Monetary policy refers to actions taken by central banks, such as the U.S. Federal Reserve, designed to help maintain economic stability. This includes controlling the money supply, managing bank reserve requirements, and setting interest rate policy. In essence, central banks try to regulate the amount of money available in the economy. They use various tools to maintain stable economic growth, modest inflation, and a healthy employment environment.

Article

How global monetary policy affects the economy

September 24, 2025

Key takeaways

Central bank monetary policy remains a key factor in the global economy’s direction.

Lower interest rates are a prominent, 2025 trend, though the Federal Reserve delayed rate cuts in the first half of the year.

However, central bankers are also wrestling with dual risks of renewed inflation threats and potential economic stagnation stemming in large part from expanded tariffs.

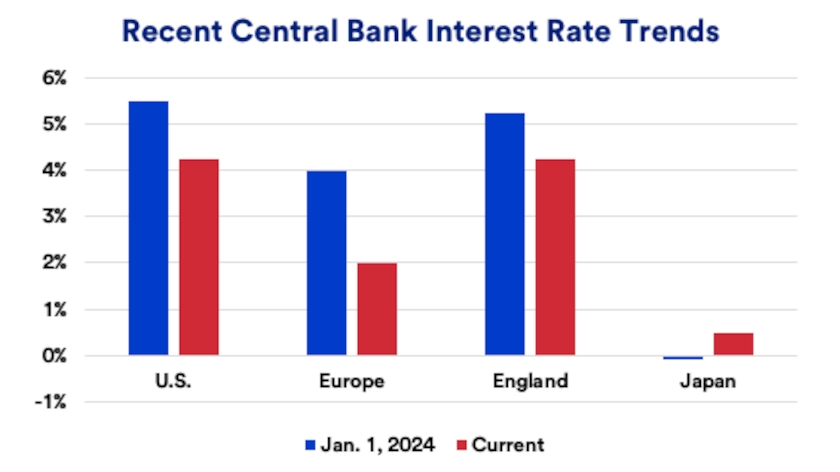

With the notable exception of the Bank of Japan, major global central banks have implemented easier money policies since mid-2024. The European Central Bank (ECB) and Bank of England (BOE) have repeatedly lowered interest rates. In contrast, the Federal Reserve (Fed) has taken a more deliberate rate-cutting stance.

“This time around, we’ve seen a different process for rate cuts,” says Beth Ann Bovino, chief economist at U.S. Bank. “Quite often, it’s the Federal Reserve that gets a jump on rate cuts, setting the stage for other central banks to follow.” In the current rate-cutting cycle, the Fed delayed rate cuts through much of 2024 until implementing three cuts in the year’s closing months. Again in 2025, the Fed maintained the federal funds rate at an upper level of 4.50% until mid-September, when it implemented a 0.25% rate cut.

Businesses and investors closely monitor central bank interest rate policies. The Bank of Japan (BOJ) has slowly raised rates, but from a rate base below 0%.

Central bank policy adjustments

Since mid-2024, U.S. and European monetary policy makers have eased their monetary policy stance. The ECB got a jump, initiating interest rate reductions in June 2024. Its main interest rate peaked at 4% in 2023 but now stands at 2.0%. 1 The BOE raised rates to a top level of 5.25% in 2023. It initiated rate cuts in August 2024, and its bank rate currently stands at 4.25%. 2

Persistent inflation concerns caused the Fed to delay rate cuts until September 2024. Over the ensuing months, the fed funds target rate was lowered from a peak of 5.50% in 2023 to an upper level of 4.50%. Between December 2024 and September 2025, the Fed held rates steady. As the Fed delayed 2025 rate cuts, President Trump directed intense criticism toward Chair Powell for the Fed’s stance. Powell has cited uncertainty surrounding the current administration’s policies as contributing to Fed caution. “In effect, we went on hold when we saw the size of tariffs and essentially all inflation forecasts for the United States went up materially as a consequence of the tariffs,” Powell stated. 3 However, at its September 2025 meeting, the Fed cut the upper level fed funds target rate by another 25 basis-points to 4.25%. 4 Market watchers anticipate that more rate cuts will follow at the Fed’s October and December meetings. 5

“Europe has been flirting with recession risk for some time, largely due to the impact of the Russia-Ukraine war. Unfortunately, the tariff war launched this April only adds to Europe’s recession concerns.”

