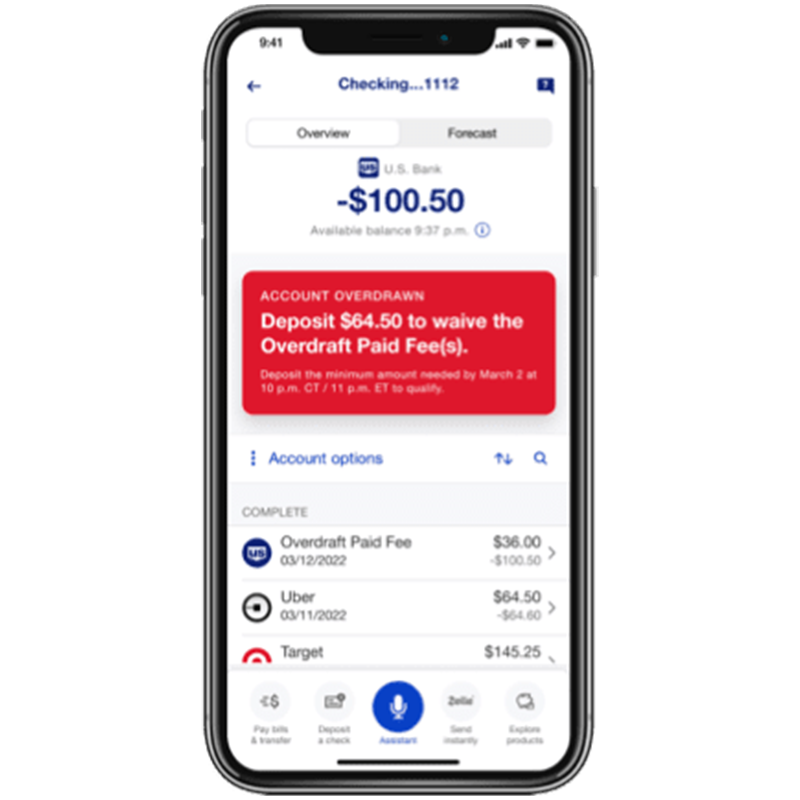

Overdraft Fee Forgiven alerts are sent via email, text message5 and push notification.

Via email

To receive alerts via email, provide a valid email address in your profile information. No enrollment is needed to receive the first email alert. You can sign up to receive additional reminder email alerts.

Via text5

To receive alerts via text message5, you must log in to the U.S. Bank Mobile App or Online Banking to enable the account to receive the text messages.5

- U.S. Bank Mobile App: Select the checking account and go to Account options. From the Manage notifications menu, select Overdraft Fee Forgiven.

- U.S. Bank Online Banking: Select the checking account. From the Manage account menu, select Set up account alerts and then Add alerts next to the checking account of your choice. Then select Transaction Alerts to expand the dropdown menu. Go to Overdraft Fee Forgiven and select Add.

Via push notification

To receive alerts via push notification, download the latest version of the U.S. Bank Mobile App and turn on push notifications via the setting on your mobile device. From the main menu, select Notifications then choose Insights & Updates. Use the toggle switch next to Allow push notifications for all accounts to turn them on.

Note: The first alert email, text message5 and push notification are sent in the early morning on the day the Overdraft Fee Forgiven period starts. If you wish to receive additional reminder emails and text messages5 during the Overdraft Fee Forgiven period, log in to your account via the U.S. Bank Mobile App or Online Banking and manage the Overdraft Fee Forgiven alerts from there.