What is financial fraud?

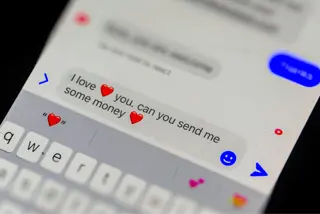

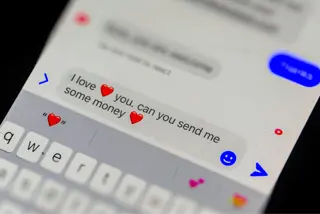

What to know about romance scams

If you’ve been scammed, take prompt action — you may be able to get your money back.

A good first step is contacting your bank and credit card company.

You can also file a report with the Federal Trade Commission (FTC) and FBI.

If your identity is at risk, contact the FTC’s Identify Theft unit.

Recent data from Pew Research Center suggests that around 73% of U.S. adults surveyed have been targeted as part of an online scam or attack. 48% of scam victims have had scammers make fraudulent charges using their credit or debit card. A different report from the FTC revealed that consumers are losing more money on investment scams than other categories. With scam tactics evolving continuously, consumers can benefit from learning the common signs of a scam and steering clear of suspicious looking financial schemes.

The good news is that there are steps you can take if you become a victim of fraud to attempt to get your money back, repair your finances and protect yourself — and others — from more damage.

While there are many different types of scams out there, some are more common than others. We’ve rounded up a few of the most common financial scams so you know the signs to look for.

There are many different types of credit card fraud. They range from using lost or stolen cards to phishing, to counterfeit card creation and even account takeovers.

Typically, the scammers will contact you by phone, text, or email letting you know that you've won a prize. They'll ask you to pay a fee or tax upfront so you can claim the prize. Avoid sharing any personal information (including credit card details or your Social Security number. It's best not to make any payments for prizes, especially for any contests you don't remember entering.

Imposter scams are one of the most common. These occur when scammers pretend to be someone they aren’t in order to get money or financial information. They often pose as friends, family members, bank representatives or a tech support agent. Usually, you can easily verify the authenticity of these calls by hanging up and directly contacting the person/agency that the scammer was impersonating.

Fraudsters often buy lists of people who have fallen for scams, according to the FTC. These secondary scammers will then contact you, promising to help you recover your funds or financial information from the original scam.

If someone calls claiming to be from your bank, credit card company or even the FTC, hang up and call the institutions directly to see if they attempted to contact you.

Scammers generally send you emails or text messages impersonating a major company or service provider. They may pretend to be an employee of your bank or even a federal agency and ask you to provide personal information that enables them to steal your identity. Phishing emails can look very official, so check the email and sender's address carefully. Look for odd symbols, unusual language or amateur logos.

When scammers strike, it’s important to act quickly. You may be able to minimize the damage by alerting your bank and quickly locking down your accounts.

No matter the type of scam, notifying your bank should always be your first move. “The minute you see something or notice something is off, report it,” says Dave Pilot, vice president, Financial Crimes Disruption, at U.S. Bank.

This is especially important if you spot unauthorized charges on your checking account. These can include small charges (since thieves often wait to see if these are noticed before targeting a larger amount), recurring payments that seem legit (like from a streaming service you might have signed up for), duplicate transactions, charges in foreign currencies or any charge that you don’t recognize.

Under the Electronic Fund Transfer Act, if you report unauthorized payments from your bank account within two days of them occurring, you won’t be liable for the loss. If you don’t notice the fraudulent payments until later, that’s okay too — you can still report the transactions within 60 days for limited liability.

“Your bank will do everything in its power to recoup those funds for you,” says Charles Banks, vice president, Information Security, at U.S. Bank. “They will also likely put a freeze on your account to prevent further losses.”

Just note that if you pay a fraudster from your account, the payment is considered “authorized,” according to the Federal Deposit Insurance Corporation. That means it’s much harder to get back the money. But call your bank anyway. Depending on your timing, your bank may be able to freeze or reverse the payment.

“In a digital world with real-time payments and cryptocurrency, there’s a small window to stop those funds from going through,” says Pilot. “So be proactive.”

Similarly, if unauthorized charges show up on your credit card, call the bank that issued your card as soon as possible (the customer service number is typically on the back of the card). Your mobile banking app may give you the option to freeze or deactivate your card instantly.

Thanks to the Fair Credit Billing Act, you won’t be responsible for more than $50 of any stolen funds, in most cases. To recoup your losses, there’s no deadline to report credit card fraud — as there is with bank payments — but the longer you wait, the more time scammers have to use your card. Your issuer’s fraud department will hold all charges until an investigation is complete.

When it comes to payments made through an app, like Venmo and Zelle, you have fewer consumer protections. Some apps may offer you the option to freeze your accounts immediately, but this is only possible if you still have access to your accounts.

The FTC still recommends letting those platforms know what happened and asking for your money back. If you’ve linked your app to a credit card or bank account, however, call your bank directly. It may help to keep customer service emergency numbers saved on your phone so you don’t lose valuable time once you realize you’ve been scammed.

State and federal government agencies can help you stop any fraudulent practices. They collect reports from consumers, conduct investigations, and sue people or companies who are breaking the law. These agencies also have tons of resources available on how to recognize scams, protect yourself and take action should a scam occur. The biggest one is the FTC’s Bureau of Consumer Protection.

“Consumer protection agencies are going to be the best tool on your tool belt,” says Banks. “They provide services, make recommendations and get you in contact with other entities you may not have thought of.”

You can report a scam to the FBI’s Internet Crime Complaint Center and your local police department. While this won’t necessarily help you get your money or financial information back, it does help the government track scams and warn the public about them — and, in some cases, can lead to finding and prosecuting criminals.

“The aggregation of all that data allows the bureau to get a better idea of how citizens are being targeted,” says Pilot. “It gives them a nationwide view of what’s going on — such as who’s being targeted, if there are certain patterns or if specific geographic regions are being hit.”

This information also helps banks improve their security. “Teams like mine work with law enforcement to take steps to make sure the bad guys have bad days,” Pilot adds.

If you’re the victim of a scam or identity theft, reach out to one of the three nationwide credit reporting agencies, Equifax, Experian or TransUnion. (You only need to contact one, as it will inform the others.) They will put a fraud alert on your credit report to hinder further fraudulent activity and let potential creditors know that your information has been jeopardized. There’s no charge for placing a fraud alert on your account.

If your personal information was stolen or compromised — for example, if you gave a scammer your Social Security number or driver’s license number — you can file a report through IdentityTheft.gov. Doing so formally documents the crime (which will help you dispute any fraudulent charges, accounts or debts that may occur) and can aid in stopping or reversing the damage.

Some types of fraud (like credit card fraud) offer stronger protections than others. The Fair Credit Billing Act (FCBA) limits your liability for unauthorized charges to just $50. Some banks or card issuers like U.S. Bank may also offer additional protections that aim to reimburse you for 100% of fraud losses (under certain circumstances). However, if you've knowingly made payments to fraudsters, your money may be harder to recover.

The exact list of documents will differ based on the type of scam and the agency you're reporting it to. In general, here's a list of documentation that can help support your complaint.

Reporting a scam to the appropriate parties is just one part of the equation. You also need to ensure you stop the scammer now and stop scammers in the future.

Here’s what to do:

No matter what happens, don’t be embarrassed about sharing your story and taking action, Pilot notes. “Help is available, so don’t let fear or shame keep you from getting it when you need it.”

Read about more ways to help prevent fraud and keep your financial information safe from scammers.