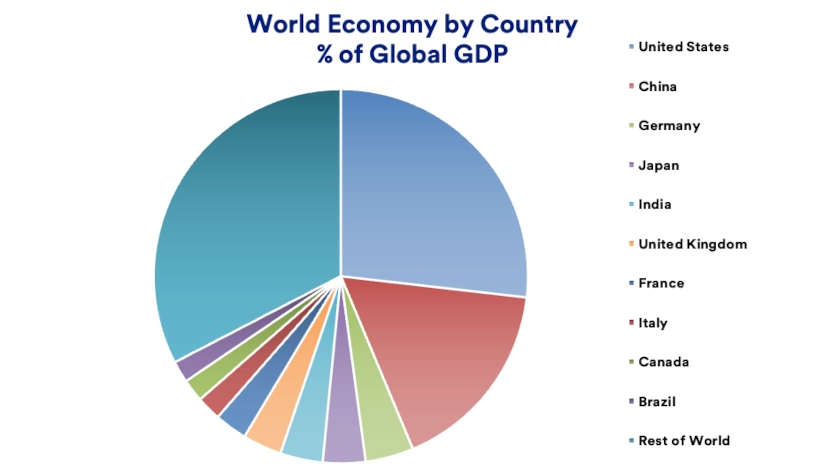

Central to trade tensions is the U.S.-China relationship. The two largest economies have become closely connected in recent decades, with China exporting significant goods to the U.S., while U.S. exports to China are notable but limited. “China appears to be trying to gain more leverage as an active trading partner with other countries given Trump administration efforts to reduce import activity from most countries,” says Bovino.

Tensions have also escalated with other major trading partners, including India. “If China and India were to pull away significantly from economic engagement with the U.S., there are more profound risks of trade wars than before,” says Matt Schoeppner, Senior Economist, U.S. Bank. “It threatens disrupting supply chains, creating renewed inflationary pressures. It also reduces market access for U.S. exports.”

The U.S. consumer’s critical role in the global economy

As the U.S. adopts new, stricter tariff policies, foreign trade could slow, which could have a significant global economic impact. “The reliance on U.S. consumption and investment has been ongoing, largely because we’re the largest economy in the world and we tend to spend a lot,” says Bovino. U.S. household savings rates tend to lag those of the rest of the world.” This level of U.S. spending by businesses and consumers is an essential ingredient in global economic growth that isn’t easily replaced. “If the world doesn’t want to be dependent on the U.S., the question is, how will it replace that cash flow?” says Bovino. “It’s hard to imagine another country could step up to the plate and replace the U.S. role.”

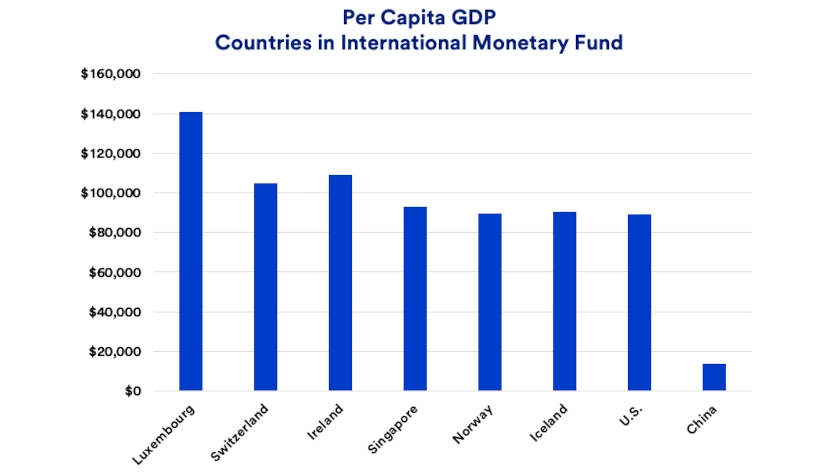

China is the greatest threat to overtake the U.S. role as the world’s largest economy. While China’s GDP is second only in size to the U.S., its per capita GDP ranks far lower, reflecting poorer living standards than the U.S. and other Westernized nations. 3

While questions are raised about whether the U.S. dollar will stay the world’s reserve currency, Bovino doubts there’s an immediate replacement coming. “China is trying to boost the yuan renminbi as a reserve currency, but its economy is too closed for that to happen anytime soon.”

Schoeppner agrees, saying “geopolitical tensions, regulatory uncertainty, and the lack of consistent policy predictability make it difficult to conclude that countries like China and India will remain significant targets for foreign investment.”

Factors to watch going forward

Immediate economic concerns center on continued trade tensions and whether they can be resolved without a significant economic impact. “At the household level, the challenge created by tariffs is that they work as a tax on purchases,” says Bovino. “If the price of that cheap product you bought that was produced in China suddenly doubles, that creates a squeeze on household income.” This could also pressure U.S. corporations’ profit margins, particularly if trading partners put retaliatory tariffs in place. The full economic fallout remains unclear.

Businesses have become more cautious due to uncertainties over trade policy directions, but most are working from a position of strength. “We’ll be watching the potential impact of artificial intelligence (AI), which could positively impact productivity for the U.S. and global economy,” says Bovino.

Geopolitical tensions remain a concern, although the economic impact has not yet significantly worsened due to the Russia-Ukraine war or ongoing Middle East conflicts. “The base has not changed materially with respect to the wars,” says Schoeppner. “If things escalated, particularly given Russia’s recent drone incursion into Poland, there could be significant implications and associated risks.”

The direction of the U.S. economy will likely continue to be an influential factor in the global economy’s fortunes. “If U.S. economic activity slows, the impact may reverberate worldwide and the global economy could face challenging times,” says Bovino.

FAQ

Although U.S. consumers and investors may be primarily concerned with domestic economic matters, the economy depends on global activity. U.S. consumers frequently purchase products that are mainly manufactured overseas. Similarly, the U.S. ships a percentage of its goods overseas and provides significant services to other countries (i.e., movies, technology). Particularly since global trade opened up in the 1990s, the interconnectedness of the global economy has become more apparent.

Tariffs must be paid when goods from another country enter the U.S. “The challenge created by tariffs is that they work as a tax on purchases,” says Beth Ann Bovino, chief economist at U.S. Bank. The concern is that higher prices might reduce overall economic activity. “The risk stems from the fact that tariffs raise costs for consumers and businesses,” says Bovino. The concern is heightened by the potential that more countries will apply tariffs, making global trade more costly and potentially dampening economic activity.

Tags:

U.S. Bank Economics Research Group

Beth Ann Bovino

Chief Economist

Ana Luisa Araujo

Senior Economist

Matt Schoeppner

Senior Economist

Adam Check

Economist

Andrea Sorensen

Economist

Subscribe to our economic insights newsletter

Not currently a subscriber? Sign up to get our economic insights delivered to your inbox weekly.

Learn more

If you have any questions about any of these topics or want to learn more, please contact us to connect with a U.S. Bank Corporate and Commercial banking expert.