Apply for both online in under 5 minutes.

Maximize your money’s potential

Combine the power of Bank Smartly® Checking and Bank Smartly® Savings to turn every dollar into a step forward. Together, they’ll unlock ways to help you reach your goals faster including savings interest rates that grow as your Combined Qualifying Balances grow.1

Try to find a more dynamic (banking) duo.

With benefits you’ll use now and more you’ll appreciate later, you’d be hard-pressed to find a smarter pair.

Bank Smartly Checking

Simple ways to manage your money and earn rewards from day one

Bank Smartly® Checking features insightful digital tools to help you track your cash and manage your finances. Plus, you automatically get the $12 Monthly Maintenance Fee3 waived for the first two months. After that, you can easily waive the fee in multiple ways. Additionally, you’ll enjoy even more perks with Smart Rewards.

smarter together

Two simple ways to grow your money. One 5-minute application.

Save time, unlock higher rates1 and pile on the perks as your balances grow when you open a Bank Smartly® Checking and Bank Smartly® Savings account together.

Plan for future success with smart ways to manage money now.

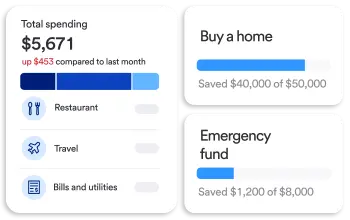

Our easy-to-use digital budgeting tools help you monitor all your accounts (even ones at other banks) while setting clear financial goals.

Only need one account to level up?

If you already have a Bank Smartly® Checking or Bank Smartly® Savings account, unlock the bigger benefits of bundling by opening the one you don’t have yet.

Frequently asked questions

General questions

Bundling in banking refers to the ability to combine multiple financial services into a single offering. In addition to offering individual services separately, banks might bundle checking, savings, credit cards or other related services together to create a solution that may be more beneficial for their customers.

At U.S. Bank, you can save time and grow your money faster when you open Bank Smartly® Checking and Bank Smartly® Savings accounts together.

Currently, you can bundle Bank Smartly® Checking, which automatically comes with Smart Rewards, and Bank Smartly® Savings account with interest rates that grow as your Combined Qualifying Balances grow.1

Combined Qualifying Balances (CQB) include the following products offered by U.S. Bank and it's affiliates, where the account is open, and you are an account owner.

- Checking accounts

- Money Market accounts

- Savings accounts

- CDs and/or IRAs

- Personal Trust accounts4

- U.S. Bancorp Advisors5 brokerage accounts

Note: Business and commercial products are never eligible.

Funds on deposit in an eligible product, where you have ownership interest, are counted towards your CQB. Examples of eligible customer to account relationship types, include, but are not limited to: Individual owner, joint owner, principal non-signer. Conversely, funds on deposit in an eligible product that do not grant ownership interest, are not counted towards your CQB. Examples of ineligible customer to account relationship types, include, but are not limited to: Trustee (IFI)6, Grantor (GRT)7, all Irrevocable Trust roles, Payable on Death, Representative Payee, Guardian.

Yes, at U.S. Bank, you can save time when you apply for the Bank Smartly® Checking and Bank Smartly® Savings accounts together. The application typically takes less than 5 minutes.

- Streamlined application. At U.S. Bank, the process typically takes less than 5 minutes.

- Convenient access to your money. With checking and savings at the same bank, you can move money between accounts faster. At U.S. Bank, connected Bank Smartly® accounts help you waive fees, increase your savings rates1 and protect you from overdraft penalties.

- Easier money management. Track everyday spending and set personal savings goals. U.S. Bank Smartly accounts include banking tools with the ability to manage accounts inside and outside the bank with the U.S. Bank app.

- Extra perks. Combining Bank Smartly® Checking and Bank Smartly® Savings accounts lets you enjoy the best of both accounts including more fee waivers and a savings interest rate bump to help you earn more on your money. Additionally, you’ll automatically start benefiting from our Smart Rewards program when you open a Bank Smartly Checking account.

These are the three features you should look for when opening these accounts at the same time:

- Low or no Monthly Maintenance Fees. U.S. Bank Smartly® accounts give you multiple ways to waive those account fees.2,3

- Access to your money. Get cash whenever and wherever you need it with convenient debit card access and thousands of ATMs and branch locations.

- Digital financial tools. Knowing where every dollar goes can help you reach your goals faster. U.S. Bank provides ways to organize your spending and save your money wisely.

A regular checking account is typically used for day-to-day spending and paying your bills. You can easily access your money with a debit card, ATM or by writing a check (if you have a traditional checking account with checks). Although Bank Smartly® Checking is an interest-bearing checking account, savings accounts typically have higher rates than checking accounts, which will help you grow your money faster.8 Savings accounts are meant to help you set aside funds for a big purchase. It’s often beneficial to have both as part of your financial plan.