Beth Ann Bovino, chief economist for U.S. Bank

Unlike the Fed and European banks, the BOJ raised its policy rate from below zero -where it had been since 2016—to 0.5 percent by early 2025. 6 The BOJ is combating a longstanding challenge of slower economic growth with ongoing inflation risks.

Facing a balancing act

In the current environment, central bank policymakers face multiple challenges. Threats of rising inflation, tied in large part to tariff impacts, represent a key concern. At the same time, higher tariffs may slow international trade. “Tariffs usually result in higher prices for imported goods,” says Bovino, as their cost (a tax on imports) is often passed on to consumers by companies . “That could lead to a loss of demand for foreign-produced goods.” Bovino says this could slow economic growth in Japan and across Europe. “For the Bank of Japan, that would mean a more measured pace of interest rate adjustments, as higher prices at home may be muted by slowing demand.”

In the U.S., the Fed has a dual mandate to promote maximum employment and stable prices. Since the U.S. is the world’s largest economy, Fed policy draws the most attention. “In the current environment, inflation remains a key concern for the Fed,” says Bovino. She notes that core inflation component of the Consumer Price Index (CPI), which excludes food and energy prices, remains elevated, at 3.1%. 7 The core Personal Consumption Expenditures deflator, the Fed’s preferred inflation measure, stands at 2.9%. 8 These figures compare to the Fed’s targeted 2% inflation rate. Meanwhile, the unemployment rate has drifted modestly higher, to 4.3% in August. 7 “While inflation has eased from its 2022 peaks, it’s far from the Fed’s target,” says Bovino. “Now the Fed has shifted its focus to the jobs front.” Bovino says the Fed is likely to be cautious in cutting rates to avoid re-igniting inflation.

Rising living costs most recently became a significant concern in 2021 and 2022. By June 2022, the U.S. inflation rate based on CPI topped 9%, its highest level in decades. 7 In response, the Fed began an aggressive interest rate-hiking strategy. The Fed sought to slow economic activity to reduce pricing pressures.

By contrast, central bankers typically lower interest rates if concerned that the economy may be slowing or tipping into a recession. In 2020, the Fed notably lowered rates from 1.75% to near zero percent at the onset of the COVID-19 pandemic. Similarly, during the financial crisis of 2007-2009, when the economy experienced a significant slowdown, the Fed dropped the fed funds rate from 5.25% to 0.25%.

Overseas challenges may be different

Other global central banks primarily focus on maintaining stable prices, without a mandate related to full employment. “Europe has been flirting with recession risk for some time, largely due to the impact of the Russia-Ukraine war,” says Bovino. The war’s onset in early-2022 led to higher energy prices and geopolitical uncertainty, contributing to slower economic activity. “Unfortunately, the tariff war launched this April only adds to Europe’s recession concerns,” says Bovino.

In 2025, the dollar weakened against most foreign currencies. “Dollar depreciation adds to Europe and China’s deflationary risks,” says Matt Schoeppner, senior economist, U.S. Bank. These concerns stand in stark contrast to domestic inflation worries. “The result is other central banks have moved faster to cut interest rates than the Fed.”

This reflects the primary reality of tariffs’ inflationary impact. “The U.S. is the country absorbing the price shock,” notes Bovino. “The rest of the world may lose exports to the U.S., which is a drag on growth, but they aren’t necessarily importing higher prices.”

Japan’s deflationary concerns have long focused on its demographic challenges stemming from an aging population. However, recent trade disputes add to Japan’s issues and complicate the Bank of Japan’s policy path even as the country risks slipping back into recession. “The BOJ may try another rate hike as core inflation reaches a 2-year high,” says Bovino. “But given trade tensions, the BOJ might also want to also wait and see if potential U.S. tariffs slow domestic economic growth and impact prices.”

Stagflation, a mix of rising prices and slowing economic growth (including higher unemployment), is an increasing risk. “Central bankers are deathly afraid of this scenario,” says Schoeppner. “Their tools don’t typically work around both of these issues simultaneously. They can only respond to one at a time.”

Quantitative tightening strategies

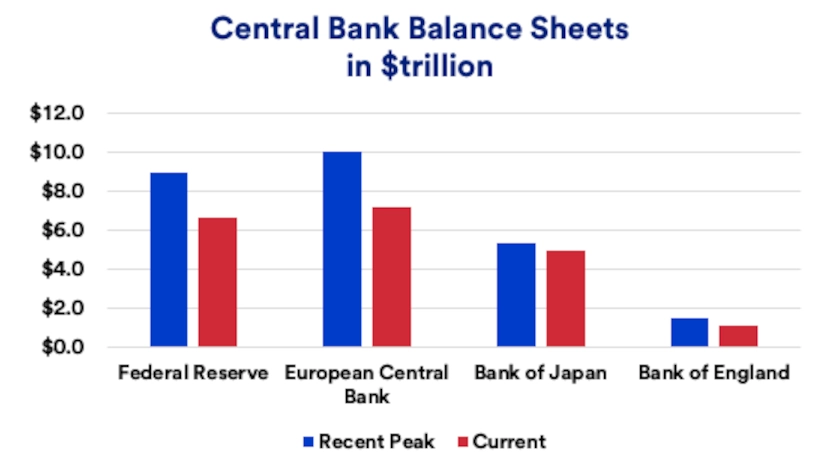

Another tool central banks use is to inject liquidity into markets through a process known as quantitative easing (QE). Central banks purchase assets, such as government bonds, to help keep interest rates down and potentially spur increased lending activity. The Federal Reserve injected trillions of dollars into markets during the 2007-2009 financial crisis, and again in 2020-21 amid the COVID-19 pandemic. Other central banks followed a similar path.

In recent years, as inflation soared, central banks reversed course, applying a quantitative tightening (QT) strategy. The Federal Reserve, for example, carried this out by letting its bond holdings mature and not reinvesting those assets into additional bonds.

Central bank balance sheets remain large, particularly by historic standards. However, the Fed and ECB balances have shrunk considerably from their 2022 peaks, though the pace of change recently slowed. BOE and BOJ balance sheets are little changed in recent months.

Central banks’ influence and critical role

Monetary policy is a constant factor that could significantly impact economic and market trends. Consumers, business owners, and investors pay close attention to actions by the Fed and other central banks and the policy stances they pursue. Interest rate policy and other monetary actions will be implemented to respond to the current economic environment.

Political leaders are increasingly willing to express monetary policy opinions. “It’s a tough time to be a central banker,” notes Bovino. “They can be some of the most unliked people in the world, yet they are just doing their jobs, managing monetary policy.”

FAQs

These are two separate tools that can be used to help determine the economy’s direction. Monetary policy is generally determined by central banks such as the U.S. Federal Reserve. Central banks primarily influence the economy through control of the money supply and setting interest rate policy. Fiscal policy refers to government powers (in the legislative and executive branches) to influence the economy’s direction. This includes tax and spending policy. Tax increases are considered a way to slow economic activity, while tax cuts tend to stimulate economic growth. Similarly, government spending cuts can have negative economic ramifications, while spending increases are designed to promote economic growth.

Interest rates are a key policy strategy applied by central banks to help promote specific economic outcomes. In a slowing economy, central banks, such as the U.S. Federal Reserve (Fed), may reduce interest rates they control to stimulate more lending activity to help spur economic growth. In 2020, the Fed notably lowered rates from 1.75% to near zero percent at the onset of the COVID-19 pandemic. Similarly, during the financial crisis of 2007-2009, when the economy experienced a significant slowdown, the Fed dropped the fed funds rate from 5.25% to 0.25%. By contrast, if the economy is growing too quickly, threatening the potential for higher inflation, central banks may raise interest rates in an effort to dampen economic activity. Inflation most recently became a significant concern in 2021 and 2022. By June 2022, the U.S. inflation rate based on CPI topped 9%, its highest level in decades.7 In response, the Fed began an aggressive interest rate-hiking strategy.

Tags:

U.S. Bank Economics Research Group

Beth Ann Bovino

Chief Economist

Ana Luisa Araujo

Senior Economist

Matt Schoeppner

Senior Economist

Adam Check

Economist

Andrea Sorensen

Economist

Subscribe to our economic insights newsletter

Not currently a subscriber? Sign up to get our economic insights delivered to your inbox weekly.

Learn more

If you have any questions about any of these topics or want to learn more, please contact us to connect with a U.S. Bank Corporate and Commercial banking expert.